PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844272

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844272

Europe Pet Cargo Boxes Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

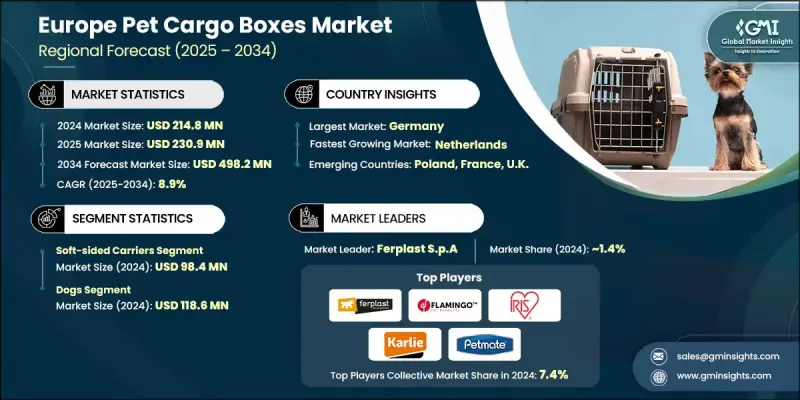

Europe Pet Cargo Boxes Market was valued at USD 214.8 million in 2024 and is estimated to grow at a CAGR of 8.9% to reach USD 498.2 million by 2034.

Market expansion is supported by growing emphasis on humane and compliant animal transportation across European borders. As transportation standards become more regulated, particularly under EU animal welfare laws, there is a rising demand for secure, ergonomic, and regulation-ready pet cargo boxes. These carriers must ensure not only physical safety but also address the behavioral and physiological needs of pets during travel. The heightened scrutiny on animal welfare and lack of a uniform pan-European policy have led several countries to adopt strict national regulations, increasing demand for universally accepted transport solutions. Pet transport within the region often requires traceability, proper identification, and health documentation, intensifying the need for well-constructed, traceable, and regulation-compliant cargo boxes. This regulatory complexity opens new avenues for manufacturers to innovate in areas such as temperature regulation, ventilation, and material durability while complying with varying country-level standards. As consumer awareness rises and pet travel increases, the need for premium, compliant, and user-friendly carriers will continue to grow across the continent.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $214.8 Million |

| Forecast Value | $498.2 Million |

| CAGR | 8.9% |

The soft-sided segment generated USD 98.4 million in 2024 and is forecasted to grow at a CAGR of 9.5% between 2025 and 2034. Their lightweight, foldable design and compatibility with most airline travel guidelines make them the preferred option among pet owners. Although vehicle-mounted and professional-grade modular systems hold a smaller share, they continue to serve niche segments, including regular travelers and licensed pet transport services seeking long-term durability and functionality.

The dogs segment generated USD 118.6 million in 2024, claiming a 55.2% share. Dogs remain the most frequently transported animals for both personal and professional use, driving significant demand for cargo boxes. Stricter transport regulations applied to dogs have resulted in a need for more robust, feature-rich containers, boosting average price points and segment revenue. Their use in areas like therapy, emergency services, and law enforcement further accelerates the demand for specially designed carriers tailored to mobility and animal welfare.

Germany Pet Cargo Boxes Market was estimated at USD 27.9 million in 2024 and is expected to grow at a CAGR of 8.6% through 2034. Germany and France are at the forefront of regional growth due to high pet adoption rates and a strong preference for compliant, premium-grade transport products. German producers typically focus on rugged designs and vehicle-compatible systems, aligning with the country's automotive market. In contrast, French companies tend to prioritize lightweight, fashionable, and environmentally conscious materials. Both countries benefit from well-established retail chains and online platforms, ensuring widespread access to quality pet transport solutions.

Key players in the Europe Pet Cargo Boxes Market include IRIS Europe, Duvo+, Karlie Flamingo GmbH, Trixie Pet Products, Pet Gear Europe, Flamingo Pet Products, Petmate Europe, MPS Italia S.r.l., Marchioro S.p.A., Sherpa, Sleepypod, Richell Europe, Stefanplast S.p.A., Ferplast S.p.A., Savic NV, and Suncast Europe. To expand their footprint, companies operating in the Europe pet cargo boxes market are focusing on innovation that aligns with changing transport regulations and consumer lifestyles. Manufacturers are launching ergonomically designed carriers with features like improved ventilation, reinforced walls, collapsible designs, and built-in tracking compatibility. Sustainable and eco-conscious materials are gaining traction, particularly among younger consumers. Leading brands are enhancing distribution via e-commerce and partnering with airline-approved travel gear platforms to boost visibility. Many are also investing in modular product lines that can be tailored for specific pet sizes and transport modes. Regional expansion into emerging European markets and adapting designs to meet country-specific standards has become a key strategy for capturing share in this evolving industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Country wise trends

