PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844355

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844355

Data Center Security Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

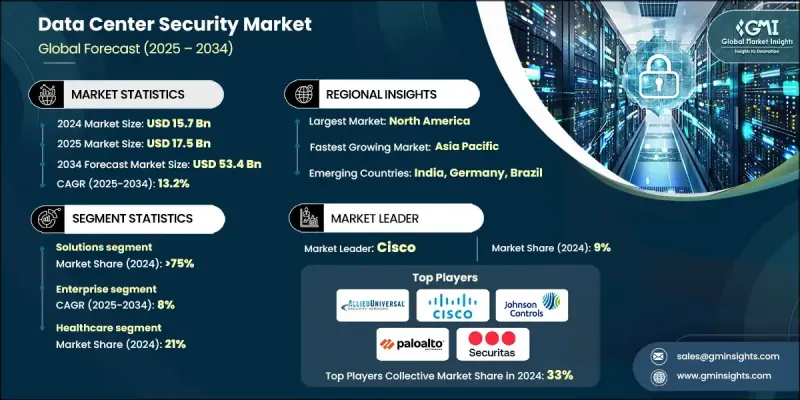

The Global Data Center Security Market was valued at USD 15.7 billion in 2024 and is estimated to grow at a CAGR of 13.2% to reach USD 53.4 billion by 2034.

As organizations continue to store and manage vast volumes of critical data, the importance of robust data center security, both physical and cyber, has grown significantly. Comprehensive protection now requires seamless coordination between incident response planning, risk assessments, continuous monitoring, and multi-layered defense systems. With businesses under constant pressure to secure customer data and maintain operational continuity, security has become a core component of data center strategy. Compliance with global standards like NIST, ISO, and region-specific regulations is not only necessary but also heavily enforced, pushing organizations to integrate governance and security management in daily operations. Companies face strict penalties and potential shutdowns if these requirements are ignored. Today's data center environments demand more than isolated firewalls or camera systems; a fully unified security architecture has become the industry norm, involving continuous audits and real-time incident mitigation. Market growth is further supported by rising adoption of cloud infrastructure, AI-enabled security technologies, and increasing regulatory oversight across critical sectors, including finance, healthcare, and government operations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15.7 Billion |

| Forecast Value | $53.4 Billion |

| CAGR | 13.2% |

In 2024, the solutions segment held a 75% share. This segment includes a full suite of cyber and physical security tools working together inside data center facilities. Physical solutions such as biometric access, motion sensors, fencing, alarm systems, and surveillance cameras are key to preventing unauthorized access and securing perimeter boundaries. On the cyber side, technologies like endpoint detection and response (EDR), firewalls, intrusion detection and prevention systems (IDS/IPS), cloud-native security platforms, and AI-driven monitoring solutions are designed to detect and respond to threats in real time.

The enterprises segment will grow at a CAGR of 8% between 2025 and 2034. These enterprise-run data centers serve as the backbone of critical business operations. Internal facilities managed by companies in sectors like finance, healthcare, and manufacturing prioritize a blend of physical safeguards, such as controlled access and surveillance, with cybersecurity systems that include firewalls, anomaly detection, and infrastructure monitoring. With the stakes high for protecting confidential data and meeting compliance mandates, enterprises continue to invest heavily in integrated, end-to-end security solutions.

US Data Center Security Market generated USD 4.7 billion in 2024, owing to its extensive digital infrastructure. Data center growth in areas like North Virginia has established the region as a national hub. However, newer markets such as Richmond are gaining traction as well, driven by favorable infrastructure and business environments.

