PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844271

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844271

North America Cargo Vans Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

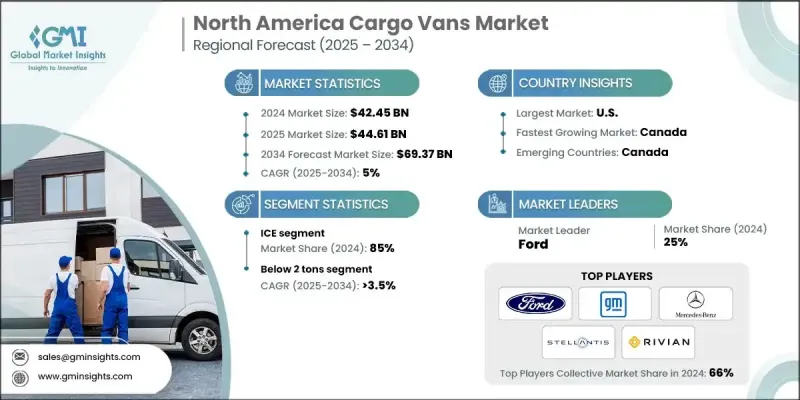

North America Cargo Vans Market was valued at USD 42.45 billion in 2024 and is estimated to grow at a CAGR of 5% to reach USD 69.37 billion by 2034.

This growth is largely supported by the rising integration of advanced mobility technologies and the evolving role of cargo vans within modern logistics systems. Once primarily used by small service providers and local businesses, cargo vans are now critical assets within expansive delivery networks and corporate fleets. The continued boom in e-commerce has placed increasing pressure on logistics providers to meet high expectations for fast, efficient delivery. Cargo vans are uniquely positioned to address these needs due to their mid-sized design and ability to access both urban and suburban areas with ease. Furthermore, shifting environmental policies are encouraging the adoption of low-emission commercial transport options. New greenhouse gas standards targeting medium-duty vehicles are anticipated to impact fleet decisions in both the U.S. and Canada, pushing manufacturers and operators toward improved fuel economy and greener technologies. These regulatory shifts, combined with logistics sector growth, are accelerating the demand for high-performance, efficient cargo vans across North America.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $42.45 Billion |

| Forecast Value | $69.37 Billion |

| CAGR | 5% |

In 2024, the internal combustion engine (ICE) cargo vans segment accounted for an 85% share and are projected to grow at a CAGR of 3.9% between 2025 and 2034. ICE vans maintain their lead in the market due to extensive fueling infrastructure, higher payload capacity, and better performance across long-haul commercial operations. Compared to electric alternatives, ICE vans continue to offer unmatched convenience in terms of refueling speed and route flexibility, especially in less urbanized areas across the region. Their dominance is reinforced by fleet familiarity, cost efficiency, and supply chain maturity.

The cargo vans with a payload capacity of less than 2 tons segment held a 54% share in 2024 and are projected to register a CAGR of 3.5% through 2034. This segment is preferred by small and medium-sized commercial buyers because of its cost-effectiveness, maneuverability, and broad utility across applications. Light-duty cargo vans offer lower operating costs, easier licensing, and fewer regulatory challenges, making them ideal for last-mile delivery, mobile services, and urban logistics.

U.S. Cargo Vans Market held 88% share, generating USD 37.36 billion in 2024, driven by strong OEM presence, robust demand from delivery and trade fleets, and consistent investment in manufacturing and infrastructure. Several leading automotive companies, including RAM (Stellantis), General Motors, BrightDrop, and Ford, continue to innovate and expand production across both ICE and electric cargo vans to serve a wide range of commercial applications within the U.S. market.

Major players in the North America Cargo Vans Market include Nissan, Mercedes-Benz, Isuzu, Rivian, Ford, BrightDrop, General Motors, and RAM (Stellantis). To reinforce their market position, cargo van manufacturers in North America are focusing on diversifying their product lines to include both ICE and electric models. Companies are investing in local production facilities to reduce lead times and streamline logistics. Strategic partnerships with fleet operators, logistics firms, and last-mile service providers are helping drive volume sales. Moreover, players are adopting connected vehicle technology, advanced telematics, and modular van configurations to appeal to both small businesses and large commercial fleet buyers.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Country

- 2.2.2 Propulsion

- 2.2.3 Tonnage capacity

- 2.2.4 Vehicle class

- 2.2.5 End use

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising E-commerce and last-mile delivery demand

- 3.2.1.2 Government regulations on emissions

- 3.2.1.3 Advancements in electric vehicle technology

- 3.2.1.4 Fleet electrification initiatives by major corporations

- 3.2.1.5 Growth of urbanization and smart cities

- 3.2.1.6 Enhanced safety and connectivity features

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial cost of electric vans

- 3.2.2.2 Limited charging infrastructure in rural areas

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of Fleet-as-a-Service (Faas) Models

