PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858990

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858990

Middle East and Africa Low Voltage Drives Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

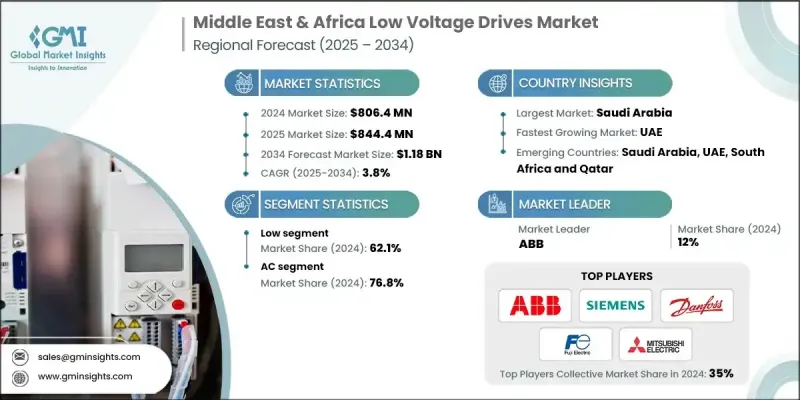

Middle East & Africa Low Voltage Drives Market was valued at USD 806.4 million in 2024 and is estimated to grow at a CAGR of 3.8% to reach USD 1.18 billion by 2034.

The market is driven by the growing adoption of automation technologies across various industrial sectors, coupled with a surge in infrastructure development projects. Technological advancements aimed at improving efficiency, precision, and scalability in motor control systems are also fueling market growth. Industries are increasingly turning to smart systems and digital tools, creating synergies between automation and infrastructure, which opens new growth opportunities to enhance traditional workflows and create more intelligent, agile ecosystems. Additionally, government policies designed to reduce industrial emissions and substantial investments in infrastructure and manufacturing are playing a key role in shaping the market landscape. Increasing investments from both private and public sectors are advancing the development of cutting-edge facilities, modern technologies, and highly efficient production systems. The growing integration of renewable energy solutions, along with a stabilizing economy and thriving industrial sectors, further supports the market's expansion. Companies are focusing on sustainability and cost-efficiency to meet the evolving needs of industrial processes, which is accelerating the adoption of clean energy technologies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $806.4 Million |

| Forecast Value | $1.18 Billion |

| CAGR | 3.8% |

The low power range segment generated USD 500.4 million in 2024. The low voltage drives market is experiencing a significant shift due to an increased focus on energy efficiency, widespread adoption of industrial automation, and constant technological advancements. Favorable government policies and incentive programs that promote energy-saving solutions are bolstering the market's growth.

The AC drive segment held a 76.8% share in 2024, with a growth rate of 4% projected by 2034. AC drives are highly sought after for their scalability and versatility, making them suitable for both large-scale operations and compact systems. They regulate motor parameters such as speed, torque, acceleration, deceleration, and rotational direction, which are essential for energy conservation and optimizing processes. This growing demand for intelligent motor control systems is fueling the widespread adoption of AC drives across various industries.

Saudi Arabia Low Voltage Drives Market generated USD 155.7 million in 2024. The country is increasingly focusing on improving energy efficiency and integrating advanced technologies into manufacturing processes, which is shaping the industrial landscape. Rising interest in clean energy, combined with increased industrial investments and efforts to reduce energy consumption, is driving transformation across various sectors. Government initiatives promoting Industry 4.0, smart manufacturing, and automation are further accelerating the pace of development in production environments. Innovation, operational efficiency, and sustainability are key priorities influencing business decisions in the region.

Key players in the Middle East & Africa Low Voltage Drives Market include Siemens, Schneider Electric, YASKAWA ELECTRIC CORPORATION, Beckhoff Automation, Danfoss, GE Vernova, Eaton, WEG, Mitsubishi Electric Corporation, Rockwell Automation, ABB, Bosch Rexroth, Delta Electronics, Inc., Nidec Corporation, Fuji Electric Co., Ltd., Johnson Controls, Emotron, TMEIC, and Emerson Electric Co. To strengthen their position in the Middle East & Africa Low Voltage Drives Market, companies are focusing on a variety of strategic initiatives. These include investments in research and development to innovate new, energy-efficient drive solutions, which can meet the increasing demand for automation and digitalization in industries. Many are forming strategic alliances and partnerships with local firms to expand their geographical reach and tap into emerging markets. Additionally, companies are emphasizing product customization and offering solutions tailored to specific industrial needs, particularly in energy-intensive sectors. Enhancing after-sales service and technical support is another key strategy, ensuring long-term customer satisfaction and building brand loyalty.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Power range trends

