PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836509

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836509

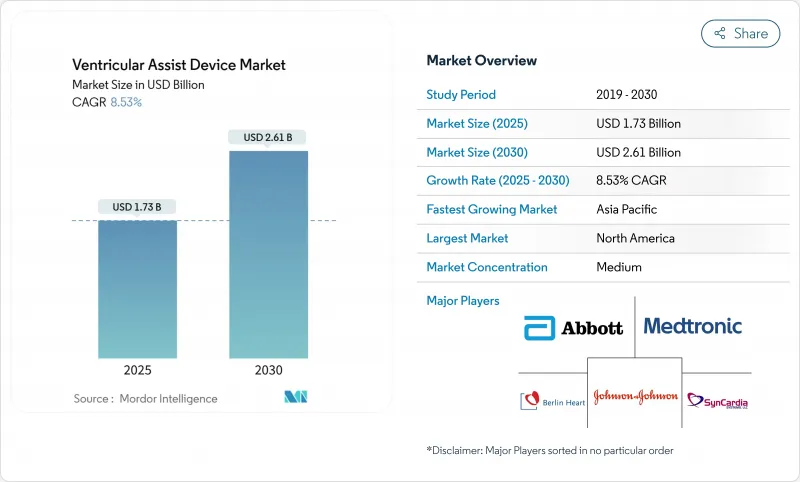

Ventricular Assist Device - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Ventricular Assist Devices market is valued at USD 1.73 billion in 2025 and is forecast to reach USD 2.61 billion by 2030, advancing at an 8.53% CAGR over the period.

Demand grows as ageing populations swell the pool of advanced-heart-failure patients and technological progress raises the clinical ceiling for mechanical circulatory support. Device makers are moving beyond bridge-to-transplant use cases, widening the total addressable Ventricular Assist Devices market through permanent support indications and fully implantable designs. Real-world data from large registries such as INTERMACS is driving evidence-based refinements in patient selection, while reimbursement expansions in key regions strengthen provider confidence. Simultaneously, new magnetic-levitation pumps and wireless power platforms lower adverse-event rates, reinforcing their role as long-term cardiac replacements.

Global Ventricular Assist Device Market Trends and Insights

Growing burden of cardiac diseases & heart failure

Heart-failure prevalence rose to 6.7 million Americans in 2025 and will climb to 11.4 million by 2050, widening the patient base for mechanical support. Younger cohorts and racial minorities are showing steeper incidence curves, which shifts device demand toward patients likely to need decades of circulatory assistance. Estimates place the cumulative cost of heart failure at USD 420 billion by mid-century, encouraging payers to support durable devices over repeated hospitalizations.

Technological advances

Magnetic levitation pumps such as HeartMate 3 post 63.3% five-year survival and lower thrombosis risk than earlier bearings-based systems. Miniaturised percutaneous pumps now use 9 Fr delivery profiles with 100% valve-crossing success in more than 500 procedures. Early studies on wireless power transfer demonstrate safe energy delivery across seven meters, pointing to future cable-free, fully implantable platforms.

High device and procedure costs

Implantation averages USD 175,420 and total stay costs approach USD 193,192, with a further USD 52,068 for readmissions, frustrating adoption in cost-sensitive markets. Limited insurer coverage and large capital budgets deter smaller centres, even as cost-effectiveness improves with battery longevity and reduced complication rates.

Other drivers and restraints analyzed in the detailed report include:

- Expanding destination therapy amid organ donor shortage

- Ageing population and healthcare spending

- Device-related complications and recalls

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Left Ventricular Assist Devices command 73.24% of 2024 revenues, the largest slice of the Ventricular Assist Devices market. Their 9.24% CAGR to 2030 reflects broad clinical eligibility and strong data on long-term survival. The Ventricular Assist Devices market size for LVADs is forecast to expand steadily as magnetic levitation platforms reduce thrombosis and pump stoppage rates. LVAD innovation now centres on wireless power and miniature control units, features that will narrow the gap with total artificial hearts.

Right Ventricular Assist Devices fill niche needs in isolated right-side failure, and Biventricular systems address complex bi-ventricle dysfunction, while total artificial hearts such as Aeson progress in pilot roll-outs. Clinical evidence highlights a 14-year support record for a single LVAD recipient, underscoring the destination-therapy potential of new models.

