PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844345

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844345

Ventricular Assist Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

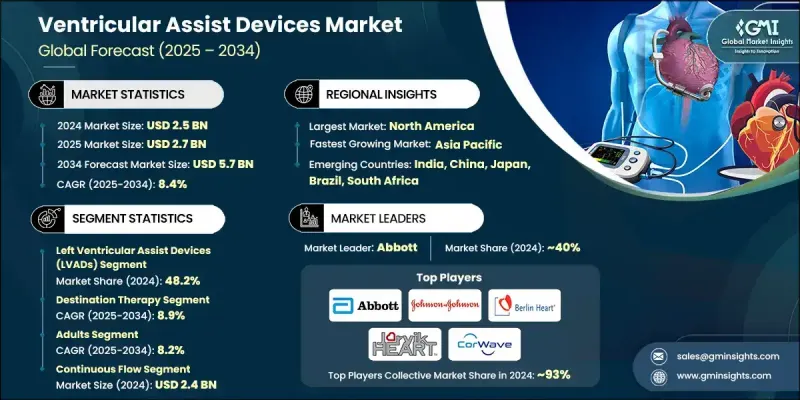

The Global Ventricular Assist Devices Market was valued at USD 2.5 billion in 2024 and is estimated to grow at a CAGR of 8.4% to reach USD 5.7 billion by 2034.

Market growth is driven by the increasing prevalence of cardiovascular disorders and heart failure, coupled with growing patient awareness and the persistent shortage of heart donors. With heart transplants remaining limited, VADs have become an essential alternative for long-term support and bridge-to-transplant cases. Rapid technological evolution has enhanced both clinical performance and user safety, leading to better patient survival rates and wider global adoption. Advancements in implantable technologies, material science, and digital health integration are supporting expanded use in both critical care and outpatient settings. Miniaturized and biocompatible components, combined with smart functionalities such as wireless monitoring and remote diagnostics, are helping shift VADs from invasive mechanical supports to intelligent cardiac care systems. As both emerging and developed markets expand their cardiac care capabilities, VADs are playing an increasingly important role in comprehensive heart failure treatment, especially in cases where medical therapy alone falls short.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.5 Billion |

| Forecast Value | $5.7 Billion |

| CAGR | 8.4% |

The right ventricular assist devices (RVADs) segment will grow at a CAGR of 9.4% through 2034. Their rising demand is closely tied to the growing number of patients with right-sided heart complications and the need for specialized ventricular support in advanced cardiac therapies. With continuous enhancements in compact device architecture and materials that reduce rejection risks, RVADs are increasingly favored in complex cardiac procedures requiring targeted intervention. These devices are now more suitable for bridge-to-transplant procedures and short-term recovery applications, strengthening their relevance across multiple care pathways.

In 2024, the hospitals segment held a 43.1% share and is projected to reach USD 2.4 billion by 2034. Hospitals remain the epicenter of surgical implantation, real-time monitoring, and postoperative care for VAD patients. The increasing burden of severe heart failure cases requiring advanced intervention is fueling demand for device installation in hospital environments. Additionally, specialized cardiac units and trained personnel enhance the efficiency and safety of device deployment, reinforcing hospitals' dominant market position. The presence of modern infrastructure and growing access to innovative tools are positioning hospital systems as critical contributors to the long-term success of VAD programs.

United States Ventricular Assist Devices Market was valued at USD 1.3 billion in 2024, owing to its well-established cardiac care ecosystem. Advanced medical facilities, a large base of trained cardiovascular surgeons, and access to the latest surgical innovations are major enablers for VAD adoption. The nation continues to lead in surgical volumes, innovation uptake, and post-implantation care. With its robust reimbursement frameworks and strong patient awareness, the U.S. offers a favorable environment for companies expanding VAD solutions.

Prominent players in the Global Ventricular Assist Devices Market include CorWave, Berlin Heart, Abbott, BrioHealth, Jarvik HEART, EVAHEART, and Johnson & Johnson. Leading companies in the ventricular assist devices market are focusing heavily on innovation-driven growth by developing next-gen technologies that emphasize miniaturization, wireless connectivity, and biocompatibility. Many are enhancing device lifespans and lowering complication risks through smart materials and flow algorithms. To reach wider patient populations, firms are investing in less-invasive implantation techniques and fully implantable systems. Strategic partnerships with hospitals and research centers help drive clinical trials and accelerate regulatory approvals. Additionally, players are expanding geographically by entering emerging healthcare markets through distribution alliances and training programs for surgical teams.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Application trends

- 2.2.4 Patient trends

- 2.2.5 Flow trends

- 2.2.6 Design trends

- 2.2.7 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increase in the number of heart failures and cardiovascular diseases

- 3.2.1.2 Technological advancements

- 3.2.1.3 Rise in awareness regarding heart failure treatment

- 3.2.1.4 Shortage of heart donors

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of devices

- 3.2.2.2 Surgical risks and complications

- 3.2.3 Market opportunities

- 3.2.3.1 Adoption in emerging markets

- 3.2.3.2 Growing demand for patient-friendly solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technological landscape

- 3.5.1 Current technologies

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Reimbursement scenario

- 3.8 Global heart transplantation scenario

- 3.9 Epidemiology landscape

- 3.10 Pipeline analysis

- 3.11 Investment landscape

- 3.12 Pricing analysis, 2024

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

- 3.15 Gap analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 North America

- 4.3.2 Europe

- 4.3.3 Asia Pacific

- 4.3.4 LAMEA

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn, Units)

- 5.1 Key trends

- 5.2 Left ventricular assist devices (LVADs)

- 5.3 Right ventricular assist devices (RVADs)

- 5.4 Biventricular assist devices (BIVADs)

- 5.5 Percutaneous ventricular assist devices

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Destination therapy

- 6.3 Bridge-to-candidacy (BTC) therapy

- 6.4 Bridge-to-transplant (BTT) therapy

- 6.5 Bridge-to-recovery (BTR) therapy

- 6.6 Other applications

Chapter 7 Market Estimates and Forecast, By Patient, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Adults

- 7.3 Pediatrics

Chapter 8 Market Estimates and Forecast, By Flow, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Pulsatile flow

- 8.3 Continuous flow

- 8.3.1 Axial continuous flow

- 8.3.2 Centrifugal continuous flow

Chapter 9 Market Estimates and Forecast, By Design, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Transcutaneous

- 9.3 Implantable

Chapter 10 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 Hospitals

- 10.3 Cardiac catheterization labs

- 10.4 Ambulatory surgical centers

- 10.5 Other end use

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Abbott

- 12.2 Berlin Heart

- 12.3 BrioHealth

- 12.4 CorWave

- 12.5 EVAHEART

- 12.6 Jarvik HEART

- 12.7 Johnson & Johnson