PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844282

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844282

AI Watermarking Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

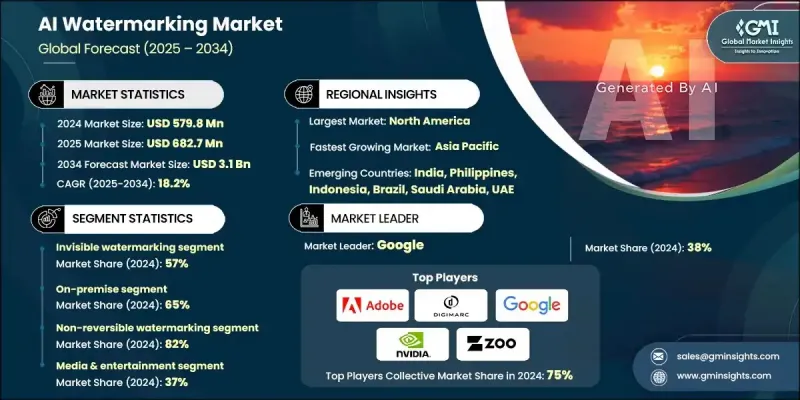

The Global AI Watermarking Market was valued at USD 579.8 million in 2024 and is estimated to grow at a CAGR of 18.2% to reach USD 3.1 billion by 2034.

The growth is driven by the widespread adoption of generative AI, large language models, and synthetic media across industries. As enterprises and institutions increasingly adopt AI-generated content, the need to implement watermarking solutions for traceability, content verification, and regulatory compliance becomes critical. With rising concerns around deepfakes and misinformation, watermarking technologies now play a key role in maintaining digital trust and integrity. Regulatory developments, such as upcoming global AI governance frameworks and content authenticity initiatives, are further encouraging the integration of watermarking across AI workflows. Standards like provenance metadata and interoperable frameworks help reduce disinformation risks while enhancing transparency across digital ecosystems. Companies are also emphasizing high-performance watermarking systems that support multimodal formats, such as text, audio, images, and video, while integrating metadata and model-embedded techniques. The market continues to be shaped by advancements in watermark visibility, real-time tracking, and the adoption of scalable, secure tools. North America leads the global market, with significant developments and adoption across major enterprise platforms, technology providers, and government-backed innovation programs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $579.8 Million |

| Forecast Value | $3.1 Billion |

| CAGR | 18.2% |

The invisible watermarking segment held a 57% share in 2024 and is expected to grow at a CAGR of 17% through 2034, owing to its ability to embed markers directly within AI-generated outputs without altering the content's appearance or quality. Invisible watermarks are integrated at the model level, making them highly resistant to manipulation such as cropping, editing, or compression. Because these watermarks are undetectable to users, they preserve content aesthetics while enabling regulators, developers, and businesses to ensure authenticity. The balance between user experience and security is a major factor behind this segment's strong market positioning.

The on-premise deployment segment held a 65% share in 2024 and is forecast to grow at a CAGR of 17.5% from 2025 to 2034. On-premise adoption remains dominant, particularly among institutions handling sensitive data such as government bodies, defense agencies, and financial institutions. These entities prefer in-house watermarking systems for full control over operations, enhanced data protection, and compliance with internal IT governance. On-premises models offer additional advantages in preventing exposure to external threats and ensuring tighter alignment with region-specific data privacy standards and cybersecurity protocols.

U.S. AI Watermarking Market held 85% share, generating USD 198.2 million in 2024, driven by a strong emphasis on generative AI adoption, intellectual property protection, and regulatory compliance. Enterprises across sectors are investing heavily in watermarking tools to combat content misuse, verify origin, and scale authentication systems. Demand is also supported by AI content regulation frameworks, cloud-native system compatibility, and the need for high-performance, energy-efficient watermarking engines that support both speed and accuracy.

Key players in the Global AI Watermarking Market include Digimarc, Microsoft, OpenAI, IMATAG, Adobe, NVIDIA, Verimatrix, Meta Platforms, Google, and ZOO Digital. To strengthen their presence in the AI Watermarking Market, companies are focusing on a combination of strategic innovation and ecosystem partnerships. Leading players are investing in advanced R&D to develop robust, tamper-proof watermarking solutions capable of handling large-scale multimodal content. Emphasis is placed on interoperability with AI platforms and regulatory alignment to ensure global adoption. Some are expanding on embedded watermarking technologies at the model training level, while others are building AI watermark APIs for integration with third-party content systems.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Technology

- 2.2.4 Deployment Mode

- 2.2.5 Application

- 2.2.6 End Use

- 2.2.7 Content

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising Deepfake & ai-generated content threats

- 3.2.1.2 Regulatory pressure for content authentication

- 3.2.1.3 Rise in consumer demand for content verification

- 3.2.1.4 Increase in AI model integration

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Technical implementation complexity

