PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844333

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844333

Household Refrigerators and Freezers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

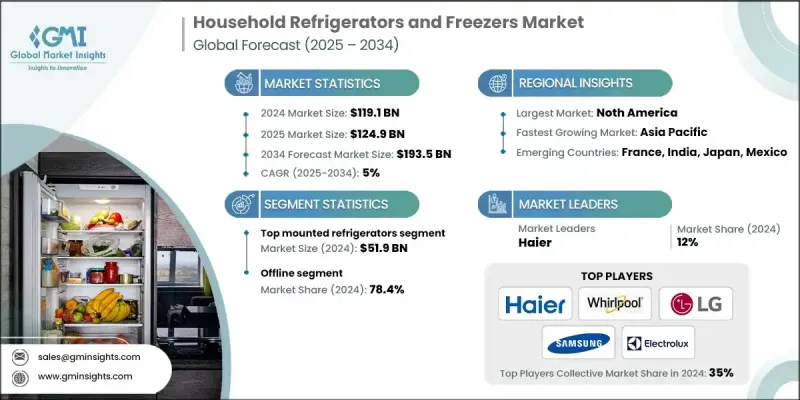

The Global Household Refrigerators and Freezers Market was valued at USD 119.1 billion in 2024 and is estimated to grow at a CAGR of 5% to reach USD 193.5 billion by 2034.

Increasing consumer awareness about environmental sustainability and rising electricity costs are fueling the demand for energy-efficient home appliances. Consumers are now prioritizing appliances that offer advanced energy-saving capabilities without compromising on performance. This trend is further strengthened by growing government initiatives and regulatory policies promoting eco-friendly products. Simultaneously, households are adopting smart technologies that provide greater control and convenience. Modern refrigerators now come equipped with features like touchscreen panels, virtual assistant compatibility, and wireless connectivity, which allow users to manage storage, monitor inventory, and access integrated services remotely. The merging of smart homes with connected appliances continues to reshape the market landscape, reflecting shifting preferences for comfort, efficiency, and real-time responsiveness.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $119.1 Billion |

| Forecast Value | $193.5 Billion |

| CAGR | 5% |

The top-mounted refrigerators segment generated USD 51.9 billion in 2024, maintaining its leading position in the market. These models, which place the freezer compartment above the main refrigerator section, remain popular for their affordability and space-saving design. Their lower price point makes them an ideal option for value-driven consumers across developed and emerging regions. Compactness, ease of use, and consistent performance continue to support their strong market presence.

The offline distribution channel segment held 78.4% share in 2024. In-store shopping allows buyers to physically inspect appliances, assess features, and make informed decisions with the guidance of trained sales staff. Consumers place significant value on personal assistance, immediate product demonstrations, and the added convenience of services such as delivery, installation, and maintenance, all of which are better facilitated through brick-and-mortar stores. This immersive, service-driven retail experience plays a major role in maintaining offline leadership in the appliance segment.

U.S. Household Refrigerators and Freezers Market held 74.9% share in 2024. Strong consumer purchasing power and a rising preference for premium, high-performance home appliances are driving adoption. The integration of intelligent home ecosystems is accelerating demand for refrigerators with smart features such as app control, energy monitoring, and digital interfaces. U.S. consumers are also highly responsive to innovations that align with sustainability goals, supporting the growth of energy-efficient models.

Major companies active in the Global Household Refrigerators and Freezers Market include Toshiba, Samsung, Whirlpool, Gree, Panasonic, LG, Midea, Haier, Arcelik, Liebherr, Hisense, BSH, Sharp, Hitachi, and Electrolux. Companies in the household refrigerators and freezers market are focusing on product innovation, sustainability, and digital integration to solidify their competitive position. Many brands are expanding their smart appliance portfolios by embedding IoT capabilities, AI-based inventory tracking, and mobile connectivity. To meet regulatory standards and consumer demand for eco-friendly solutions, manufacturers are enhancing energy efficiency through inverter technology and environmentally friendly refrigerants. Geographic expansion, particularly into emerging markets, is another core strategy, supported by localized production and retail partnerships.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Capacity

