PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844263

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844263

Hyperphosphatemia Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

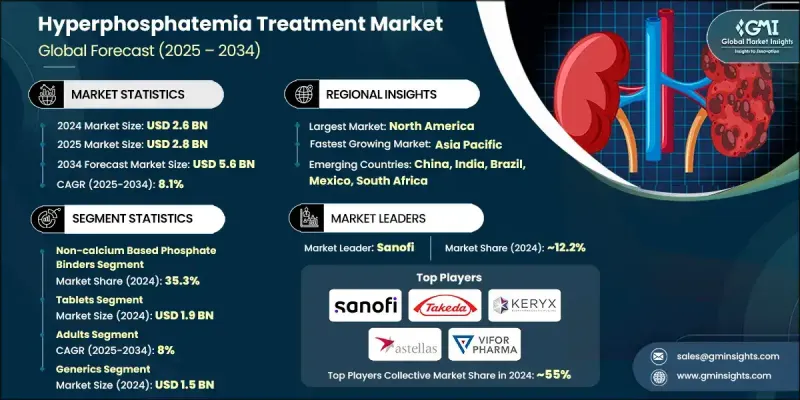

The Global Hyperphosphatemia Treatment Market was valued at USD 2.6 billion in 2024 and is estimated to grow at a CAGR of 8.1% to reach USD 5.6 billion by 2034.

The growth is fueled by rising cases of chronic kidney disease (CKD), the expanding number of end-stage renal disease (ESRD) patients, and the increasing adoption of dialysis worldwide. An aging population, together with higher rates of diabetes and hypertension, continues to drive up CKD prevalence globally, directly impacting the demand for hyperphosphatemia treatments. The shift toward processed food and sedentary lifestyles has also contributed to phosphate imbalances, pushing patients into long-term therapeutic regimens. In response, the treatment landscape is evolving rapidly, moving beyond traditional calcium-based binders toward more innovative options like iron-based binders and phosphate absorption inhibitors. These next-generation therapies offer improved tolerability and fewer side effects, boosting adherence and outcomes. As regulatory approvals and clinical trials increase, non-calcium binders and novel agents are being adopted more broadly across regions, supporting long-term market momentum.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.6 Billion |

| Forecast Value | $5.6 Billion |

| CAGR | 8.1% |

In 2024, the non-calcium-based phosphate binders held a 35.3% share and are anticipated to reach USD 2 billion by 2034, growing at a CAGR of 8%. These treatments offer smaller pill sizes and reduced gastrointestinal discomfort, leading to better patient adherence. As lifelong therapy is required for hyperphosphatemia, patient demand for more convenient and better-tolerated options is increasing steadily. Healthcare providers and dialysis centers increasingly prefer non-calcium binders due to their alignment with modern value-based care goals, which focus on improved cardiovascular outcomes and enhanced phosphate regulation, thereby reinforcing this segment's role in market expansion.

The adult patient group segment is growing at a CAGR of 8% throughout 2034. Adults over the age of 40 represent the highest-risk demographic for both chronic kidney disease and ESRD, making them the largest consumers of phosphate-lowering treatments. As the global adult CKD population grows, demand for hyperphosphatemia therapies continues to scale, especially in markets where access to nephrology specialists and dialysis centers is widespread. In developed regions, structured care protocols and early intervention frameworks are improving diagnosis and treatment compliance, helping maintain the adult segment's market dominance.

North America Hyperphosphatemia Treatment Market held 44.3% share in 2024, with the United States contributing the largest portion of regional revenue. The high burden of CKD and the widespread adoption of dialysis drive strong demand for phosphate-lowering drugs across the region. A well-established network of dialysis clinics, managed by leading providers, enables reliable phosphate monitoring and consistent therapy delivery. This infrastructure supports the expansion of both traditional and next-generation treatments, making North America a central force in shaping global market dynamics and therapeutic innovation.

Key players shaping the Global Hyperphosphatemia Treatment Market include Fresenius Medical Care, Vifor Pharma (CSL Limited), Dr. Reddy's, Takeda Pharmaceuticals, Astellas Pharma, Sanofi, Lupin, Cipla, Glenmark, Teva Pharmaceuticals, Amneal, Mitsubishi Tanabe Pharma, Aurobindo Pharma, Macleods, and Keryx Biopharmaceuticals. Companies operating in the hyperphosphatemia treatment market are focusing on expanding their therapeutic portfolios through drug innovation and strategic licensing deals. Many are investing in clinical research to develop non-calcium and iron-based binders that provide better safety profiles and improved patient outcomes. Partnerships with dialysis networks and nephrology clinics help ensure consistent distribution and patient access. Firms like Sanofi and Vifor Pharma are strengthening global reach through regional collaborations, while generics players such as Cipla and Teva Pharmaceuticals are entering emerging markets with cost-effective formulations.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Dosage form trends

- 2.2.4 Age group trends

- 2.2.5 Type trends

- 2.2.6 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of chronic kidney disease (CKD) and dialysis patients

- 3.2.1.2 Aging population and lifestyle-related disorders

- 3.2.1.3 Advancements in drug development and novel therapies

- 3.2.1.4 Increasing awareness and preventive healthcare initiatives

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High pill burden and poor patient compliance

- 3.2.2.2 High treatment costs

- 3.2.3 Market opportunities

- 3.2.3.1 Development of low-pill-burden therapies

- 3.2.3.2 Personalized medicine and combination therapies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.1 North America

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Pricing analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Calcium-based phosphate binders

- 5.3 Non-calcium based phosphate binders

- 5.4 Iron-based phosphate binders

- 5.5 Lanthanum carbonate

- 5.6 Other products

Chapter 6 Market Estimates and Forecast, By Dosage Form, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Tablets

- 6.3 Powder

- 6.4 Other dosage forms

Chapter 7 Market Estimates and Forecast, By Age Group, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Adults

- 7.3 Pediatrics

Chapter 8 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Branded

- 8.3 Generics

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals

- 9.3 Homecare settings

- 9.4 Dialysis centers

- 9.5 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Amneal

- 11.2 Astellas Pharma

- 11.3 Aurobindo Pharma

- 11.4 Cipla

- 11.5 Dr. Reddy's

- 11.6 Glenmark

- 11.7 Fresenius Medical Care

- 11.8 Keryx Biopharmaceuticals

- 11.9 Lupin

- 11.10 Macleods

- 11.11 Mitsubishi Tanabe Pharma

- 11.12 Sanofi

- 11.13 Takeda Pharmaceuticals

- 11.14 Teva Pharmaceuticals

- 11.15 Vifor Pharma (CSL Limited)