PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833683

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833683

Asia Pacific Low Voltage Drives Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

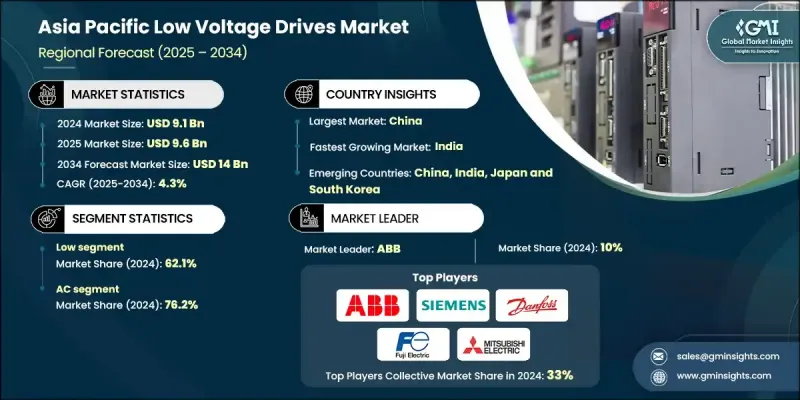

Asia Pacific Low Voltage Drives Market was valued at USD 9.1 billion in 2024 and is estimated to grow at a CAGR of 4.3% to reach USD 14 billion by 2034.

This growth is driven by the increasing demand for precise motor control systems across various industrial applications and the rapid evolution of digital manufacturing technologies. The rise of intelligent automation and artificial intelligence within industrial operations is reshaping production environments. As businesses strive to boost accuracy, efficiency, and sustainability, adoption of low voltage drives continues to surge. Furthermore, growing investments in infrastructure, increasing industrial activity in developing nations, and urban expansion are contributing to the region's evolving industrial landscape.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.1 Billion |

| Forecast Value | $14 Billion |

| CAGR | 4.3% |

Government mandates on energy efficiency and a rising preference for integrating renewable energy systems are also pushing demand higher. Expanding consumer income and enhanced living standards across both emerging and mature economies are supporting the shift toward energy-efficient technologies. Regional governments are also launching initiatives to modernize industrial infrastructure and cut energy consumption, directly fueling market penetration. Energy policies focused on long-term efficiency and support for automation adoption are increasing the uptake of smart, reliable, and cost-effective drive systems that align with changing industrial demands.

The low power range devices segment generated USD 5.6 billion in 2024. This segment continues to grow steadily due to expanding automation in industrial applications and the need for affordable, efficient motor control technologies. Backed by regulatory frameworks promoting energy conservation and smart manufacturing, manufacturers are prioritizing automation investments. Demand is accelerating for solutions that reduce energy use and operational costs while improving process efficiency, driving adoption of compact and advanced low voltage drives.

The low voltage AC drives segment held 76.2% share in 2024 and is expected to grow at a 4.7% CAGR through 2034. This segment is experiencing robust growth due to advancements in smart drive technology, IoT-enabled features, and improved performance metrics. The growing implementation of industrial automation and adoption of smart systems are positively influencing this market. AC drives are becoming the go-to solution for manufacturers seeking scalable, adaptable, and efficient motor control technologies across both large-scale operations and smaller installations. These systems help optimize performance by controlling speed, torque, acceleration, and direction, enhancing overall productivity and system reliability.

China Low Voltage Drives Market held 46.9% share in 2024, generating USD 4.2 billion. A strong national focus on boosting energy efficiency and advancing automation technologies continues to reshape the manufacturing sector. Government-backed policies aimed at encouraging clean energy use and industrial upgrades are contributing significantly to market expansion. As businesses pursue smart manufacturing goals, efforts to streamline operations and support sustainable production practices are becoming central to growth strategies. The transformation is further supported by targeted investments in next-generation industrial solutions and infrastructure innovation.

Key players active in the Asia Pacific Low Voltage Drives Market include Fuji Electric Co., Ltd., Bosch Rexroth (India) Private Limited, Rockwell Automation, Beckhoff Automation, Schneider Electric, LS ELECTRIC Co., Ltd., Hitachi Hi-Rel Power Electronics Private Limited, Nidec Conversion, Eaton, Danfoss, WEG, Emerson Electric Co., Mitsubishi Electric Corporation, Delta Electronics, Inc., CG Power & Industrial Solutions Ltd., Siemens, GE Vernova, Air Liquide, ABB, Erhardt+Leimer, and YASKAWA ELECTRIC (SINGAPORE) PTE LTD. To establish and maintain a strong position in the Asia Pacific low voltage drives market, leading manufacturers are prioritizing technological innovation focused on smart functionality, digital connectivity, and energy optimization. Companies are expanding production capabilities across emerging markets to meet regional demand more efficiently. Strategic alliances with local industrial firms and distributors are helping broaden market reach.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Power range trends

