PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844308

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844308

Atmospheric Water Harvesting for Agriculture Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

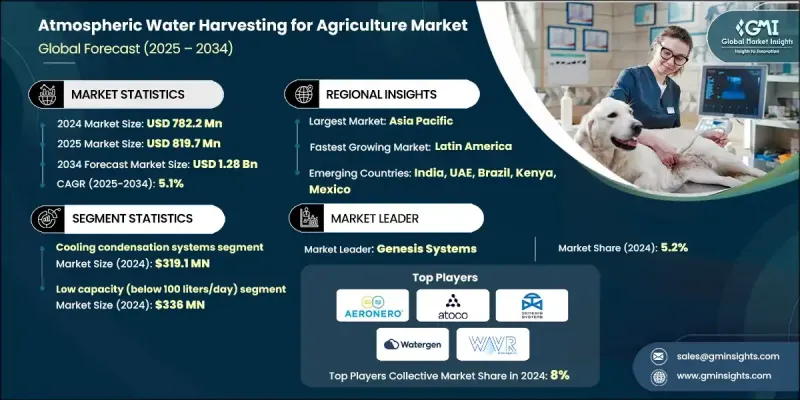

The Global Atmospheric Water Harvesting for Agriculture Market was valued at USD 782.2 million in 2024 and is estimated to grow at a CAGR of 5.1% to reach USD 1.28 billion by 2034.

This market is experiencing growth due to the escalating impact of climate change, including rising global temperatures and unpredictable rainfall patterns, which are worsening water scarcity. AWH offers a decentralized, sustainable solution for extracting moisture from the air to provide water in locations with limited access to conventional water sources. These systems are particularly suited for remote agricultural zones, where infrastructure is minimal or non-existent, and they help smallholder farmers reduce dependency on seasonal rainfall and unreliable water distribution systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $782.2 Million |

| Forecast Value | $1.28 Billion |

| CAGR | 5.1% |

AWH systems provide significant advantages over traditional water generation technologies. Unlike desalination, AWH does not produce harmful brine and can function with minimal power, especially when solar powered. The industry has seen advances in materials science and system efficiency, leading to improved condensation surfaces, energy-saving desiccants, and smart solar integration. Some of the newer units can generate up to 80 liters per hour, making them increasingly viable for larger-scale agricultural operations. These systems are also crucial for disaster response, as they offer portable, reliable water sources when traditional supply chains are disrupted by environmental catastrophes or emergency events.

The cooling condensation systems generated USD 319.1 million in 2024 and are projected to grow at a CAGR of 3.9% between 2025 and 2034, driven by the technical maturity of these systems and their operational simplicity, which makes them easier to deploy and scale across varied agricultural terrains. These systems continue to attract attention due to their adaptability and relatively lower upfront costs, which appeal to a broad range of agricultural stakeholders.

The low-capacity below 100 liters per day segment held a 43% share in 2024 and generated USD 336 million. These smaller-scale systems are particularly popular in early-stage deployments, experimental installations, and small-scale farms. Their compact design, portability, and affordability have positioned them as the go-to solution for pilot projects and decentralized irrigation in emerging agricultural economies.

U.S. Atmospheric Water Harvesting for Agriculture Market generated USD 136.2 million and is forecast to grow at a CAGR of 5.9% through 2034. The United States is emerging as a frontrunner in innovation within this space, with significant research and development efforts targeting high-efficiency water extraction techniques. Advanced systems are being engineered to operate in extremely arid environments, expanding the reach of AWH into historically water-stressed agricultural zones. Government agencies and research institutions are also investing in AWH for military logistics and disaster response, creating pathways for broader commercialization in agricultural use cases.

Leading players shaping the Global Atmospheric Water Harvesting for Agriculture Market include GENAQ, Watergen, WAVR Technologies, RussKap Water, Skywell, Genesis Systems, Tsunami Products, Inc., AWG Water Harvesting, Atlantis Solar, Air2Water, Aeronero, atoco, Aquatech International, Maithri Aquatech Pvt. Ltd., and AT Company. To gain a competitive advantage in the Atmospheric Water Harvesting for Agriculture Market, companies are employing a mix of strategies, including partnerships with agricultural cooperatives, local governments, and NGOs to scale deployment in rural areas. Innovation remains central, and firms are investing heavily in solar integration, autonomous operation, and IoT-connected monitoring. Several manufacturers are expanding their product lines across different capacity ranges to serve both smallholder farms and large agribusinesses. Localization of production and regional customization are also becoming key to improving adoption, alongside government-backed pilot programs and participation in climate-resilience initiatives.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product Type

- 2.2.2 Application

- 2.2.3 Farm Size

- 2.2.4 Water Output Capacity

- 2.2.5 Distribution Channel

- 2.2.6 Regional

- 2.3 CXO perspective: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry Impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region and product type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Major market trends and disruptions

- 3.9 GAP analysis

- 3.10 Risk assessment and mitigation

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Cooling condensation systems

- 5.3 Sorption-based systems

- 5.4 Membrane-based systems

- 5.5 Hybrid systems

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Agricultural processing

- 6.3 Controlled environment farming

- 6.4 Greenhouse farming

- 6.5 Irrigation

- 6.6 Livestock water systems

- 6.7 Vertical farming

- 6.8 Others

Chapter 7 Market Estimates & Forecast, By Farm Size, 2021 - 2034 (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Small Farms (Below 10 hectares)

- 7.3 Medium Farms (10-50 hectares)

- 7.4 Large Farms (Above 50 hectares)

Chapter 8 Market Estimates & Forecast, By Water Output Capacity, 2021 - 2034 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Low Capacity (Below 100 liters/day)

- 8.3 Medium Capacity (100-1000 liters/day)

- 8.4 High Capacity (Above 1000 liters/day)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Million) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 U.K.

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 11.1 Aeronero

- 11.2 Air2Water

- 11.3 Aquatech International

- 11.4 AT Company

- 11.5 Atlantis Solar

- 11.6 atoco

- 11.7 AWG Water Harvesting

- 11.8 GENAQ

- 11.9 Genesis Systems

- 11.10 Maithri Aquatech Pvt. Ltd.

- 11.11 RussKap Water

- 11.12 Skywell

- 11.13 Tsunami Products, Inc.

- 11.14 Watergen

- 11.15 WAVR Technologies