PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871076

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871076

Small Forklift Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

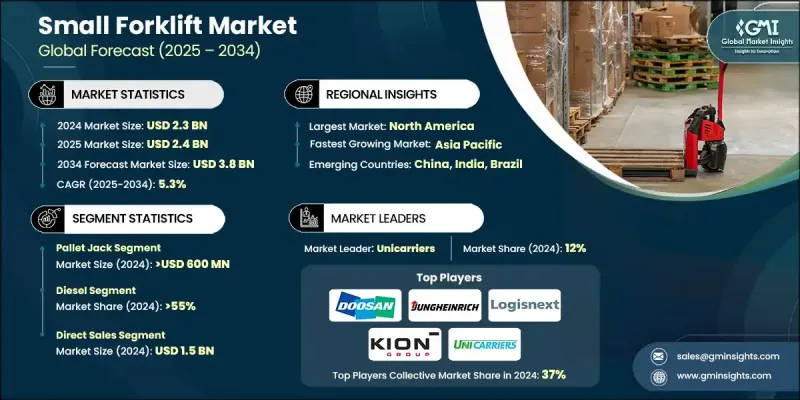

The Global Small Forklift Market was valued at USD 2.3 Billion in 2024 and is estimated to grow at a CAGR of 5.3% to reach USD 3.8 Billion by 2034.

Market growth is being driven by the growing need for compact, maneuverable, and efficient material-handling equipment across facilities with limited floor space. Small forklifts are becoming essential for warehouses, retail centers, and small manufacturing units due to their ability to operate in confined aisles while providing reliable lifting performance. The rising demand for space optimization and cost efficiency is enhancing their market appeal, particularly among businesses seeking low-maintenance and fuel-efficient alternatives. Small forklifts provide a cost-effective solution for operations with limited logistics budgets or moderate handling requirements. The increasing adoption of electric small forklifts is transforming the industry, supported by their quiet operation, reduced emissions, and environmental benefits. Companies focused on sustainability are shifting toward battery-powered forklifts to meet regulatory goals and improve indoor air quality. Manufacturers are also advancing product innovation by enhancing battery life, ergonomic design, and safety systems such as automated alerts and intuitive controls. Additionally, the market is seeing growth in rental and leasing programs, offering businesses flexible access to equipment without major capital expenditure, an attractive model for short-term projects and seasonal operations. Over the past decade, the small forklift has evolved from a niche solution to a widely adopted industrial standard across multiple sectors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.3 Billion |

| Forecast Value | $3.8 Billion |

| CAGR | 5.3% |

The pallet jack segment reached USD 600 million in 2024, holding the largest market share. Pallet jacks have become integral to warehouse and distribution operations due to their affordability, versatility, and efficiency in ground-level material handling. The expansion of e-commerce fulfillment centers continues to accelerate demand for electric pallet jacks, which offer improved ergonomics, reduced operator fatigue, and enhanced safety in fast-paced environments. Their ease of use and low operating costs make them a preferred choice in logistics and retail operations.

The diesel segment accounted for a 55% share in 2024. Diesel-powered forklifts maintain their dominance because of their long operating range, durability, and lower upfront costs compared to electric alternatives. This segment continues to grow steadily, supported by consistent replacement demand and outdoor material-handling applications where electric options remain limited in range and performance. However, tightening emission regulations and stricter environmental standards are gradually influencing the adoption rate of diesel units, particularly in urban and indoor environments, prompting a slow but steady shift toward cleaner energy options.

U.S. Small Forklift Market held 80.4% share and generated USD 500 million in 2024. North America remains a significant contributor to global demand, underpinned by a robust logistics network and a high rate of technological adoption. The region is witnessing rapid growth in electric forklift utilization, supported by strong export performance and regulatory mandates promoting zero-emission operations. U.S. states with strict environmental laws are accelerating the transition toward electric material-handling equipment, fostering a cleaner and more sustainable operational landscape across warehouses, factories, and retail facilities.

Prominent players active in the Global Small Forklift Market include Mitsubishi Logisnext Americas Inc., Toyota Industries Corporation, Jungheinrich AG, Doosan Bobcat, Crown Equipment Corporation, Manitou Group, Hyster-Yale, Inc., EP Equipment, Combilift, KION Group AG, Unicarriers, Clark Material Handling, Anhui Heli Co., Ltd., Regional Champions, Hangcha Group Co., Ltd., Niche Specialists, and Godrej & Boyce. Companies operating in the Global Small Forklift Market are employing strategic initiatives to strengthen their competitive position and expand their global footprint. They are heavily investing in electric and hybrid forklift technologies to meet growing sustainability requirements and regulatory standards. Manufacturers are focusing on advanced lithium-ion battery systems and fast-charging solutions to enhance efficiency and reduce downtime. Strategic collaborations with logistics providers and rental firms help increase market accessibility while providing customers with flexible ownership options.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Fuel

- 2.2.4 End use

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Expansion of e-commerce and fulfillment infrastructure

- 3.2.1.2 Transition toward electrification and sustainable operations

- 3.2.1.3 Integration of smart technologies and automation

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High capital investment for advanced forklift systems

- 3.2.2.2 Skilled labor shortage and training gaps

- 3.2.3 Opportunities

- 3.2.3.1 Growth in emerging economies and infrastructure development

- 3.2.3.2 Rise of micro-fulfillment and urban warehousing models

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Reach truck

- 5.3 Order picker

- 5.4 Turret truck

- 5.5 Pallet jack

- 5.6 Pallet stacker

- 5.7 Tow tractor

- 5.8 Walkie pallet truck

- 5.9 Rider pallet truck

Chapter 6 Market Estimates and Forecast, By Fuel, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Diesel

- 6.3 Electric

- 6.4 Gasoline & LPG/CNG

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Warehousing & logistics

- 7.3 Retail & e-commerce fulfillment centers

- 7.4 Manufacturing (light industry, electronics, food & beverage)

- 7.5 Construction & building materials

- 7.6 Automotive components handling

- 7.7 Ports & distribution terminals

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indirect sales

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Toyota Industries Corporation

- 10.2 KION Group AG

- 10.3 Jungheinrich AG

- 10.4 Crown Equipment Corporation

- 10.5 Mitsubishi Logisnext Americas Inc.

- 10.6 Hyster-Yale, Inc.

- 10.7 Anhui Heli Co., Ltd.

- 10.8 Hangcha Group Co., Ltd.

- 10.9 Doosan Bobcat

- 10.10 Clark Material Handling

- 10.11 Godrej & Boyce

- 10.12 Manitou Group

- 10.13 EP Equipment

- 10.14 Combilift

- 10.15 Unicarriers