- 2.4 Capacity trends

- 2.5 Drive trends

- 2.6 Technology trends

- 2.7 System trends

- 2.8 Application trends

- 2.9 End use trends

- 2.10 Country trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Key factors affecting the value chain

- 3.1.3 Disruptions

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Cost structure breakdown of low voltage drives

- 3.8 Emerging opportunities & trends

- 3.8.1 Digital transformation with IoT technologies

- 3.8.2 Emerging market penetration

- 3.9 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis, by country, 2024

- 4.2.1 China

- 4.2.2 Japan

- 4.2.3 India

- 4.2.4 Australia

- 4.2.5 South Korea

- 4.2.6 Thailand

- 4.2.7 Singapore

- 4.2.8 Malaysia

- 4.2.9 Philippines

- 4.2.10 Vietnam

- 4.2.11 Indonesia

- 4.3 Strategic initiatives

- 4.3.1 Key partnerships & collaborations

- 4.3.2 Major M&A activities

- 4.3.3 Product innovations & launches

- 4.3.4 Market expansion strategies

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Power Range, 2021 - 2034 (‘000 Units & USD Million)

- 5.1 Key trends

- 5.2 Micro

- 5.3 Low

Chapter 6 Market Size and Forecast, By Capacity, 2021 - 2034 (‘000 Units & USD Million)

- 6.1 Key trends

- 6.2 2.2 kW

- 6.3 2.2 kW - 7.5 kW

- 6.4 7.5 kW - 22 kW

- 6.5 22 kW - 75 kW

- 6.6 ≥ 75 kW - 110 kW

- 6.7 ≥ 110 kW - 500 kW

- 6.8 ≥ 500 kW

Chapter 7 Market Size and Forecast, By Drive, 2021 - 2034 (‘000 Units & USD Million)

- 7.1 Key trends

- 7.2 AC

- 7.2.1 Efficiency class

- 7.2.1.1 IE 1

- 7.2.1.2 IE 2

- 7.2.1.3 IE 3

- 7.2.1.4 IE 4

- 7.2.1.5 Others

- 7.2.1 Efficiency class

- 7.3 DC

- 7.4 Servo

Chapter 8 Market Size and Forecast, By Technology, 2021 - 2034 (‘000 Units & USD Million)

- 8.1 Key trends

- 8.2 Standard

- 8.3 Regenerative

Chapter 9 Market Size and Forecast, By System, 2021 - 2034 (‘000 Units & USD Million)

- 9.1 Key trends

- 9.2 Open Loop

- 9.3 Closed Loop

Chapter 10 Market Size and Forecast, By Application, 2021 - 2034 (‘000 Units & USD Million)

- 10.1 Key trends

- 10.2 Pump

- 10.3 Fan

- 10.4 Conveyor

- 10.5 Compressor

- 10.6 Extruder

- 10.7 Others

Chapter 11 Market Size and Forecast, By End Use, 2021 - 2034 (‘000 Units & USD Million)

- 11.1 Key trends

- 11.2 Oil & Gas

- 11.3 Power generation

- 11.4 Food processing

- 11.5 Automotive

- 11.6 Mining & metals

- 11.7 Pulp & paper

- 11.8 Textile

- 11.9 Marine

- 11.10 Others

Chapter 12 Market Size and Forecast, By Country, 2021 - 2034 (‘000 Units & USD Million)

- 12.1 Key trends

- 12.2 China

- 12.3 Japan

- 12.4 India

- 12.5 Australia

- 12.6 South Korea

- 12.7 Thailand

- 12.8 Vietnam

- 12.9 Indonesia

Chapter 13 Company Profiles

- 13.1 ABB

- 13.2 Beckhoff Automation

- 13.3 Bosch Rexroth (India) Private Limited

- 13.4 CG Power & Industrial Solutions Ltd.

- 13.5 Danfoss

- 13.6 Delta Electronics, Inc.

- 13.7 Eaton

- 13.8 Emerson Electric Co.

- 13.9 Erhardt+Leimer

- 13.10 Fuji Electric Co., Ltd.

- 13.11 GE Vernova

- 13.12 Hiconics Eco-energy Technology Co., Ltd.

- 13.13 Hitachi Hi-Rel Power Electronics Private Limited

- 13.14 LS ELECTRIC Co., Ltd.

- 13.15 Mitsubishi Electric Corporation

- 13.16 Nidec Conversion

- 13.17 Rockwell Automation

- 13.18 Schneider Electric

- 13.19 Siemens

- 13.20 WEG

- 13.21 YASKAWA ELECTRIC (SINGAPORE) PTE LTD