Key players actively shaping the Global Data Center Security Market include Johnson Controls, Honeywell, Securitas, Genetec, Allied Universal, Cisco, Fortinet, Axis Communications, Palo Alto Networks, and ASSA ABLOY. To strengthen their foothold, companies in the data center security space are focusing on integrated solutions that combine physical and cybersecurity. Many are enhancing their product offerings through AI-driven threat detection and real-time analytics. Strategic acquisitions and partnerships are also helping expand their technology portfolios and market access. Players are investing in R&D to develop advanced biometric and cloud-native tools tailored for hybrid infrastructure. Geographic expansion into emerging secondary data center markets is a common tactic, especially in regions with rising cloud adoption and digital infrastructure projects.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Data center

- 2.2.4 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising investment in physical security infrastructure

- 3.2.1.2 Adoption of integrated cyber-physical security solutions

- 3.2.1.3 Cloud and hybrid data center expansion

- 3.2.1.4 Regulatory compliance (ISO, NIST, GDPR)

- 3.2.1.5 Increasing insider threat mitigation initiatives

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Limited skilled workforce

- 3.2.2.2 Budget constraints for SMEs

- 3.2.3 Market opportunities

- 3.2.3.1 Edge data centers growth

- 3.2.3.2 Managed security services adoption

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology maturity assessment framework

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Cost structure analysis

- 3.9 Patent analysis

- 3.10 Sustainability and ESG impact assessment

- 3.10.1 Environmental impact analysis and metrics

- 3.10.2 Social impact considerations and metrics

- 3.10.3 Governance and compliance framework

- 3.10.4 ESG investment implications and financial impact

- 3.11 Use cases and applications

- 3.12 Best-case scenario

- 3.13 ROI analysis and business case framework

- 3.13.1 Total cost of ownership (TCO) analysis

- 3.13.2 Risk mitigation and security value quantification

- 3.13.3 Operational efficiency and productivity gains

- 3.13.4 Business case templates and financial models

- 3.14 Data Center Construction Activity

- 3.14.1 North America

- 3.14.2 Europe

- 3.14.3 Asia Pacific

- 3.14.4 Latin America

- 3.14.5 Middle East & Africa

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

- 4.7 Venture capital and private equity activity

- 4.8 Infrastructure investment patterns

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 Solutions

- 5.2.1 Physical security

- 5.2.2 Logical/network security

- 5.2.3 Threat intelligence

- 5.2.4 Data security

- 5.3 Services

- 5.3.1 Managed security

- 5.3.2 Consulting

- 5.3.3 Support & maintenance

Chapter 6 Market Estimates & Forecast, By Data Center, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 Hyperscale

- 6.3 Colocation

- 6.4 Enterprise

- 6.5 Edge

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 BFSI

- 7.3 Healthcare

- 7.4 Retail & E-commerce

- 7.5 Media & entertainment

- 7.6 IT & telecommunication

- 7.7 Government & defense

- 7.8 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 US

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Nordics

- 8.3.7 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Global Players

- 9.1.1 ASSA ABLOY

- 9.1.2 Axis Communications

- 9.1.3 Check Point Software Technologies

- 9.1.4 Cisco

- 9.1.5 CrowdStrike

- 9.1.6 Fortinet

- 9.1.7 Genetec

- 9.1.8 Honeywell

- 9.1.9 Johnson Controls

- 9.1.10 Palo Alto Networks

- 9.1.11 Securitas

- 9.1.12 Siemens

- 9.1.13 Tyco International

- 9.1.14 Verint Systems

- 9.1.15 Zebra Technologies

- 9.1.16 Allied Universal

- 9.2 Regional Players

- 9.2.1 ADT

- 9.2.2 Bosch Security Systems

- 9.2.3 Brinks Home Security

- 9.2.4 Dahua Technology

- 9.2.5 Eaton

- 9.2.6 Flir Systems

- 9.2.7 Hanwha Techwin

- 9.2.8 Hikvision

- 9.2.9 LenelS2

- 9.2.10 Motorola Solutions

- 9.3 Emerging Players / Disruptors

- 9.3.1 Armis Security

- 9.3.2 Chainguard

- 9.3.3 Cynomi

- 9.3.4 Endor Labs

- 9.3.5 Koi