PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844382

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844382

Current Sensor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

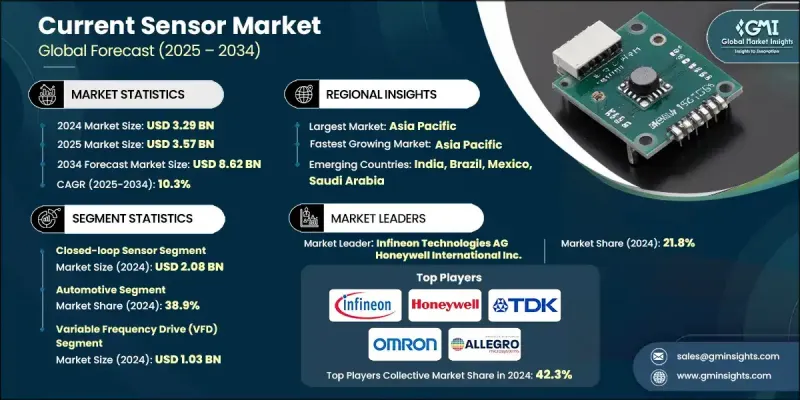

The Global Current Sensor Market was valued at USD 3.29 billion in 2024 and is estimated to grow at a CAGR of 10.3% to reach USD 8.62 billion by 2034.

Growth is fueled by rising demand for high-precision, energy-efficient current sensing across segments like industrial automation, electric mobility, renewable energy, and consumer electronics. As electronics become more compact and power-dense, the push for reliable, compact, and isolated current sensors has intensified. Technologies such as closed-loop and open-loop Hall effect sensors lead to high-volume integration, while digital and fluxgate sensors gain popularity in applications requiring greater accuracy and voltage handling. As current sensors become central to systems beyond basic motor control or power supply oversight, their presence is growing in electric vehicle traction inverters, battery monitoring systems, solar power stages, and intelligent robotics. These sensors are vital for predictive diagnostics, safety assurance, and performance optimization. Emerging use cases and the growing importance of real-time data acquisition in smart electronics are expected to significantly influence product innovation and market momentum over the next decade.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.29 billion |

| Forecast Value | $8.62 billion |

| CAGR | 10.3% |

The closed-loop sensor segment was valued at USD 2.08 billion in 2024, reflecting strong demand in automation, robotics, and next-gen smart systems. Closed-loop sensors are favored for their ability to deliver precise real-time feedback and tighter control in operational environments. Increasing reliance on automation, both in industrial and consumer spaces, is elevating the role of closed-loop designs. Enhanced durability, miniaturization, and integration with AI-driven systems have become key selling points. As market dynamics evolve, sensor manufacturers continue advancing real-time analytics, predictive capabilities, and seamless connectivity, making closed-loop configurations more intelligent and responsive than ever.

The automotive segment held a 38.9% share in 2024. Its dominance is supported by the broad integration of current sensors across electric and hybrid vehicle architectures and advanced safety platforms. These components are integral to systems such as battery management, onboard charging, auxiliary electronics, and traction inverters. High isolation and accuracy standards make them essential for safety and performance in EVs. Global vehicle electrification and infrastructure growth will continue reinforcing this segment's leadership, while evolving battery chemistries and platform innovations require increasingly tailored sensing solutions.

United States Current Sensor Market was valued at USD 840.38 million in 2024. Expansion is largely tied to increased adoption of EVs, advanced battery technologies, and the deployment of smart grid and renewable energy initiatives. The growing need for high-accuracy current sensing in automation, cloud data centers, and performance electronics is further accelerating demand. To remain competitive, manufacturers are designing advanced current sensing solutions suited for next-generation EV powertrains, solar systems, and industrial machinery.