- 3.2.2.2 High development & integration costs

- 3.2.3 Market opportunities

- 3.2.3.1 Increase in compliance requirements

- 3.2.3.2 Rise in consumer awareness

- 3.2.3.3 Surge in cross-industry collaborations

- 3.2.1 Growth drivers

- 3.3 Regulatory landscape

- 3.3.1 North America

- 3.3.2 Europe

- 3.3.3 Asia Pacific

- 3.3.4 Latin America

- 3.3.5 Middle East & Africa

- 3.4 Porter’s analysis

- 3.5 Cost breakdown analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.1.1 Invisible watermarking algorithm evolution

- 3.7.1.2 Robust watermarking technique advances

- 3.7.1.3 Neural network watermarking innovation

- 3.7.1.4 Blockchain integration for provenance

- 3.7.1.5 Multi-modal watermarking development

- 3.7.2 Emerging technologies

- 3.7.2.1 Real-time processing capabilities

- 3.7.2.2 Cross-platform interoperability solutions

- 3.7.2.3 AI model protection techniques

- 3.7.2.4 Quantum-resistant watermarking

- 3.7.2.5 Technology adoption curves

- 3.7.2.6 R&D investment patterns

- 3.7.1 Current technological trends

- 3.8 Patent analysis

- 3.9 Sustainability and environmental impact analysis

- 3.9.1 Sustainable practices

- 3.9.2 Waste reduction strategies

- 3.9.3 Energy efficiency in production

- 3.9.4 Eco-friendly initiatives

- 3.9.5 Carbon footprint considerations

- 3.10 Use cases

- 3.11 Best-case scenario

- 3.12 Customer behavior analysis

- 3.12.1 Enterprise adoption decision factors

- 3.12.2 Platform integration preferences

- 3.12.3 Content creator usage patterns

- 3.12.4 Technology selection criteria

- 3.12.5 User experience requirements

- 3.12.6 Regional preference variations

- 3.13 Digital transformation impact

- 3.13.1 Content creation workflow integration

- 3.13.2 Automated detection systems

- 3.13.3 AI-powered quality assurance

- 3.13.4 Cloud-native architecture adoption

- 3.13.5 DevOps integration strategies

- 3.13.6 Data analytics & insights

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 ($Bn)

- 5.1 Key trends

- 5.2 Invisible watermarking

- 5.3 Visible watermarking

- 5.4 Hybrid

Chapter 6 Market Estimates & Forecast, By Technology, 2021-2034 ($Bn)

- 6.1 Key trends

- 6.2 Reversible watermarking

- 6.3 Non-reversible watermarking

Chapter 7 Market Estimates & Forecast, By Deployment Mode, 2021-2034 ($Bn)

- 7.1 Key trends

- 7.2 On-premises

- 7.3 Cloud

- 7.4 Hybrid

Chapter 8 Market Estimates & Forecast, By Content, 2021-2034 ($Bn)

- 8.1 Key trends

- 8.2 Image watermarking

- 8.3 Video watermarking

- 8.4 Audio watermarking

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By Application, 2021-2034 ($Bn)

- 9.1 Key trends

- 9.2 Authentication & security

- 9.3 Copyright protection

- 9.4 Branding & marketing

- 9.5 Others

Chapter 10 Market Estimates & Forecast, By End Use, 2021-2034 ($Bn)

- 10.1 Key trends

- 10.2 BFSI

- 10.3 Healthcare

- 10.4 Media & Entertainment

- 10.5 Government & Defense

- 10.6 Retail & E-commerce

- 10.7 Others

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 US

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Philippines

- 11.4.7 Indonesia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Global Players

- 12.1.1 Adobe

- 12.1.2 Amazon Web Services

- 12.1.3 Digimarc

- 12.1.4 Google

- 12.1.5 IBM

- 12.1.6 IMATAG

- 12.1.7 Irdeto

- 12.1.8 Meta Platforms

- 12.1.9 Microsoft

- 12.1.10 NVIDIA

- 12.1.11 OpenAI

- 12.1.12 Verimatrix

- 12.1.13 ZOO Digital

- 12.2 Regional Players

- 12.2.1 Alitheon

- 12.2.2 Amber Video

- 12.2.3 Attestiv

- 12.2.4 Civolution

- 12.2.5 ContentWise

- 12.2.6 MarkAny

- 12.2.7 Quantum Digital Solutions

- 12.2.8 Serelay

- 12.2.9 Veridium

- 12.2.10 Vobile

- 12.3 Emerging Players

- 12.3.1 Clarifai

- 12.3.2 Cognitech

- 12.3.3 Deepware Scanner

- 12.3.4 Numbers Protocol

- 12.3.5 Reality Defender

- 12.3.6 Sensity AI

- 12.3.7 SigniFlow

- 12.3.8 Steg AI

- 12.3.9 Videntifier