PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844369

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844369

Regenerative Blower Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

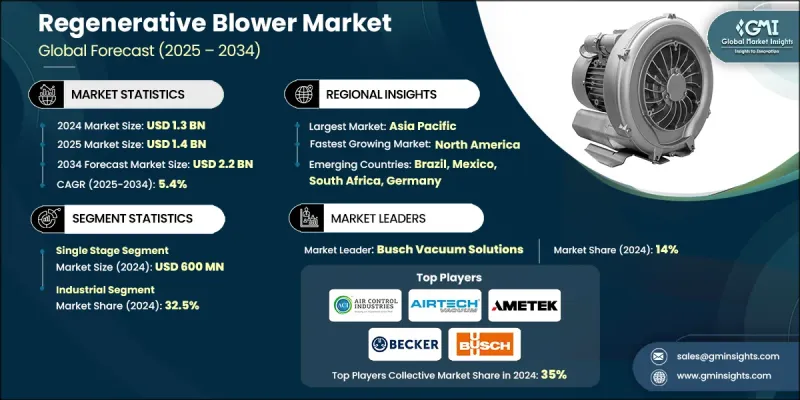

The Global Regenerative Blower Market was valued at USD 1.3 billion in 2024 and is estimated to grow at a CAGR of 5.4% to reach USD 2.2 billion by 2034.

Rising demand is largely fueled by the rapid advancement of automation and the widespread implementation of automated systems across diverse sectors. Regenerative blowers have become a key component in these environments due to their role in supporting essential functions like cooling, material handling, drying, and pneumatic conveying. Their oil-free, consistent airflow and low maintenance needs make them highly favored in high-performance industrial settings.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.3 Billion |

| Forecast Value | $2.2 Billion |

| CAGR | 5.4% |

Continued innovation in regenerative blower design and engineering has significantly improved efficiency, performance, and versatility. Enhanced materials and intelligent control systems have expanded their use across both established and emerging sectors. Applications in newer fields such as clean energy systems, additive manufacturing, and advanced pneumatic handling are further driving adoption. In these scenarios, regenerative blowers provide precise air movement, energy savings, and contamination-free operation, making them ideal for modern manufacturing and environmentally focused industries. Their value proposition lies not only in operational efficiency but also in contributing to sustainable production and lower operational risks.

The single-stage segment accounted for USD 600 million in 2024 owing to its extensive use in both heavy-duty and light industrial applications. These blowers are essential in systems where consistent airflow is required, supporting tasks like chemical agitation, combustion air delivery, dust removal, suction applications, and air knife blow-offs. Their widespread use is attributed to their ability to deliver high reliability with minimal complexity, which supports uptime and lowers operational costs.

The industrial application segment held a 32.5% share in 2024, highlighting the importance of regenerative blowers in heavy industries. These systems are tailored for operations that demand both high flow rates and pressure stability. Commonly used in sectors such as wastewater management, pneumatic transport, and aeration, these blowers provide efficient performance while maintaining oil-free operation, which is critical for environments where product or process contamination must be avoided.

United States Regenerative Blower Market held a 76% share in 2024 as domestic industries embraced automation and energy-efficient solutions. Increased regulatory scrutiny around emissions, workplace safety, and equipment noise levels has encouraged the shift toward quieter, smarter blower technologies. U.S. manufacturers are addressing this demand by delivering blowers with enhanced efficiency, digital integration, and advanced variable speed capabilities. These developments align with the growing need for precision airflow systems in smart manufacturing and industrial process control.

Key players in the Global Regenerative Blower Market include Airtech Vacuum Incorporated, Goorui, The Spencer Turbine Company, FPZ SpA, Hitachi Ltd., Eurus Blowers, Becker Pump Corporation, Gardner Denver Holdings, Inc., Air Control Industries Ltd., Busch SE / Busch Vacuum Solutions, Gast Manufacturing, Inc., Atlantic Blowers, Rietschle Thomas, Ametek Inc., and KNB Corporation. Companies competing in the Regenerative Blower Market are focusing on innovation, customization, and energy efficiency to solidify their presence across global markets. Many are investing in smart blower technologies that integrate IoT features, remote diagnostics, and advanced control systems. Strategic partnerships and acquisitions are helping manufacturers expand product portfolios while improving supply chain resilience. Firms are also emphasizing R&D to develop noise-reduced, oil-free blowers suitable for clean energy and automation-driven applications. Localization of production facilities and tailored service offerings are being used to address region-specific needs.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type trends

- 2.2.3 Method trends

- 2.2.4 Application trends

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for industrial automation

- 3.2.1.2 Environmental regulations promoting energy efficiency

- 3.2.1.3 Expansion of wastewater treatment and air handling applications

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Cost pressure due to high manufacturing and maintenance

- 3.2.2.2 Technological displacement by alternative solutions

- 3.2.3 Opportunities

- 3.2.3.1 Integration with smart monitoring systems

- 3.2.3.2 Emerging markets and infrastructure development

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Stage Type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Single staged

- 5.3 Two-staged

- 5.4 Three-staged

Chapter 6 Market Estimates and Forecast, By Pressure Range, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Low pressure (up to 1 bar)

- 6.3 Medium pressure (1 to 2 bar)

- 6.4 High pressure (more than 2 bar)

Chapter 7 Market Estimates and Forecast, By End Use, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Water and wastewater

- 7.3 Food & beverage

- 7.4 Industrial

- 7.5 Chemical

- 7.6 Oil & gas

- 7.7 Medical

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indirect sales

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 Saudi Arabia

- 9.6.2 UAE

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Air Control Industries Ltd.

- 10.2 Airtech Vacuum Incorporated

- 10.3 Atlantic Blowers

- 10.4 Ametek Inc.

- 10.5 Becker Pump Corporation

- 10.6 Busch SE / Busch Vacuum Solutions

- 10.7 Eurus Blowers

- 10.8 FPZ SpA

- 10.9 Gardner Denver Holdings, Inc.

- 10.10 Gast Manufacturing, Inc.

- 10.11 Goorui

- 10.12 Hitachi Ltd.

- 10.13 KNB Corporation

- 10.14 Rietschle Thomas

- 10.15 The Spencer Turbine Company