- 2.4 Capacity trends

- 2.5 Drive trends

- 2.6 Technology trends

- 2.7 System trends

- 2.8 Application trends

- 2.9 End Use trends

- 2.10 Country trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Key factors affecting the value chain

- 3.1.3 Disruptions

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Cost structure analysis of low voltage drives

- 3.8 Emerging opportunities & trends

- 3.8.1 Digital transformation with IoT technologies

- 3.8.2 Emerging market penetration

- 3.9 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by country, 2024

- 4.2.1 Saudi Arabia

- 4.2.2 UAE

- 4.2.3 Qatar

- 4.2.4 South Africa

- 4.2.5 Nigeria

- 4.2.6 Egypt

- 4.2.7 Algeria

- 4.3 Strategic initiatives

- 4.3.1 Key partnerships & collaborations

- 4.3.2 Major M&A activities

- 4.3.3 Product innovations & launches

- 4.3.4 Market expansion strategies

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Power Range, 2021 - 2034 (‘000 Units & USD Million)

- 5.1 Key trends

- 5.2 Micro

- 5.3 Low

Chapter 6 Market Size and Forecast, By Capacity, 2021 - 2034 (‘000 Units & USD Million)

- 6.1 Key trends

- 6.2 2.2 kW

- 6.3 2.2 kW - 7.5 kW

- 6.4 7.5 kW - 22 kW

- 6.5 22 kW - 75 kW

- 6.6 ≥ 75 kW - 110 kW

- 6.7 ≥ 110 kW - 500 kW

- 6.8 ≥ 500 kW

Chapter 7 Market Size and Forecast, By Drive, 2021 - 2034 (‘000 Units & USD Million)

- 7.1 Key trends

- 7.2 AC

- 7.2.1 Efficiency class

- 7.2.1.1 IE 1

- 7.2.1.2 IE 2

- 7.2.1.3 IE 3

- 7.2.1.4 IE 4

- 7.2.1.5 Others

- 7.2.1 Efficiency class

- 7.3 DC

- 7.4 Servo

Chapter 8 Market Size and Forecast, By Technology, 2021 - 2034 (‘000 Units & USD Million)

- 8.1 Key trends

- 8.2 Standard

- 8.3 Regenerative

Chapter 9 Market Size and Forecast, By System, 2021 - 2034 (‘000 Units & USD Million)

- 9.1 Key trends

- 9.2 Open Loop

- 9.3 Closed Loop

Chapter 10 Market Size and Forecast, By Application, 2021 - 2034 (‘000 Units & USD Million)

- 10.1 Key trends

- 10.2 Pump

- 10.3 Fan

- 10.4 Conveyor

- 10.5 Compressor

- 10.6 Extruder

- 10.7 Others

Chapter 11 Market Size and Forecast, By End Use, 2021 - 2034 (‘000 Units & USD Million)

- 11.1 Key trends

- 11.2 Oil & Gas

- 11.3 Power generation

- 11.4 Food processing

- 11.5 Automotive

- 11.6 Mining & metals

- 11.7 Pulp & paper

- 11.8 Textile

- 11.9 Marine

- 11.10 Others

Chapter 12 Market Size and Forecast, By Country, 2021 - 2034 (‘000 Units & USD Million)

- 12.1 Key trends

- 12.2 Saudi Arabia

- 12.3 UAE

- 12.4 Qatar

- 12.5 South Africa

- 12.6 Nigeria

- 12.7 Egypt

- 12.8 Algeria

Chapter 13 Company Profiles

- 13.1 ABB

- 13.2 Beckhoff Automation

- 13.3 Bosch Rexroth

- 13.4 Danfoss

- 13.5 Delta Electronics, Inc

- 13.6 Eaton

- 13.7 Emerson Electric Co.

- 13.8 Emotron

- 13.9 Fuji Electric. Co., Ltd.

- 13.10 GE Vernova

- 13.11 Johnson Controls

- 13.12 LS ELECTRIC Co., Ltd.

- 13.13 Mitsubishi Electric Corporation

- 13.14 Nidec Corporation

- 13.15 Rockwell Automation

- 13.16 Schneider Electric

- 13.17 Siemens

- 13.18 TMEIC

- 13.19 WEG

- 13.20 YASKAWA ELECTRIC CORPORATION