PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844317

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844317

Helicobacter Pylori Testing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

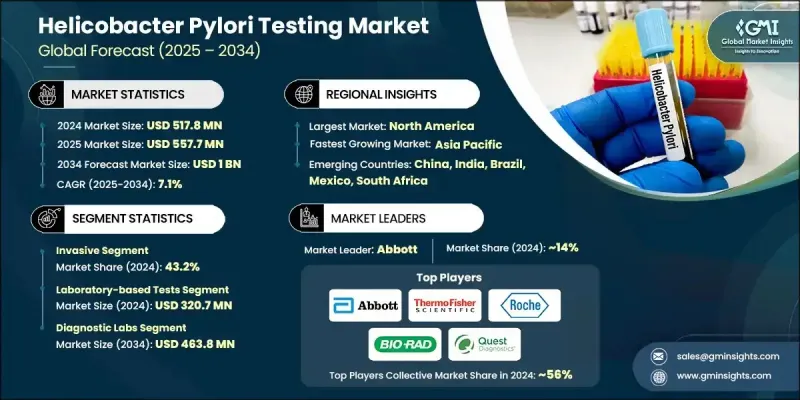

The Global Helicobacter Pylori Testing Market was valued at USD 517.8 million in 2024 and is estimated to grow at a CAGR of 7.1% to reach USD 1 billion by 2034.

The steady growth is driven by the increasing prevalence of gastric disorders, a rise in the elderly population, and growing interest in non-invasive diagnostic approaches. A major shift is underway in clinical diagnostics, with healthcare systems across the world focusing on early disease detection through advanced testing tools. As gastrointestinal diseases become more common, the demand for accurate and patient-friendly tests is climbing. Simultaneously, rising awareness and preference for early detection are influencing hospitals and diagnostic centers to expand their H. pylori testing capabilities. Point-of-care testing is also gaining widespread traction due to its speed, convenience, and accessibility in a variety of healthcare settings. These devices enable clinicians to deliver rapid results, which enhances patient outcomes and treatment timelines. Additionally, innovations in molecular diagnostics and digital health tools including AI-based result interpretation and remote testing platforms are significantly broadening market accessibility and improving clinical precision. Combined, these elements are shaping the helicobacter pylori testing space into a key sector of gastrointestinal healthcare diagnostics worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $517.8 Million |

| Forecast Value | $1 Billion |

| CAGR | 7.1% |

The invasive testing segment captured 43.2% share in 2024, due to its superior diagnostic accuracy achieved through tissue biopsies and microscopic analysis. These methods offer reliable insights into bacterial infection and associated gastric abnormalities, particularly in high-risk or complicated cases. Clinicians continue to rely on invasive procedures when precision and detailed pathology are required, reinforcing their critical role in comprehensive diagnosis and cancer screening.

The laboratory-based tests segment generated USD 320.7 million in 2024. This segment holds its lead due to the high reliability and depth of diagnostic information provided. Laboratory tests like histological analysis, cultures, and serological assays are essential for identifying bacterial strains, determining infection stages, and assessing antibiotic resistance. Rising rates of H. pylori-associated gastrointestinal conditions such as ulcers and chronic gastritis continue to fuel the demand for precise lab-based diagnostics in both hospital and independent lab environments.

North American Helicobacter Pylori Testing Market held 34.6% share in 2024, driven by the region's well-established healthcare infrastructure and increasing gastrointestinal disease burden. Strong presence of diagnostic laboratories, growing clinical awareness, and early screening practices contribute to widespread test adoption. The region also benefits from ongoing investments in advanced diagnostics and rising uptake of non-invasive solutions, supporting sustained market growth across the US and Canada.

Key players actively competing in the Global Helicobacter Pylori Testing Market include Abbott, bioMerieux, Thermo Fisher Scientific, Bio-Rad Laboratories, Meridian Biosciences, Quidel Corporation, Gulf Coast Scientific, CERTEST, Coris BioConcept, Quest Diagnostics, Roche, Cardinal Health, and BIOHIT. Companies in the helicobacter pylori testing market are adopting multifaceted strategies to reinforce their market presence. Leading manufacturers are prioritizing R&D investments to develop high-sensitivity diagnostic kits with shorter turnaround times and broader clinical utility. Many firms are expanding their non-invasive testing portfolios to align with rising demand for patient-friendly diagnostics. Strategic partnerships with hospitals, diagnostic chains, and research institutions allow companies to widen distribution networks and integrate testing solutions into mainstream clinical workflows.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Test type trends

- 2.2.3 Method trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rise in prevalence of gastric ulcer

- 3.2.1.2 Increasing geriatric population at risk

- 3.2.1.3 Growing demand for point-of-care testing devices

- 3.2.1.4 Rising adoption of non-invasive H. pylori testing

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Lack of skilled professionals for invasive testing

- 3.2.2.2 Lack of awareness regarding H. pylori infection

- 3.2.3 Market opportunities

- 3.2.3.1 Technological innovations in molecular testing

- 3.2.3.2 Home-based and self-testing kits

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.1.1 Non-invasive testing adoption (urea breath, stool antigen, serology)

- 3.5.1.2 Automation and high-throughput diagnostic systems

- 3.5.1.3 Integration with laboratory information systems (LIS)

- 3.5.1.4 Improved sensitivity and specificity of assays

- 3.5.2 Emerging technologies

- 3.5.2.1 Point-of-Care (POC) portable H. pylori detection kits

- 3.5.2.2 Molecular and PCR-based assays for precise detection

- 3.5.2.3 AI and machine learning for biopsy and histology analysis

- 3.5.2.4 Multiplex testing platforms for simultaneous pathogen detection

- 3.5.1 Current technological trends

- 3.6 Future market trends

- 3.6.1 Increased adoption of non-invasive home-based H. pylori testing kits

- 3.6.2 Expansion of AI-driven diagnostic tools for faster and more accurate detection

- 3.6.3 Growing integration of digital health platforms and telemedicine for test monitoring

- 3.7 Go-to-market strategies

- 3.8 Pricing analysis

- 3.9 GAP analysis

- 3.10 Porter’s analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.2.5 LAMEA

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Test Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Invasive

- 5.2.1 Rapid urease test

- 5.2.2 Histology

- 5.2.3 HP culture

- 5.3 Non-invasive

- 5.3.1 Serologic test

- 5.3.2 Urea breath test

- 5.3.3 Stool/fecal antigen test

Chapter 6 Market Estimates and Forecast, By Method, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Laboratory based tests

- 6.3 Point of care (POC) tests

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Diagnostic labs

- 7.3 Hospitals

- 7.4 Clinics

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott

- 9.2 BIOHIT

- 9.3 bioMerieux

- 9.4 Bio-Rad Laboratories

- 9.5 Cardinal Health

- 9.6 CERTEST

- 9.7 Coris BioConcept

- 9.8 Gulf Coast Scientific

- 9.9 Meridian Biosciences

- 9.10 Quest Diagnostics

- 9.11 Quidel Corporation

- 9.12 Roche

- 9.13 Thermo Fisher Scientific