Key companies driving the Global Current Sensor Market include Littelfuse, Inc., Infineon Technologies AG, Vishay Intertechnology, Inc., Melexis, TE Connectivity, Honeywell International Inc., VACUUMSCHMELZE GmbH & Co. KG, Allegro MicroSystems, Inc., LEM International SA, Sensitec GmbH, ROHM Co., Ltd., TAMURA Corporation, Omron Corporation, Asahi Kasei Microdevices Corporation, NVE Corporation, STMicroelectronics N.V., Silicon Laboratories, TDK Corporation, KOHSHIN ELECTRIC CORPORATION, Texas Instruments Incorporated, Aceinna. Companies in the current sensor market are enhancing their global presence by expanding production capabilities and developing application-specific solutions tailored to automotive, industrial, and renewable energy systems. A major focus is placed on miniaturization, increased accuracy, and integration of smart features like digital interfaces and self-diagnostics. Strategic partnerships with electric vehicle manufacturers, solar integrators, and automation firms help accelerate adoption across emerging sectors. Many players are also investing in R&D to create next-generation sensors compatible with high-voltage systems and harsh environments.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Business trends

- 2.2.2 Type trends

- 2.2.3 Technology trends

- 2.2.4 Application trends

- 2.2.5 End use trends

- 2.2.6 Regional trends

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand from data centers and cloud infrastructure

- 3.2.1.2 Adoption of advanced current sensing technologies

- 3.2.1.3 Integration of current sensors in consumer and high-performance electronics

- 3.2.1.4 Use of current sensors in industrial and automation systems

- 3.2.1.5 Deployment of current sensors in automotive and EV applications

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High implementation and upgrade costs

- 3.2.2.2 Competition from alternative sensing technologies

- 3.2.3 Market opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging business models

- 3.9 Compliance requirements

- 3.10 Consumer sentiment analysis

- 3.11 Patent and IP analysis

- 3.12 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.2 Market concentration analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Digital Transformation Initiatives

- 4.5 Emerging/ Startup Competitors Landscape

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Million and Million Units)

- 5.1 Key trends

- 5.2 Closed loop

- 5.3 Open loop

Chapter 6 Market Estimates & Forecast, By Technology, 2021-2034 (USD Million and Million Units)

- 6.1 Key trends

- 6.2 Hall-effect

- 6.3 Shunt

- 6.4 Fluxgate

- 6.5 Magneto-resistive

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Million and Million Units)

- 7.1 Key trends

- 7.2 Battery Management Systems (BMS)

- 7.3 Power Distribution Units (PDUs)

- 7.4 Switched-mode Power Supply (SMPS)

- 7.5 UPS

- 7.6 Calibration benches

- 7.7 Traction motor inverter

- 7.8 On-board charger (OBC)

- 7.9 Variable Frequency Drives (VFDs)

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million and Million Units)

- 8.1 Key trends

- 8.2 Automotive

- 8.3 Industrial

- 8.4 Data center

- 8.5 Healthcare

- 8.6 Renewable energy

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million and Million Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players:

- 10.1.1 Allegro MicroSystems, Inc.

- 10.1.2 Asahi Kasei Microdevices Corporation

- 10.1.3 Honeywell International Inc.

- 10.1.4 Infineon Technologies AG

- 10.1.5 LEM International SA

- 10.1.6 Melexis

- 10.1.7 STMicroelectronics N.V.

- 10.1.8 TDK Corporation

- 10.1.9 TE Connectivity

- 10.1.10 Texas Instruments Incorporated

- 10.1.11 Vishay Intertechnology, Inc.

- 10.2 Regional Players:

- 10.2.1 KOHSHIN ELECTRIC CORPORATION

- 10.2.2 Omron Corporation

- 10.2.3 ROHM Co., Ltd.

- 10.2.4 Sensitec GmbH

- 10.2.5 TAMURA Corporation

- 10.2.6 VACUUMSCHMELZE GmbH & Co. KG

- 10.3 Emerging Players:

- 10.3.1 Aceinna

- 10.3.2 Littelfuse, Inc.

- 10.3.3 NVE Corporation

- 10.3.4 Silicon Laboratories