PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844289

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844289

Electric Last Mile Delivery Vehicle Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

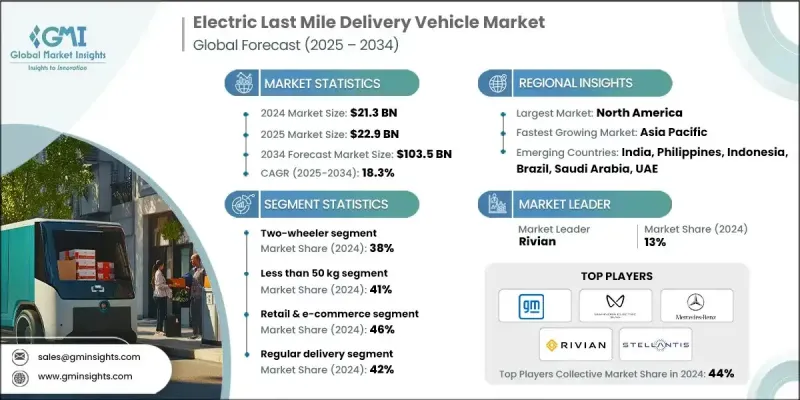

The Global Electric Last Mile Delivery Vehicle Market was valued at USD 21.3 billion in 2024 and is estimated to grow at a CAGR of 18.3% to reach USD 103.5 billion by 2034.

Several dynamics are fueling this surge, including the rising demand for eco-friendly urban delivery options, stricter emissions regulations, and the accelerating pace of e-commerce activity. Electric delivery vehicles such as small vans, compact cargo trikes, and lightweight bikes are becoming integral to fleet operators aiming to enhance delivery efficiency while reducing emissions and maintenance costs. Regulatory pressure to reduce urban emissions is also compelling fleet operators to switch to electric vans, hybrid trucks, and compact delivery vehicles. Technologies like predictive maintenance powered by AI, IoT-based vehicle tracking, and advanced telematics are becoming central to optimizing fleet performance and reducing vehicle downtime. Charging infrastructure innovations like fast depot charging and battery swapping systems are also playing a critical role in supporting extended delivery shifts in traffic-heavy urban environments. The rising use of electric micro-mobility for retail, healthcare logistics, and grocery delivery, especially in dense urban settings, is significantly boosting the market landscape.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $21.3 Billion |

| Forecast Value | $103.5 Billion |

| CAGR | 18.3% |

In 2024, the electric two-wheelers segment held a 38% share and is expected to grow at a CAGR of 18% through 2034. These vehicles are particularly attractive due to their affordability, maneuverability, and operational ease within congested city environments. Startups and small delivery businesses favor electric two-wheelers for their low operating costs and faster delivery capabilities across shorter routes. Their compact size enables smooth navigation through traffic-dense areas, helping businesses maximize delivery speed and efficiency.

The segment of vehicles designed to carry less than 50 kilograms held a 41% share in 2024. Urban congestion and the need for flexible, low-cost logistics solutions have driven the adoption of lightweight vehicles such as compact scooters and three-wheelers. These vehicles require minimal infrastructure, offer lower upfront and running costs due to smaller battery capacities, and are a preferred choice for both small retailers and major e-commerce firms seeking to optimize last-mile delivery operations in emission-regulated zones.

United States Electric Last-Mile Delivery Vehicle Market held an 86% share and generated USD 6.8 billion in 2024. Factors such as federal EV incentives, improved urban delivery infrastructure, and robust e-commerce activity are propelling the market forward. Investments in electrification, fleet digitization, and smart technologies such as route planning through AI and real-time tracking are further advancing the sector. Fleet operators are increasingly leveraging these tools to reduce operational costs and improve energy efficiency across last-mile networks.

Some of the leading companies in the Global Electric Last-Mile Delivery Vehicle Market include Mahindra Electric, Xos, Tata Motors, Ford Motor Company, Mercedes-Benz, Rivian, BYD, GreenPower Motor Company, Stellantis, and General Motors. To expand their presence, major companies in the electric last-mile delivery vehicle sector are focusing on several strategic initiatives. These include forming strategic alliances and partnerships with e-commerce platforms, logistics firms, and government bodies to support large-scale electrification. Many are ramping up investments in R&D to introduce new electric vehicle models with improved battery performance, extended range, and smarter telematics systems. Additionally, they are scaling up production capabilities to meet growing demand, while also collaborating with charging infrastructure providers to deploy fast-charging and battery-swapping solutions. OEMs also emphasizing digital fleet management tools that integrate AI and IoT for predictive maintenance and operational efficiency, helping them deliver value-added services to fleet customers and increase brand loyalty.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Vehicle

- 2.2.3 Payload Capacity

- 2.2.4 Application

- 2.2.5 Delivery Mode

- 2.2.6 Battery Capacity

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increase in e-commerce demand and online shopping.

- 3.2.1.2 Surge in government incentives and emission regulations.

- 3.2.1.3 Growth in urbanization and expansion of low-emission zones.

- 3.2.1.4 Rise in cost savings from lower fuel and maintenance.

- 3.2.1.5 Advancements in battery technology and fast-charging solutions.

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment in vehicles and infrastructure.

- 3.2.2.2 Limited charging infrastructure and restricted vehicle range.

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of fleet electrification programs by logistics companies.

- 3.2.3.2 Integration of renewable energy into charging infrastructure.

- 3.2.3.3 Rise in demand from emerging urban markets.

