PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833669

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833669

Power Optimizer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

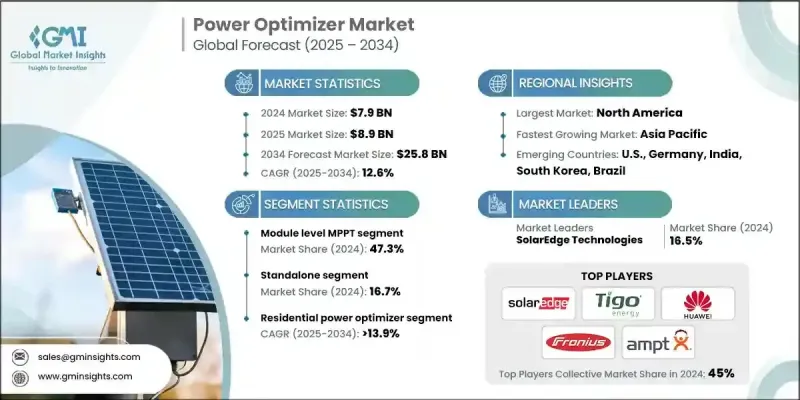

The Global Power Optimizer Market was valued at USD 7.9 billion in 2024 and is estimated to grow at a CAGR of 12.6% to reach USD 25.8 billion by 2034.

The industry is experiencing notable momentum as the demand for higher energy output and safer solar power systems continues to grow across both residential and commercial sectors. Power optimizers are now central to modern photovoltaic infrastructure, allowing real-time monitoring and system diagnostics that help improve yield and cut down on operational costs. The increasing integration of energy storage systems and smart grid platforms is reinforcing this growth, as these technologies support greater energy control, stable grid interaction, and two-way power communication. Innovations in IoT, artificial intelligence, and cloud-based analytics are reshaping how power optimizers function-ensuring smarter, predictive maintenance and better system efficiency. Manufacturers are also investing in low-footprint designs and recyclable components to align with sustainability goals. Regulatory frameworks encouraging solar adoption across the globe are fueling market expansion, especially with incentives aimed at distributed energy generation. Furthermore, the convergence of blockchain with solar systems is opening opportunities for transparent, secure energy transactions, strengthening the decentralized renewable energy ecosystem, and propelling global acceptance of smart energy solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.9 Billion |

| Forecast Value | $25.8 Billion |

| CAGR | 12.6% |

The module-level MPPT segment held 47.3% share in 2024 and is expected to grow at a CAGR 3.1% through 2034. This technology has become essential for improving energy production on a per-panel basis, especially in installations affected by shade, varying tilt angles, or irregular panel configurations. As adoption of rooftop solar accelerates across developing and developed economies, the push for more granular power tracking and enhanced panel-level control is boosting demand for module-level MPPT solutions. Financial incentives and favorable government policies across regions, including the U.S., India, and Europe are strengthening market penetration, with cost reductions in electronic components making the technology increasingly affordable.

The on-grid segment held 83.3% share in 2024 and is expected to grow at a CAGR of 11.9% through 2034. On-grid systems continue to dominate due to the strong policy support for solar integration into utility infrastructure, especially with net metering programs and smart grid initiatives. These policies not only encourage residential and commercial rooftop solar installations but also necessitate high-performing power optimizers to maintain energy stability across varying production levels. Rooftop solar installations on homes, office buildings, and industrial structures are becoming more common, and in such applications, optimizers are crucial in minimizing energy losses from partial shading or complex roof geometries.

United States Power Optimizer Market held an 83.8% share and generated USD 3.5 billion in 2024. Growth in the U.S. market continues to be driven by a combination of policy initiatives, consumer awareness, and a robust increase in solar deployments across residential, commercial, and utility-scale applications. Financial incentives and tax credits have made solar more cost-effective, boosting installation rates and driving higher demand for optimization technologies that enhance performance and system reliability. With advancements in digital grid systems and increased emphasis on renewable energy independence, power optimizers are playing a vital role in ensuring seamless integration and efficient power delivery.

Key players actively shaping the Global Power Optimizer Industry include Tigo Energy, Fronius International, Huawei Technologies, HIITIO, Ferroamp, Altenergy Power System, Infineon Technologies, SolarEdge Technologies, Suzhou Convert Semiconductor, Sun Sine Solution, Ampt, PCE Process Control Electronics, Alencon Systems, and SUNGROW. Leading power optimizer companies are leveraging product innovation and strategic partnerships to strengthen their market presence. Manufacturers are focusing on integrating AI, IoT, and cloud-based analytics into their systems to offer smarter monitoring, predictive maintenance, and improved energy yields. Emphasis on modular and scalable designs enables customization for residential, commercial, and utility-scale deployments. Collaborations with solar panel manufacturers and installers are enhancing distribution networks and widening market access.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1.1 Raw material & component suppliers

- 3.1.1.2 Technology & design

- 3.1.1.3 Manufacturing

- 3.1.1.4 Distribution & logistics

- 3.1.1.5 Installation & integration

- 3.1.1.6 Aftermarket services

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Emerging opportunities & trends

- 3.7.1 Digitalization & IoT integration

- 3.7.2 Emerging market penetration

- 3.8 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.4.1 Key partnerships & collaborations

- 4.4.2 Major M&A activities

- 4.4.3 Product innovations & launches

- 4.4.4 Market expansion strategies

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By End Use , 2021 - 2034 (USD Million & MW)

- 5.1 Key trends

- 5.2 Module level MPPT

- 5.3 Advanced power line communication

- 5.4 Monitoring components

- 5.5 Safety shutdown components

- 5.6 Others

Chapter 6 Market Size and Forecast, By Connectivity, 2021 - 2034 (USD Million & MW)

- 6.1 Key trends

- 6.2 Standalone

- 6.3 On grid

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & MW)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial & industrial

- 7.4 Utility

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & MW)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 Italy

- 8.3.3 Netherlands

- 8.3.4 UK

- 8.3.5 France

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Australia

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 India

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Chile

- 8.6.3 Mexico

Chapter 9 Company Profiles

- 9.1 Alencon Systems

- 9.2 Altenergy Power System

- 9.3 Ampt

- 9.4 Ferroamp

- 9.5 Fronius International

- 9.6 HIITIO

- 9.7 Huawei Technologies

- 9.8 Infineon Technologies

- 9.9 PCE Process Control Electronic

- 9.10 SolarEdge Technologies

- 9.11 SUNGROW

- 9.12 Sun Sine Solution

- 9.13 Suzhou Convert Semiconductor

- 9.14 Tigo Energy