- 2.2.2 Product type trends

- 2.2.3 Pet type trends

- 2.2.4 Price range trends

- 2.2.5 Application trends

- 2.2.6 End use trends

- 2.2.7 Distribution channel trends

- 2.3 CXO perspective: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

- 2.5 Strategic recommendations

- 2.5.1 Supply chain diversification strategy

- 2.5.2 Product portfolio enhancement

- 2.5.3 Partnership and alliance opportunities

- 2.5.4 Cost management and pricing strategy

- 2.6 Decision framework

- 2.6.1 Investment priority matrix

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising pet humanization & travel trends

- 3.2.1.2 Growth in professional pet services industry

- 3.2.1.3 Increasing pet ownership in emerging markets

- 3.2.1.4 E-commerce expansion & online retail growth

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High manufacturing & compliance costs

- 3.2.2.2 Fragmented regulatory standards across regions

- 3.2.3 Opportunities

- 3.2.3.1 EU green deal & sustainable material innovation

- 3.2.3.2 Digital single market & e-commerce expansion

- 3.2.3.3 European professional services market growth

- 3.2.3.4 EU-wide harmonized standards development

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Emerging Trends & Technologies

- 3.6 Technology and innovation landscape

- 3.6.1 Current technological trends

- 3.6.2 Emerging technologies

- 3.7 Pricing trends

- 3.7.1 By country and product type

- 3.7.2 Raw material cost

- 3.8 Regulatory framework

- 3.9 Trade statistics (HS code - 420100)

- 3.9.1 Major importing countries

- 3.9.2 Major exporting countries

- 3.10 Porter's five forces analysis

- 3.11 PESTEL analysis

- 3.12 Consumer behavior analysis

- 3.12.1 Purchasing patterns

- 3.12.2 Preference analysis

- 3.12.3 Country variations in consumer behavior

- 3.12.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis, by country

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Hard-sided carriers

- 5.3 Soft-sided carriers

- 5.4 Vehicle-mounted systems

- 5.5 Professional & modular systems

Chapter 6 Market Estimates & Forecast, By Pet Type, 2021 - 2034 (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Dogs

- 6.3 Cats

- 6.4 Birds

- 6.5 Fish & aquatic pets

- 6.6 Others (mammals, rabbits, hamsters, etc.)

Chapter 7 Market Estimates & Forecast, By Price Range, 2021 - 2034 (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Low (Below USD 50)

- 7.3 Medium (USD 50 - USD 150)

- 7.4 High (Above USD 150)

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Air travel transport

- 8.3 Ground transport

- 8.4 Facility-based housing

- 8.5 Emergency & disaster response

- 8.6 Others (pet shows, exhibitions, and competitions, etc.)

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 Individual pet owners

- 9.3 Professional pet services

- 9.4 Commercial transport services

- 9.5 Government & military

- 9.6 Others (animal welfare organizations, etc.)

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Million) (Thousand Units)

- 10.1 Key trends

- 10.2 Online

- 10.2.1 E-commerce

- 10.2.2 Company Website

- 10.3 Offline

- 10.3.1 Supermarkets and Hypermarkets

- 10.3.2 Pet Specialty Stores

- 10.3.3 Other Retail Stores (Pet Hospitals, etc.)

Chapter 11 Market Estimates & Forecast, By Country, 2021 - 2034, (USD Million) (Thousand Units)

- 11.1 Key trends

- 11.2 U.K.

- 11.3 Germany

- 11.4 France

- 11.5 Italy

- 11.6 Spain

- 11.7 Netherlands

- 11.8 Belgium

- 11.9 Poland

- 11.10 Czech Republic

- 11.11 Nordic Countries

Chapter 12 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 12.1 Duvo+

- 12.2 Ferplast S.p.A

- 12.3 Flamingo Pet Products

- 12.4 IRIS Europe

- 12.5 Karlie Flamingo GmbH

- 12.6 Marchioro S.p.A

- 12.7 MPS Italia S.r.l

- 12.8 Pet Gear Europe

- 12.9 Petmate Europe

- 12.10 Richell Europe

- 12.11 Savic NV

- 12.12 Sherpa

- 12.13 Sleepypod

- 12.14 Stefanplast S.p.A

- 12.15 Suncast Europe

- 12.16 Trixie Pet Products