PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801909

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801909

Pancreatic Cancer Diagnostic Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

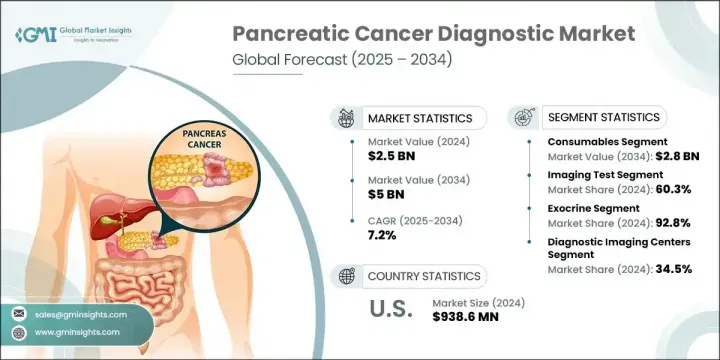

The Global Pancreatic Cancer Diagnostic Market was valued at USD 2.5 billion in 2024 and is estimated to grow at a CAGR of 7.2% to reach USD 5 billion by 2034. This growth is largely driven by the increasing global incidence of pancreatic cancer, rising investments in healthcare infrastructure, and ongoing advancements in diagnostic technologies. As awareness about early detection improves and healthcare systems focus on faster diagnosis and improved outcomes, the adoption of advanced diagnostic tools has accelerated. These tools-ranging from molecular diagnostics to high-resolution imaging and biomarker-based assays-play a pivotal role in detecting cancer early, especially in asymptomatic stages when treatment can be most effective.

A wide range of innovative technologies continues to reshape the diagnostic landscape, with AI-integrated imaging, molecular profiling, and liquid biopsy techniques improving accuracy, efficiency, and safety. Additionally, the push toward personalized medicine and patient-centric care is reinforcing the importance of early-stage identification. The expansion of clinical applications, supported by improved workflow efficiencies and minimally invasive procedures, has positioned pancreatic cancer diagnostics as an integral part of modern oncology practices. Increased awareness, combined with the growing demand for timely and precise diagnosis, is creating favorable conditions for market expansion over the next decade.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.5 Billion |

| Forecast Value | $5 Billion |

| CAGR | 7.2% |

In 2024, the consumables segment generated USD 1.4 billion and is forecasted to hit USD 2.8 billion by 2034, with a CAGR of 7%. This segment's strong performance is largely due to the continued use of reagents, assay kits, and testing materials across diagnostic settings. As the demand for liquid biopsy, molecular diagnostics, and immunoassays rises, so does the need for reliable consumables that ensure test consistency, compatibility, and reproducibility. Their role in enabling fast and repeatable testing has made them indispensable in both clinical laboratories and hospital environments.

The exocrine segment held a 92.8% share in 2024, driven by the high prevalence of various exocrine pancreatic cancers, including squamous cell carcinoma, adenosquamous carcinoma, colloid carcinoma, and adenocarcinoma. With most pancreatic cancer cases falling under this category, healthcare providers are prioritizing advanced diagnostic solutions for early detection, accurate staging, and streamlined treatment planning. Emerging technologies such as automated lesion detection, cryo-biopsy innovations, and AI-assisted diagnostics are driving better patient outcomes through faster and more precise results.

The Diagnostic imaging centers segment held a 34.5% share in 2024, attributed to their specialized infrastructure and capability to deliver rapid, high-resolution scans using advanced equipment such as MRI, CT, and endoscopic ultrasound (EUS). These centers continue to play a vital role in facilitating accurate diagnosis, staging, and monitoring of pancreatic cancer. Their integrated workflows and access to cutting-edge modalities allow them to deliver timely, reliable imaging results essential for effective clinical decision-making.

United States Pancreatic Cancer Diagnostic Market reached USD 938.6 million in 2024. The steady rise in cancer incidence across the country, coupled with increasing awareness and access to advanced healthcare, has created strong demand for innovative diagnostic technologies. The favorable regulatory environment, extensive R&D investments, and public education campaigns have also contributed to the growth of the market, positioning the U.S. as a key player in global diagnostics innovation.

Leading companies operating in the Global Pancreatic Cancer Diagnostic Market include GE Healthcare, Thermo Fisher Scientific, Siemens Healthineers, Koninklijke Philips, and F. Hoffmann-La Roche. To strengthen their foothold in the pancreatic cancer diagnostic market, major companies are focusing on product innovation, AI-driven diagnostic tools, and expanding their global presence. Partnerships with healthcare providers and research institutions are enabling co-development of novel biomarkers and imaging techniques. Firms are also investing heavily in precision diagnostics and minimally invasive methods, including liquid biopsy platforms and advanced molecular profiling. Regulatory approvals for next-generation diagnostic kits and integration of software for imaging automation are helping companies gain a competitive advantage. Additionally, expanding access through digital health platforms and strategic collaborations in emerging markets are key growth initiatives.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Test type trends

- 2.2.4 Cancer type trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of pancreatic cancer

- 3.2.1.2 Advancements in diagnostic technologies

- 3.2.1.3 Growing healthcare expenditure globally

- 3.2.1.4 Rising awareness regarding early cancer detection

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory scenarios

- 3.2.2.2 High cost of diagnostic tests

- 3.2.3 Market opportunities

- 3.2.3.1 Rising integration of artificial intelligence (AI) in imaging technology

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Reimbursement scenario

- 3.8 Pricing analysis, 2024

- 3.9 Future market trends

- 3.10 Gap analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Instruments

- 5.3 Consumables

Chapter 6 Market Estimates and Forecast, By Test Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Imaging test

- 6.2.1 CT scan

- 6.2.2 MRI

- 6.2.3 Ultrasound

- 6.2.4 PET

- 6.2.5 Other imaging tests

- 6.3 Biopsy

- 6.4 Blood test

- 6.4.1 Liver function tests

- 6.4.2 Tumor markers

- 6.4.3 Other blood tests

- 6.5 Other test types

Chapter 7 Market Estimates and Forecast, By Cancer Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Exocrine

- 7.2.1 Adenocarcinoma

- 7.2.2 Colloid carcinoma

- 7.2.3 Adenosquamous carcinoma

- 7.2.4 Squamous cell carcinoma

- 7.3 Endocrine

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Cancer research institutes

- 8.3 Hospitals and clinics

- 8.4 Diagnostic laboratories

- 8.5 Diagnostic imaging centers

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Abbott Laboratories

- 10.2 Agilent Technologies

- 10.3 Becton, Dickinson and Company

- 10.4 Boston Scientific Corporation

- 10.5 Canon

- 10.6 Danaher Corporation

- 10.7 Esaote

- 10.8 F Hoffmann-La Roche

- 10.9 GE Healthcare

- 10.10 Hitachi

- 10.11 Illumina

- 10.12 Koninklijke Philips

- 10.13 Myriad Genetics

- 10.14 Olympus Corporation

- 10.15 QIAGEN

- 10.16 Siemens Healthineers

- 10.17 Sysmex Corporation

- 10.18 Thermo Fisher Scientific