PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844348

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844348

Battery Materials Recycling Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

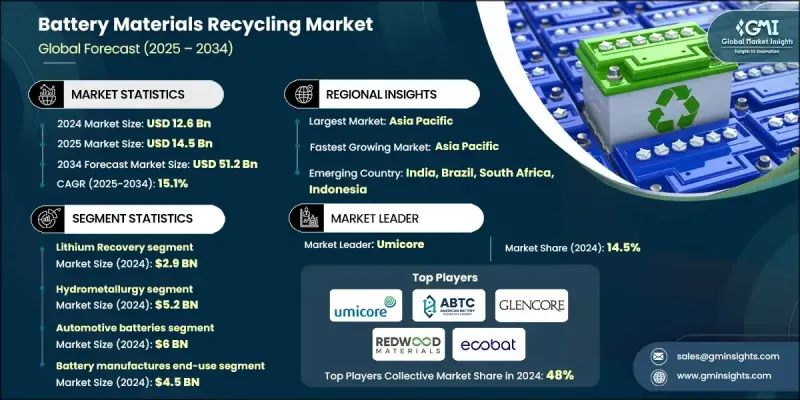

The Global Battery Materials Recycling Market was valued at USD 12.6 billion in 2024 and is estimated to grow at a CAGR of 15.1% to reach USD 51.2 billion by 2034.

Demand for key battery metals like lithium, cobalt, manganese, and nickel is surging as the electric vehicle and renewable energy sectors expand. Recycling these materials is gaining traction as a sustainable alternative to traditional mining, offering a solution to volatile raw material pricing, geopolitical uncertainty, and environmental degradation. The market is being further propelled by regulatory reforms, which are evolving rapidly across key regions to encourage resource circularity and improve battery end-of-life management. These changes are fostering long-term growth prospects and enabling robust private and public sector investments in recycling ecosystems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.6 Billion |

| Forecast Value | $51.2 Billion |

| CAGR | 15.1% |

Increasing global attention toward sustainable supply chains is reinforcing the need for circular economies in energy storage and electric mobility. Recycling is not only seen as an eco-conscious approach but also as a strategic tool for reducing dependency on virgin material extraction. One of the key trends reshaping the industry is the vertical integration of recycling operations into battery manufacturing supply chains. This integration is helping manufacturers close the loop, ensuring stable sourcing of high-value recovered materials while improving cost efficiency and regulatory compliance throughout production lifecycles.

The lithium recovery segment generated USD 2.9 billion in 2024 and is expected to grow at a CAGR of 13.9% from 2025 to 2034. Lithium continues to dominate due to its high demand in lithium-ion batteries used across EVs, portable electronics, and grid-scale storage systems. With advancements in techniques such as direct lithium extraction and hydrometallurgical processes, lithium recovery is becoming more efficient, further fueling its dominance within the battery materials recycling market. The rising use of these technologies enhances extraction yields, which is making recycling increasingly viable at a commercial scale.

The automotive battery segment generated USD 6 billion in 2024 and is projected to grow at a CAGR of 14.5% through 2034. The segment growth is fueled by the ongoing acceleration of global EV adoption, which is creating enormous volumes of spent lithium-ion batteries. Automakers and battery suppliers are forming strategic collaborations with recyclers to build closed-loop systems that reclaim metals such as lithium, cobalt, and nickel for reuse in new battery production. These systems are playing a key role in reducing the environmental impact of EV growth and ensuring more resilient supply chains.

China Battery Materials Recycling Market generated USD 3 billion in 2024 and is expected to grow at a CAGR of 15.3% through 2034. The country has implemented strict battery recycling regulations and possesses the industrial scale to support the growth of advanced recovery technologies. Meanwhile, India is quickly emerging as a promising market, with new regulations and investments strengthening its recycling capabilities. Countries like Australia, Indonesia, and Thailand are also accelerating infrastructure development to support battery material recovery as their EV and electronics sectors expand.

Leading companies driving innovation and expansion in Global Battery Materials Recycling Market include Stena Recycling, Redwood Materials, Ascend Elements, TES (part of SK Ecoplant), Umicore, LG Energy, RecycLiCo Battery Materials Inc., Duesenfeld GmbH, Primobius GmbH (Neometals JV), Glencore plc, Ecobat, Neometals Ltd, Retriev Technologies, Elemental Strategic Metals (ESM), and American Battery Technology Co. To strengthen their foothold in the battery materials recycling market, companies are pursuing strategies centered around vertical integration and technology innovation. Leading players are partnering with automakers and battery manufacturers to create closed-loop ecosystems that facilitate direct sourcing of spent batteries. Investments are also being made in advanced hydrometallurgical and direct extraction technologies to improve material recovery rates and reduce processing costs. Firms are expanding their global footprint by setting up regional recycling hubs and forming joint ventures to localize collection and refining operations.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Material Type

- 2.2.3 Technology

- 2.2.4 Battery Source

- 2.2.5 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Material Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Lithium recovery

- 5.3 Cobalt recovery

- 5.4 Nickel recovery

- 5.5 Manganese recovery

- 5.6 Base metals recovery

- 5.7 Other materials recovery

Chapter 6 Market Estimates & Forecast, By Technology, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Hydrometallurgy

- 6.3 Pyrometallurgy

- 6.4 Direct recycling

- 6.5 Mechanical processing

Chapter 7 Market Estimates & Forecast, By Battery Source, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Automotive batteries

- 7.3 Consumer electronics

- 7.4 Energy storage systems

- 7.5 Industrial sources

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Battery manufacturers

- 8.3 Material suppliers

- 8.4 Automotive OEMs

- 8.5 Electronics manufacturers

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East & Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East & Africa

Chapter 10 Company Profiles

- 10.1 American Battery Technology Co

- 10.2 Ascend Elements

- 10.3 Duesenfeld GmbH

- 10.4 Ecobat

- 10.5 Elemental Strategic Metals (ESM)

- 10.6 Glencore plc

- 10.7 LG Energy

- 10.8 Neometals Ltd

- 10.9 Primobius GmbH (Neometals JV)

- 10.10 RecycLiCo Battery Materials Inc.

- 10.11 Redwood Materials

- 10.12 Retriev Technologies

- 10.13 Stena Recycling

- 10.14 TES (part of SK ecoplant)

- 10.15 Umicore