- 2.2.4 Structure

- 2.2.5 Cooling technology

- 2.2.6 Smart features

- 2.2.7 Finish

- 2.2.8 Price range

- 2.2.9 End use

- 2.2.10 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for energy-efficient appliances

- 3.2.1.2 Technological advancements and smart features

- 3.2.1.3 Increasing urbanization and disposable income

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Extended replacement cycles

- 3.2.2.2 Price sensitivity among consumers

- 3.2.3 Opportunities

- 3.2.3.1 Expansion in emerging market

- 3.2.3.2 Growth of smart home ecosystems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By Product

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code- 8418)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

- 3.11 Consumer buying behavior analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behavior

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product, 2021-2034 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Top mounted refrigerators

- 5.3 Bottom mounted refrigerators

- 5.4 Side-by-side refrigerators

- 5.5 French door refrigerators

Chapter 6 Market Estimates & Forecast, By Capacity, 2021-2034 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Less than 15 cu. Ft.

- 6.3 16 cu. Ft to 30 cu. Ft.

- 6.4 More than 30 cu. Ft.

Chapter 7 Market Estimates & Forecast, By Structure, 2021-2034 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Built-in

- 7.3 Freestanding

- 7.4 Counter-depth

- 7.5 Compact/Mini

- 7.6 Side-by-side

- 7.7 Others (French door, top freezer, bottom freezer etc.)

Chapter 8 Market Estimates & Forecast, By Cooling technology, 2021-2034 (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Direct cool

- 8.3 Frost-free

- 8.4 Inverter compressor

- 8.5 Dual evaporator

- 8.6 Thermoelectric

Chapter 9 Market Estimates & Forecast, By Smart features, 2021-2034 (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Wi-Fi enabled

- 9.3 App-controlled

- 9.4 Voice assistant integration

- 9.5 Others (touchscreen display, internal camera etc.)

Chapter 10 Market Estimates & Forecast, By Finish, 2021-2034 (USD Billion) (Million Units)

- 10.1 Stainless steel

- 10.2 Matte black

- 10.3 Glass door

- 10.4 Others (retro, custom etc.)

Chapter 11 Market Estimates & Forecast, By Price Range, 2021-2034 (USD Billion) (Million Units)

- 11.1 Key trends

- 11.2 Low

- 11.3 Medium

- 11.4 High

Chapter 12 Market Estimates & Forecast, By End use, 2021-2034 (USD Billion) (Million Units)

- 12.1 Key trends

- 12.2 Residential

- 12.3 Commercial

Chapter 13 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Million Units)

- 13.1 Key trends

- 13.2 Online

- 13.2.1 E-commerce

- 13.2.2 Company websites

- 13.3 Offline

- 13.3.1 Departmental stores

- 13.3.2 Hypermarkets/supermarkets

- 13.3.3 Specialty retailers

- 13.3.4 Others

Chapter 14 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Million Units)

- 14.1 Key trends

- 14.2 North America

- 14.2.1 U.S.

- 14.2.2 Canada

- 14.3 Europe

- 14.3.1 Germany

- 14.3.2 UK

- 14.3.3 France

- 14.3.4 Spain

- 14.3.5 Italy

- 14.4 Asia Pacific

- 14.4.1 China

- 14.4.2 Japan

- 14.4.3 India

- 14.4.4 Australia

- 14.4.5 South Korea

- 14.5 Latin America

- 14.5.1 Brazil

- 14.5.2 Mexico

- 14.5.3 Argentina

- 14.6 Middle East and Africa

- 14.6.1 South Africa

- 14.6.2 Saudi Arabia

- 14.6.3 UAE

Chapter 15 Company Profiles

- 15.1 Arcelik

- 15.2 BSH

- 15.3 Electrolux

- 15.4 Gree

- 15.5 Haier

- 15.6 Hisense

- 15.7 Hitachi

- 15.8 LG

- 15.9 Liebherr

- 15.10 Midea

- 15.11 Panasonic

- 15.12 Samsung

- 15.13 Sharp

- 15.14 Toshiba

- 15.15 Whirlpool