- 3.2.3.2 Development of autonomous delivery vans

- 3.2.3.3 Growing demand for sustainable logistics solutions

- 3.2.3.4 Government incentives and subsidies for EV adoption

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 Federal safety standards & regulations

- 3.4.2 IEEE standards for charging infrastructure

- 3.4.3 UL certification requirements

- 3.4.4 FTA safety & security certification process

- 3.4.5 Canadian Standards Association (CSA) requirements

- 3.4.6 Interoperability standards development

- 3.4.7 Cybersecurity standards & protocols

- 3.4.8 Battery safety & testing standards

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trend analysis

- 3.8.1 By country

- 3.8.2 By propulsion

- 3.9 Cost breakdown analysis

- 3.10 Production statistics

- 3.10.1 Production hubs

- 3.10.2 Consumption hubs

- 3.10.3 Export and import analysis

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.11.5 Carbon footprint considerations

- 3.12 Risk assessment & mitigation strategies

- 3.12.1 Technology risk assessment

- 3.12.2 Supply chain risk analysis

- 3.12.3 Infrastructure reliability risks

- 3.12.4 Market adoption risk factors

- 3.12.5 Financial & economic risks

- 3.13 Future outlook and market disruptions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 US

- 4.2.2 Canada

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Propulsion, 2021 - 2034 (USD Bn, Units)

- 5.1 Key trends

- 5.2 ICE

- 5.3 Electric

- 5.3.1 Battery electric vehicle

- 5.3.2 Hybrid electric vehicle

- 5.3.3 Plug-in hybrid electric vehicle

Chapter 6 Market Estimates & Forecast, By Tonnage Capacity, 2021 - 2034 (USD Bn, Units)

- 6.1 Key trends

- 6.2 Below 2 tons

- 6.3 2 to 3 tons

- 6.4 Above 3 tons

Chapter 7 Market Estimates & Forecast, By Vehicle Class, 2021 - 2034 (USD Bn, Units)

- 7.1 Key trends

- 7.2 Light vans (class 1-2)

- 7.3 Medium vans (class 3)

- 7.4 Heavy/step vans (class 4-6)

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Bn, Million Units)

- 8.1 Key trends

- 8.2 Personal

- 8.3 Commercial

- 8.3.1 Last-mile delivery

- 8.3.2 Courier/parcel

- 8.3.3 Field services

- 8.3.4 Others

Chapter 9 Market Estimates & Forecast, By Country, 2021 - 2034 (USD Mn, Units)

- 9.1 Key trends

- 9.2 U.S.

- 9.2.1 Northeast

- 9.2.1.1 New York

- 9.2.1.2 Pennsylvania

- 9.2.1.3 New Jersey

- 9.2.1.4 Massachusetts

- 9.2.1.5 Connecticut

- 9.2.1.6 Rest of Northeast

- 9.2.2 Midwest

- 9.2.2.1 Illinois

- 9.2.2.2 Ohio

- 9.2.2.3 Michigan

- 9.2.2.4 Indiana

- 9.2.2.5 Wisconsin

- 9.2.2.6 Rest of Midwest

- 9.2.3 South

- 9.2.3.1 Texas

- 9.2.3.2 Florida

- 9.2.3.3 Georgia

- 9.2.3.4 North Carolina

- 9.2.3.5 Tennessee

- 9.2.3.6 Rest of South

- 9.2.4 West

- 9.2.4.1 California

- 9.2.4.2 Arizona

- 9.2.4.3 Washington

- 9.2.4.4 Colorado

- 9.2.4.5 Nevada

- 9.2.4.6 Rest of West

- 9.2.1 Northeast

- 9.3 Canada

- 9.3.1 British Columbia

- 9.3.2 Ontario

- 9.3.3 Quebec

- 9.3.4 Manitoba

- 9.3.5 Yukon

- 9.3.6 Alberta

- 9.3.7 Rest of Canada

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 Ford Motor Company

- 10.1.2 General Motors Company

- 10.1.3 Hyundai

- 10.1.4 Mercedes-Benz Group AG

- 10.1.5 Rivian Automotive Inc.

- 10.1.6 Stellantis N.V. (RAM/Dodge)

- 10.1.7 Toyota

- 10.1.8 Volkswagen Group

- 10.2 Regional Players

- 10.2.1 Isuzu Commercial Truck of America

- 10.2.2 Navistar International Corporation

- 10.2.3 Workhorse Group Inc.

- 10.3 Emerging Players / Disruptors

- 10.3.1 Arrival Ltd.

- 10.3.2 BrightDrop (GM Subsidiary)

- 10.3.3 Canoo Inc.

- 10.3.4 Honda

- 10.3.5 IVECO