Ventricular Assist Devices Market Report is Segments by Product Type (Left Ventricular Assist Device (LVAD), Right Ventricular Assist Device (RVAD) and More), Design (Implantable VAD, Transcutaneous/External VAD and More), Application/ Therapy (Bridge-To-Transplant (BTT), Destination Therapy, and More), and Geography (North America, Europe and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America holds 42.68% of 2024 sales, reflecting robust Medicare coverage, centre-of-excellence networks, and a rich innovation pipeline. Registry data and outcome transparency continue to boost clinician confidence. The region is the primary launch ground for new platforms granted FDA breakthrough designation, enhancing first-mover revenues.

Europe presents steady uptake, leveraging harmonised regulatory frameworks and established heart-failure networks. Adoption is tempered by slower reimbursement updates and occasional device lag, yet the region is home to landmark innovations like the Aeson total artificial heart and strong academic-industry partnerships.

Asia-Pacific is the fastest growing at a 10.56% CAGR. Urbanising economies and rising cardiovascular risk deepen unmet need, while policy reforms widen device reimbursement. However, limited trained personnel and cost constraints slow penetration in secondary cities, making training programmes and public-private financing critical.

- Abbott Laboratories

- Medtronic

- Johnson and Johnson (Abiomed)

- Berlin Heart

- SynCardia Systems

- Jarvik Heart

- BiVACOR

- Calon Cardio-Technology Ltd.

- Carmat

- ReliantHeart Inc.

- Evaheart Inc.

- Supira Medical

- CardioBridge GmbH

- Lepu Medical

- CH Biomedical Inc.

- Corwave

- Windmill Cardiovascular Systems

- VentureMed Group

- Sun Medical Technology Research Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Burden Of Cardiac Diseases & Heart Failure

- 4.2.2 Technological Advances

- 4.2.3 Expanding Destination-Therapy Amid Organ Donor Shortage

- 4.2.4 Rising Aging Population and Healthcare Spending

- 4.2.5 Increased Clinical Trials and New Device Approval

- 4.2.6 Rising Awareness and Adoption of Minimally Invasive and Percutaneous VADs

- 4.3 Market Restraints

- 4.3.1 High Device & Procedure Costs

- 4.3.2 Device-Related Complications Coupled with Product Recall

- 4.3.3 Availability of Alternatives and Evolving Heart Therapies

- 4.3.4 Shortage Of Trained LVAD Coordinators In Emerging Markets

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technology Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value-USD)

- 5.1 By Product Type

- 5.1.1 Left Ventricular Assist Device (LVAD)

- 5.1.2 Right Ventricular Assist Device (RVAD)

- 5.1.3 Biventricular Assist Device (BIVAD)

- 5.1.4 Total Artificial Heart (TAH)

- 5.2 By Design

- 5.2.1 Implantable VAD

- 5.2.2 Transcutaneous / External VAD

- 5.2.3 Percutaneous Micro-axial VAD

- 5.3 By Application / Therapy

- 5.3.1 Bridge-to-Transplant (BTT)

- 5.3.2 Destination Therapy (DT)

- 5.3.3 Bridge-to-Recovery (BTR)

- 5.3.4 Bridge-to-Decision

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.3.1 Abbott Laboratories

- 6.3.2 Medtronic plc

- 6.3.3 Johnson and Johnson (Abiomed)

- 6.3.4 Berlin Heart GmbH

- 6.3.5 SynCardia Systems LLC

- 6.3.6 Jarvik Heart Inc.

- 6.3.7 BiVACOR Inc.

- 6.3.8 Calon Cardio-Technology Ltd.

- 6.3.9 CARMAT

- 6.3.10 ReliantHeart Inc.

- 6.3.11 Evaheart Inc.

- 6.3.12 Supira Medical

- 6.3.13 CardioBridge GmbH

- 6.3.14 Lepu Medical Technology

- 6.3.15 CH Biomedical Inc.

- 6.3.16 Corwave

- 6.3.17 Windmill Cardiovascular Systems

- 6.3.18 VentureMed Group

- 6.3.19 Sun Medical Technology Research Corp.

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment