PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844292

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844292

Humic and Fulvic Acids Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

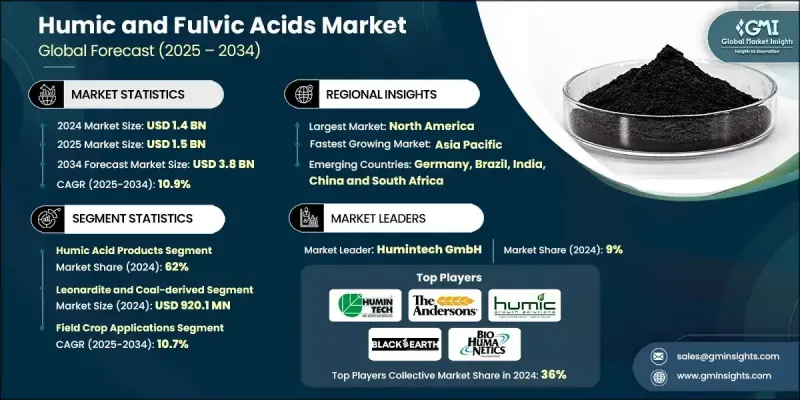

The Global Humic and Fulvic Acids Market was valued at USD 1.4 billion in 2024 and is estimated to grow at a CAGR of 10.9% to reach USD 3.8 billion by 2034.

This growth is fueled by a widespread shift in agriculture toward more sustainable soil enhancement methods and reduced dependency on synthetic fertilizers. Humic and fulvic acids play a vital role in improving soil quality, nutrient absorption, and plant productivity, which is increasingly important amid rising environmental concerns. As the emphasis on regenerative farming intensifies, these substances are gaining traction as core components of eco-friendly crop input strategies. Regulatory support, growing interest in bio-based soil additives, and a broader movement toward climate-smart agriculture continue to drive demand. Adoption is further supported by advanced farming techniques integrating humic and fulvic acids into precision application systems. Through methods such as fertigation, foliar feeding, and digital monitoring, users can fine-tune application for maximum crop efficiency. North America remains the largest market, benefiting from a well-established agriculture infrastructure and increased investment in sustainable technologies, giving humic and fulvic acids strong momentum in both conventional and organic farming systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 billion |

| Forecast Value | $3.8 billion |

| CAGR | 10.9% |

The humic acid products segment held 62% share in 2024 and is expected to grow at a CAGR of 10.7% through 2034. Their widespread use stems from strong results in enhancing soil texture, retaining nutrients, and fostering plant development. Available in liquid, powder, and granular formats, these products support diverse usage across multiple agricultural settings. Fulvic acid products, while still a smaller segment, are witnessing accelerated adoption due to their enhanced nutrient chelation abilities, particularly in fertigation systems and foliar applications. This increased uptake is helping improve plant resilience and nutrient efficiency.

In 2024, the leonardite and coal-derived sources segment reached USD 920.1 million and will grow at a CAGR of 10.7% due to their rich humification levels and consistent quality, making them ideal for extracting concentrated humic substances. Deposits from regions like North America and Europe are widely used in agricultural and environmental applications, with their high carbon content and performance capabilities fueling the expansion of biostimulant-grade and soil amendment products.

North America Humic and Fulvic Acids Market held 38.2% share in 2024. The rise in regenerative farming, organic cultivation, and eco-labeled agricultural inputs continues to elevate demand for natural soil conditioners. With a strong culture around environmentally responsible farming, farmers and agribusinesses are increasingly turning to humic and fulvic acid products to enhance crop yield and soil vitality. The trend is further reinforced by consumer preference for food grown with clean, sustainable inputs.

Key players shaping the competitive landscape of the Global Humic And Fulvic Acids Market include Humatech, Inc., Canadian Humalite International Inc., Shandong Chuangxin Humic Acid Technology Co., Ltd., Humintech GmbH, Grow More, Inc., Horizon Ag-Products, LLC, Omnia Specialities Australia Pty Ltd., The Andersons, Inc., Novihum Technologies GmbH, Inner Mongolia Yili Humic Acid Ecological Technology Co., Ltd., Humic Growth Solutions, Inc., Jiloca Industrial, S.A., Black Earth Humic LP, Bio Huma Netics, Inc., and Humatech, Inc. To secure stronger market positioning, companies in the humic and fulvic acids sector are investing in advanced formulation technologies to enhance product efficacy and ease of use. Many are expanding product lines across granular, liquid, and soluble forms to cater to varied application methods.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Source material

- 2.2.4 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing focus on soil health and regenerative agriculture

- 3.2.1.2 Environmental sustainability and climate change mitigation

- 3.2.1.3 Organic agriculture growth and consumer demand

- 3.2.1.4 Crop yield enhancement and quality improvement

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Limited consumer and farmer awareness and education

- 3.2.2.2 Higher cost vs traditional fertilizers and amendments

- 3.2.3 Market opportunities

- 3.2.3.1 Emerging market agricultural development and investment

- 3.2.3.2 Precision agriculture and technology integration

- 3.2.3.3 Carbon credit and environmental service markets

- 3.2.3.4 Government incentives and sustainability programs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code)

( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021-2034 (USD Million & Tons)

- 5.1 Key trends

- 5.2 Humic acid products

- 5.2.1 Liquid humic acid formulations

- 5.2.2 Solid humic acid products

- 5.3 Fulvic acid products

- 5.3.1 Liquid fulvic acid solutions

- 5.3.2 Solid fulvic acid products

- 5.4 Combined humic and fulvic products

- 5.4.1 Balanced formulations

- 5.4.2 Enhanced and fortified products

- 5.5 Specialty and functional products

- 5.5.1 Plant growth stimulants

- 5.5.2 Stress resistance formulations

Chapter 6 Market Estimates and Forecast, By Source Material, 2021-2034 (USD Million & Tons)

- 6.1 Key trends

- 6.2 Leonardite and coal-derived

- 6.2.1 Leonardite mining sources

- 6.2.2 Coal-based extraction

- 6.3 Composted organic matter

- 6.3.1 Composted manure sources

- 6.3.2 Plant-based compost

- 6.4 Peat and organic soil sources

- 6.4.1 Peat bog extraction

- 6.4.2 Organic soil and muck

Chapter 7 Market Estimates and Forecast, By Application, 2021-2034 (USD Million & Tons)

- 7.1 Key trends

- 7.2 Field crop applications

- 7.2.1 Cereal and grain crops

- 7.2.2 Oilseed and legume crops

- 7.3 Fruit and vegetable production

- 7.3.1 Tree fruit and orchards

- 7.3.2 Vegetable and row crops

- 7.4 Specialty and high-value crops

- 7.4.1 Wine grape and vineyard

- 7.4.2 Coffee and perennial crops

- 7.5 Turf and ornamental applications

- 7.5.1 Golf course and sports turf

- 7.5.2 Residential and commercial landscaping

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Million & Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Bio Huma Netics, Inc.

- 9.2 Black Earth Humic LP

- 9.3 Canadian Humalite International Inc.

- 9.4 Grow More, Inc.

- 9.5 Horizon Ag-Products, LLC

- 9.6 Humatech, Inc.

- 9.7 Humic Growth Solutions, Inc.

- 9.8 Humintech GmbH

- 9.9 Inner Mongolia Yili Humic Acid Ecological Technology Co., Ltd.

- 9.10 Jiloca Industrial, S.A.

- 9.11 Novihum Technologies GmbH

- 9.12 Omnia Specialities Australia Pty Ltd.

- 9.13 Shandong Chuangxin Humic Acid Technology Co., Ltd.

- 9.14 The Andersons, Inc.