PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844296

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844296

Germany Self-healing Adhesives Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

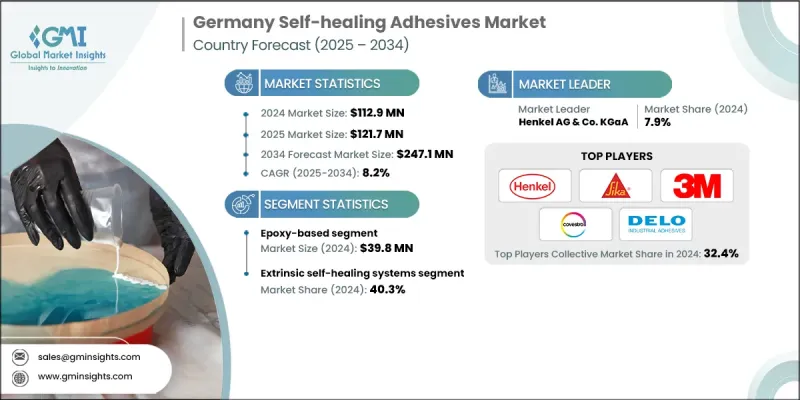

The Germany Self-healing Adhesives Market was valued at USD 112.9 million in 2024 and is estimated to grow at a CAGR of 8.2% to reach USD 247.1 million by 2034.

These advanced adhesives are gaining traction due to their unique ability to autonomously repair minor damages, significantly extending product lifespans and improving dependability in demanding industrial environments. Germany push for eco-friendly, affordable, and scalable adhesive solutions is strongly aligned with its national sustainability goals. Regulatory support for carbon reduction and energy efficiency is accelerating the adoption of these materials, especially in the automotive and electronics sectors. The automotive segment is undergoing significant changes, with a growing shift toward electric vehicles that require materials capable of withstanding higher temperatures and mechanical stress. In parallel, the electronics industry continues to shrink device sizes while increasing functionality, calling for adhesives that can manage heat dissipation and long-term performance. Additionally, the country's strong alignment with circular economy principles and evolving EU environmental policies is pushing the adoption of sustainable bonding technologies. This transformation is supported by continuous innovation from domestic manufacturers who are driving forward the development of self-repairing materials suited for industrial use while ensuring compliance with environmental standards.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $112.9 Million |

| Forecast Value | $247.1 Million |

| CAGR | 8.2% |

The epoxy-based self-healing adhesives segment generated USD 39.8 million in 2024. These adhesives are favored due to their exceptional mechanical strength and resistance to chemicals, making them ideal for a wide range of industrial applications. Their design typically includes microcapsules filled with healing agents that activate upon cracking or physical damage. A significant share of the demand for epoxy-based adhesives is tied to structural applications in major industries, where their ability to maintain integrity over extended use cycles is critical.

The extrinsic self-healing systems segment held a 40.3% share in 2024. These systems function through healing agents embedded in microcapsules or vascular-like networks that release contents when stress or damage is detected. German manufacturers have advanced these technologies to allow multiple healing cycles, enhancing the durability of adhesive bonds across various industrial applications. These innovations are crucial in maintaining equipment longevity and performance under harsh operating conditions.

North Rhine-Westphalia Self-healing Adhesives Market segment generated USD 34 million in 2024. Its dominance is attributed to a strong industrial base, including extensive chemical, automotive, and manufacturing sectors. The region benefits from a well-established infrastructure and strategic location, providing easy access to key European markets and facilitating the large-scale production and distribution of self-healing adhesives across Germany.

Leading companies operating in the Germany Self-healing Adhesives Market include WEICON GmbH & Co. KG, Covestro AG, H.B. Fuller Company, Lohmann-koester GmbH & Co. KG, Fraunhofer, DELO Industrial Adhesives, Henkel AG & Co. KGaA, Sika, 3M, and WACKER Chemie AG. To strengthen their foothold in Germany Self-healing Adhesives Market, key industry players are deploying a combination of R&D innovation and strategic collaborations. Many firms are focused on developing next-generation formulations with enhanced healing efficiency, durability, and environmental performance. Partnerships with academic institutions and research bodies are accelerating material development tailored to automotive, electronics, and manufacturing demands. Additionally, companies are investing in smart manufacturing technologies to improve scalability and cost-effectiveness.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Material trends

- 2.2.2 Technology trends

- 2.2.3 Application trends

- 2.2.4 State trends

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By state

- 3.8.2 By material

- 3.9 Future market trends

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By state

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Material, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Epoxy-based

- 5.3 Polyurethane

- 5.4 Silicone-based

- 5.5 Acrylic

- 5.6 Bio-based

Chapter 6 Market Estimates and Forecast, By Technology, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Extrinsic self-healing systems

- 6.2.1 Microcapsule-based systems

- 6.2.2 Nanoparticle-triggered systems

- 6.3 Intrinsic self-healing systems

- 6.3.1 Dynamic covalent bond systems

- 6.3.2 Reversible chemistry systems

- 6.4 Hybrid self-healing systems

- 6.4.1 Silane-terminated polymer systems

- 6.4.2 Moisture-curing systems

- 6.5 Thermally-activated systems

- 6.5.1 Heat-triggered healing systems

- 6.5.2 Magnetic nanoparticle systems

Chapter 7 Market Estimates and Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Automotive applications

- 7.2.1 EV battery sealing & thermal management

- 7.2.2 Structural bonding & body assembly

- 7.2.3 Electronic component protection

- 7.3 Electronics & semiconductor applications

- 7.3.1 Device assembly & encapsulation

- 7.3.2 Thermal interface materials

- 7.3.3 Flexible electronics & wearables

- 7.4 Medical & healthcare applications

- 7.4.1 Wound dressings & skin adhesives

- 7.4.2 Wearable medical devices

- 7.4.3 Biocompatible bonding systems

- 7.5 Construction & building applications

- 7.5.1 Structural repair systems

- 7.5.2 Weatherproofing & sealing

- 7.5.3 Maintenance & renovation

- 7.6 Aerospace & defense applications

- 7.6.1 Composite repair systems

- 7.6.2 Protective coatings

Chapter 8 Market Estimates and Forecast, By State, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North Rhine-Westphalia

- 8.3 Bavaria

- 8.4 Baden-Wurttemberg

- 8.5 Lower Saxony

- 8.6 Bremen

- 8.7 Other Federal States

Chapter 9 Company Profiles

- 9.1 3M

- 9.2 Covestro AG

- 9.3 DELO Industrial Adhesives

- 9.4 Fraunhofer

- 9.5 H.B. Fuller Company

- 9.6 Henkel AG & Co. KGaA

- 9.7 Lohmann-koester GmbH & Co. KG

- 9.8 Sika

- 9.9 WACKER Chemie AG

- 9.10 WEICON GmbH & Co. KG