PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844341

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844341

Injection Molding Machine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

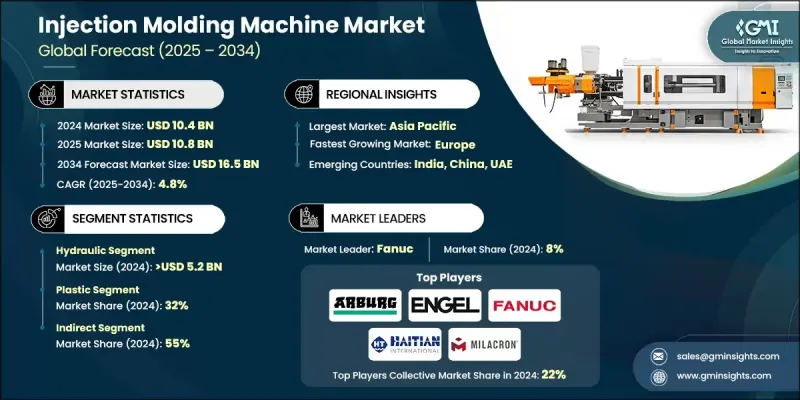

The Global Injection Molding Machine Market was valued at USD 10.4 billion in 2024 and is estimated to grow at a CAGR of 4.8% to reach USD 16.5 billion by 2034.

Market growth is propelled by the increasing demand for lightweight and high-performance plastic components across key manufacturing sectors. Industries are shifting toward materials that enhance efficiency and cut down on operational costs. In transportation and aerospace, for instance, lighter parts translate into better fuel economy and reduced emissions. Injection molding machines play a critical role here, offering precision and repeatability in producing complex parts that are both durable and lightweight. As end-use applications become more design-intensive, manufacturers are turning to machines that offer higher precision, faster cycle times, and compatibility with newer polymers. The growing emphasis on flawless output and rapid delivery has made newer-generation machines an essential upgrade. Companies are now investing in advanced technologies that can handle intricate molds and varied materials, ensuring reliable performance and minimized defects. The trend toward using complex, lightweight materials continues to shape the demand for cutting-edge injection molding machinery, making it a fundamental part of modern manufacturing strategies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.4 Billion |

| Forecast Value | $16.5 Billion |

| CAGR | 4.8% |

The hydraulic injection molding machines segment reached USD 5.2 billion in 2024 and is expected to grow at a CAGR of 4.8% through 2034. These machines remain favored for producing larger and heavier components due to their reliability and lower initial cost. Although their growth is moderate, they still hold a strong position due to widespread usage. However, electric injection molding machines are gaining traction, offering benefits like improved energy efficiency, higher accuracy, reduced noise levels, and lower maintenance requirements, which appeal to manufacturers focused on sustainability and operational efficiency.

The plastic materials segment held a 32% share in 2024 and is forecast to grow at a CAGR of 4.4% from 2025 to 2034. The continued dominance of plastic is tied to its versatility, ease of molding, and rising demand across applications like consumer goods, packaging, and automotive components. Its lightweight nature and cost-effectiveness make it the go-to choice in industries where product design and mass production play a critical role in profitability.

U.S. Injection Molding Machine Market held a 76% share and generated USD 2.15 billion in 2024. The growth in this region is closely linked to industries such as healthcare, automotive, and packaging that are shifting toward lightweight, precision plastic parts. Companies are increasingly replacing older equipment with modern machines that improve productivity and output quality. The surge in adoption of electric and hybrid machines reflects the expanding role of automation and efficiency in manufacturing across the region.

Key players driving advancements in the Global Injection Molding Machine Industry include Milacron, Haitian International, ENGEL, JSW, KraussMaffei, Yizumi, Fanuc, Nissei Plastic Industrial, Sumitomo, Shibaura Machine, Toyo Machinery & Metal, Wittmann Battenfeld, Arburg, Husky Injection Molding Systems, and Chen Hsong Holdings. These companies are consistently focused on innovation, automation, and system integration. Top companies in the injection molding machine market are focused on adopting smart manufacturing technologies and automation to improve production efficiency. Investment in energy-efficient and all-electric models has grown significantly, meeting increasing demand for sustainable solutions. Firms are continuously expanding their product lines to support complex applications, especially in high-precision sectors like medical devices and electronics. Strategic partnerships and collaborations help companies develop localized solutions for specific regional demands. Key players are also upgrading digital interfaces, integrating IoT, and offering remote monitoring capabilities to provide better machine diagnostics and reduce downtime.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Machine type

- 2.2.3 Material type

- 2.2.4 Operation

- 2.2.5 Injection pressure

- 2.2.6 Capacity

- 2.2.7 End use

- 2.2.8 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Demand for lightweight and complex plastic parts

- 3.2.1.2 Growing need for faster production and efficiency

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment and operational costs

- 3.2.2.2 Skilled labor shortage

- 3.2.3 Opportunities

- 3.2.3.1 Adoption of industry 4.0 and smart manufacturing

- 3.2.3.2 Growth in electric and hybrid injection molding machines

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By machine type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade Statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Machine Type, 2021 - 2034 ($Billion, Thousand Units)

- 5.1 Key trends

- 5.2 Hydraulic

- 5.3 Electric

- 5.4 Hybrid

Chapter 6 Market Estimates & Forecast, By Material Type, 2021 - 2034 ($Billion, Thousand Units)

- 6.1 Key trends

- 6.2 Plastic

- 6.3 Rubber

- 6.4 Metal

- 6.5 Ceramic

Chapter 7 Market Estimates & Forecast, By Operation, 2021 - 2034 ($Billion, Thousand Units)

- 7.1 Key trends

- 7.2 Automatic

- 7.3 Semi-automatic

- 7.4 Manual

Chapter 8 Market Estimates & Forecast, By Injection Pressure, 2021 - 2034 ($Billion, Thousand Units)

- 8.1 Key trends

- 8.2 Below 1000 Bar

- 8.3 Between 1000-2500 Bar

- 8.4 Above 2500 Bar

Chapter 9 Market Estimates & Forecast, By Capacity, 2021 - 2034 ($Billion, Thousand Units)

- 9.1 Key trends

- 9.2 Below 500 tons

- 9.3 Between 500-1,000 tons

- 9.4 Above 1,000 tons

Chapter 10 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Billion, Thousand Units)

- 10.1 Key trends

- 10.2 Automotive & Transportation

- 10.3 Construction

- 10.4 Consumer Goods

- 10.5 Packaging

- 10.6 Electrical & electronics

Chapter 11 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Billion, Thousand Units)

- 11.1 Key trends

- 11.2 Direct sales

- 11.3 Indirect sales

Chapter 12 Market Estimates & Forecast, By Region, 2021 - 2034 ($Billion, Thousand Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Spain

- 12.3.5 Italy

- 12.3.6 Netherlands

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 Japan

- 12.4.3 India

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 Middle East and Africa

- 12.6.1 South Africa

- 12.6.2 Saudi Arabia

- 12.6.3 UAE

Chapter 13 Company Profiles

- 13.1 Arburg

- 13.2 Chen Hsong Holdings

- 13.3 ENGEL

- 13.4 Fanuc

- 13.5 Haitian International

- 13.6 Husky Injection Molding Systems

- 13.7 JSW

- 13.8 KraussMaffei

- 13.9 Milacron

- 13.10 Nissei Plastic Industrial

- 13.11 Shibaura Machine

- 13.12 Sumitomo

- 13.13 Toyo Machinery & Metal

- 13.14 Wittmann Battenfeld

- 13.15 Yizumi