- 3.2.3.4 Surge in adoption of cargo bikes and micro-mobility solutions.

- 3.2.3.5 Growth in AI, IoT, and telematics integration for fleet optimization.

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Market adoption statistics

- 3.13.1 Electric delivery vehicle deployment rates

- 3.13.2 Fleet electrification progress

- 3.13.3 Charging infrastructure development

- 3.13.4 Technology feature adoption

- 3.13.5 Regional adoption patterns

- 3.13.6 Customer satisfaction metrics

- 3.13.7 Operational performance measurements

- 3.14 E-commerce & delivery market integration

- 3.14.1 Online retail growth impact

- 3.14.2 Last mile delivery demand analysis

- 3.14.3 Delivery speed & efficiency requirements

- 3.14.4 Customer expectation evolution

- 3.14.5 Peak season demand management

- 3.14.6 Urban delivery density optimization

- 3.14.7 Sustainability consumer preferences

- 3.15 Investment landscape analysis

- 3.15.1 Vehicle manufacturer investment

- 3.15.2 Fleet operator capital allocation

- 3.15.3 Government infrastructure funding

- 3.15.4 Private charging network investment

- 3.15.5 Venture capital in delivery technology

- 3.15.6 ROI analysis by investment type

- 3.15.7 Green bond & sustainable financing

- 3.16 Customer behavior analysis

- 3.16.1 Fleet operator decision factors

- 3.16.2 Vehicle selection criteria

- 3.16.3 Technology adoption preferences

- 3.16.4 Total cost of ownership priorities

- 3.16.5 Service & support requirements

- 3.16.6 Sustainability commitment influence

- 3.16.7 Regional preference variations

- 3.17 Business model evolution

- 3.17.1 Traditional vehicle sales models

- 3.17.2 Vehicle-as-a-service (VaaS) models

- 3.17.3 Leasing & financing solutions

- 3.17.4 Integrated fleet solutions

- 3.17.5 Charging-as-a-service models

- 3.17.6 Performance-based contracting

- 3.18 Performance & quality standards

- 3.18.1 Commercial vehicle performance metrics

- 3.18.2 Battery performance & durability

- 3.18.3 Charging speed & efficiency

- 3.18.4 Reliability & availability standards

- 3.18.5 Safety & security requirements

- 3.18.6 Environmental performance standards

- 3.19 Risk assessment framework

- 3.19.1 Technology adoption risks

- 3.19.2 Battery performance & degradation risks

- 3.19.3 Charging infrastructure availability risks

- 3.19.4 Regulatory compliance risks

- 3.19.5 Market demand volatility

- 3.19.6 Supply chain disruption risks

- 3.19.7 Competitive technology risks

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021-2034 ($Bn, Units)

- 5.1 Key trends

- 5.1.1 Two-Wheeler

- 5.1.1.1 E-Bikes/Bicycles

- 5.1.1.2 E-Scooters

- 5.1.1.3 E-Motorcycles

- 5.1.2 Three-Wheeler

- 5.1.2.1 E-Auto Rickshaws

- 5.1.2.2 E-Tricycles

- 5.1.2.3 Light Commercial Three-Wheelers

- 5.1.3 Four-Wheeler

- 5.1.3.1 Micro Commercial Vehicles

- 5.1.3.2 Light Commercial Vehicles (LCV)

- 5.1.3.3 Medium Commercial Vehicles

- 5.1.3.4 Specialized Four-Wheelers

- 5.1.4 Micro Mobility

- 5.1.4.1 Personal Mobility

- 5.1.4.2 Cargo Micro Mobility

- 5.1.1 Two-Wheeler

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Retail & E-commerce

- 6.3 Food & Grocery Delivery

- 6.4 Healthcare & Pharmaceuticals

- 6.5 Mails and Packages

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Payload Capacity, 2021-2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Less than 50 kg

- 7.3 50 to 500 kg

- 7.4 Above 500 kg

Chapter 8 Market Estimates & Forecast, By Delivery Mode, 2021-2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Regular Delivery

- 8.3 Same-Day Delivery

- 8.4 Express Delivery

Chapter 9 Market Estimates & Forecast, By Battery Capacity, 2021-2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Below 30 kWh

- 9.3 30-70 kWh

- 9.4 Above 70 kWh

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Philippines

- 10.4.7 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Arrival

- 11.1.2 Ford Motor Company

- 11.1.3 General Motors

- 11.1.4 GreenPower Motor Company

- 11.1.5 Mercedes-Benz

- 11.1.6 Nissan Motor Company

- 11.1.7 Rivian

- 11.1.8 Stellantis

- 11.1.9 Workhorse

- 11.1.10 BYD

- 11.2 Regional Players

- 11.2.1 Bollinger Motors

- 11.2.2 Canoo

- 11.2.3 Chanje Energy

- 11.2.4 Isuzu Motors

- 11.2.5 Lightning eMotors

- 11.2.6 Mahindra Electric

- 11.2.7 Renault

- 11.2.8 Tata Motors

- 11.2.9 Volkswagen Commercial Vehicles

- 11.3 Emerging Players

- 11.3.1 Alke

- 11.3.2 Cenntro Electric

- 11.3.3 Einride

- 11.3.4 Goupil

- 11.3.5 SEA Electric

- 11.3.6 StreetScooter

- 11.3.7 Tevva Motors

- 11.3.8 Volta Trucks

- 11.3.9 Xos