PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844275

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844275

U.S. Pancreatic Cancer Diagnostic Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

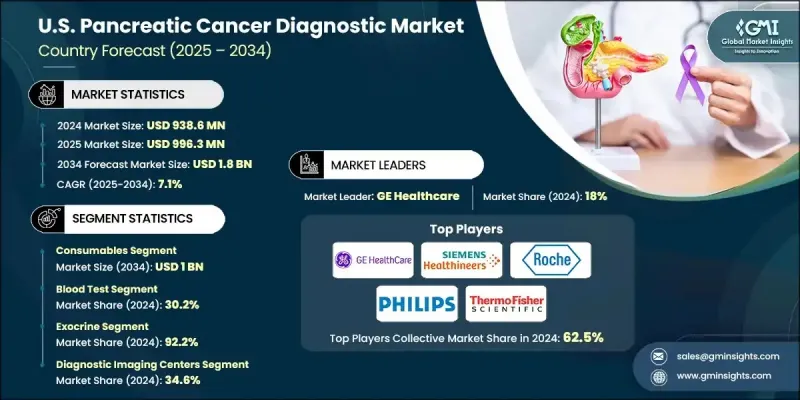

U.S. Pancreatic Cancer Diagnostic Market was valued at USD 938.6 million in 2024 and is estimated to grow at a CAGR of 7.1% to reach USD 1.8 billion by 2034.

The expansion is driven by multiple factors, including a growing elderly population, the increasing incidence of pancreatic cancer, and advancements in diagnostic technologies that support early detection. As pancreatic cancer is often identified at an advanced stage due to its asymptomatic onset and deep anatomical positioning, there is a rising demand for precise, early-stage diagnostics. In the U.S., a range of diagnostic tools from imaging systems and blood-based biomarker tests to molecular platforms are playing a crucial role in confirming diagnoses, determining disease stage, and informing treatment paths. Demand continues to rise for non-invasive, high-accuracy solutions capable of addressing the challenges of late-stage diagnosis.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $938.6 Million |

| Forecast Value | $1.8 billion |

| CAGR | 7.1% |

Technology is accelerating change across the diagnostic ecosystem, with AI-powered tools advancing imaging precision and real-time detection capabilities. Imaging platforms integrated with artificial intelligence are offering physicians earlier insights by interpreting scans faster and more accurately. These innovations are reducing diagnostic delays and improving the chances of detecting the disease at treatable stages, a vital component of successful outcomes in pancreatic cancer cases.

The instruments segment generated USD 404.5 million in 2024 and is projected to hit USD 811.9 million by 2034, growing at a CAGR of 7.3%. This segment serves as the foundation of the U.S. pancreatic cancer diagnostics market. It includes next-generation imaging equipment, endoscopy systems, and molecular diagnostic tools, all crucial for detecting and managing a disease that typically lacks early warning signs. Increasing deployment of AI-integrated technologies and advanced hardware in clinical settings is further propelling this segment forward as hospitals and imaging centers expand capacity and adopt cutting-edge systems.

In 2024, the blood test segment held a 30.2% share. Non-invasive blood-based diagnostics are gaining momentum due to their ease of use and potential for early-stage disease identification. Widely used biomarkers such as CEA and CA 19-9 remain standard for tracking disease progression, though limited sensitivity in initial stages has prompted the development of more advanced molecular diagnostics. Novel tests utilizing multiplex biomarkers or detecting electrical changes in plasma are currently emerging as promising additions to early screening protocols.

The diagnostic imaging centers segment held a 34.6% share in 2024. These facilities serve as essential access points for initial diagnostic evaluations due to their deployment of high-resolution imaging technologies capable of detecting abnormalities in pancreatic tissues. The increasing need for accurate and rapid diagnostics has led to expanded use of systems such as PCR platforms, NGS technologies, and liquid biopsy analyzers within imaging centers. These advanced solutions support the detection of genetic alterations, circulating tumor DNA, and specific biomarkers, reinforcing the role of imaging centers in timely cancer diagnosis.

Key industry players in the U.S. Pancreatic Cancer Diagnostic Market include Olympus, Illumina, Thermo Fisher Scientific, QIAGEN, Danaher, Canon, Siemens Healthineers, Myriad Genetics, Boston Scientific, Becton, Dickinson and Company, Agilent Technologies, Sysmex, Abbott Laboratories, GE Healthcare, Koninklijke Philips, and F. Hoffmann-La Roche. Companies in the U.S. pancreatic cancer diagnostic market are focusing on targeted innovation, strategic collaborations, and product diversification to maintain a competitive edge. Leading firms are investing in advanced AI-driven imaging systems and liquid biopsy technologies to improve early detection capabilities. Expanding R&D pipelines for next-generation biomarker panels and molecular diagnostics allows companies to address unmet clinical needs. Partnerships with academic institutions and diagnostic labs are accelerating product development and validation. Furthermore, firms are scaling their presence across diagnostic imaging centers and hospitals by enhancing system compatibility and integration

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Product trends

- 2.2.2 Test type trends

- 2.2.3 Cancer type trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of pancreatic cancer in the U.S.

- 3.2.1.2 Growing demand for early detection

- 3.2.1.3 Rising geriatric population

- 3.2.1.4 Advancements in diagnostic technologies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory scenarios

- 3.2.2.2 High cost of diagnostic tests

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of precision medicine and genomic testing

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Reimbursement scenario

- 3.8 Pricing analysis, 2024

- 3.9 Future market trends

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Instruments

- 5.3 Consumables

Chapter 6 Market Estimates and Forecast, By Test Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Imaging test

- 6.2.1 CT scan

- 6.2.2 MRI

- 6.2.3 Ultrasound

- 6.2.4 PET

- 6.2.5 Other imaging tests

- 6.3 Biopsy

- 6.4 Blood test

- 6.4.1 Liver function tests

- 6.4.2 Tumor markers

- 6.4.3 Other blood tests

- 6.5 Other test types

Chapter 7 Market Estimates and Forecast, By Cancer Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Exocrine

- 7.2.1 Adenocarcinoma

- 7.2.2 Colloid carcinoma

- 7.2.3 Adenosquamous carcinoma

- 7.2.4 Squamous cell carcinoma

- 7.3 Endocrine

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Cancer research institutes

- 8.3 Hospitals and clinics

- 8.4 Diagnostic laboratories

- 8.5 Diagnostic imaging centers

Chapter 9 Company Profiles

- 9.1 Abbott Laboratories

- 9.2 Agilent Technologies

- 9.3 Becton, Dickinson and Company

- 9.4 Boston Scientific

- 9.5 Canon

- 9.6 Danaher

- 9.7 F Hoffmann-La Roche

- 9.8 GE Healthcare

- 9.9 Illumina

- 9.10 Koninklijke Philips

- 9.11 Myriad Genetics

- 9.12 Olympus

- 9.13 QIAGEN

- 9.14 Siemens Healthineers

- 9.15 Sysmex

- 9.16 Thermo Fisher Scientific