PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844385

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844385

Direct-to-Consumer Genetic Testing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

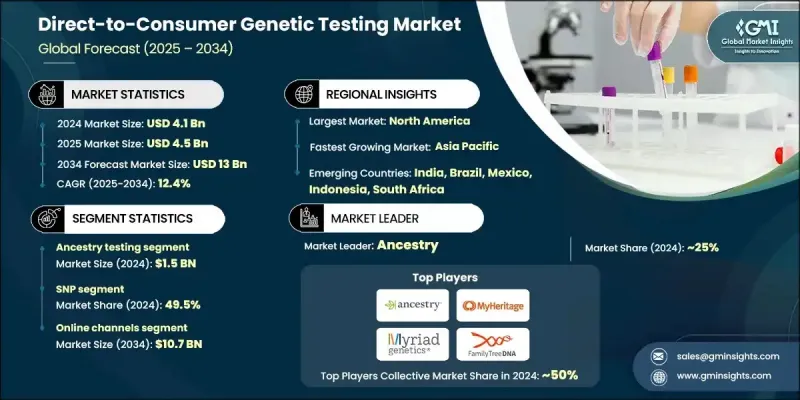

The Global Direct-to-Consumer Genetic Testing Market was valued at USD 4.1 billion in 2024 and is estimated to grow at a CAGR of 12.4% to reach USD 13 billion by 2034.

The rapid expansion is fueled by the rising consumer demand for personalized health and wellness solutions. As more individuals, especially younger demographics, seek deeper insights into their health, ancestry, and lifestyle, the demand for at-home genetic tests is accelerating. These tests eliminate the need for a healthcare intermediary, offering accessible results via simple saliva or cheek swabs. Direct-to-Consumer Genetic Testing covers a wide range of applications, including predictive and carrier testing, pharmacogenomics, skincare, nutrition, ancestry, and trait analysis. The growing integration of these genetic insights into digital health tools and mobile apps is also a key market driver. Wearables and health tracking platforms are increasingly syncing with genetic data to deliver personalized fitness, nutrition, and wellness recommendations. This alignment of genetic testing with everyday health technology is improving user experience and widening consumer appeal. The shift toward proactive health management, along with evolving consumer expectations for real-time and tailored insights, continues to support market penetration across a broader population base.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.1 Billion |

| Forecast Value | $13 Billion |

| CAGR | 12.4% |

The ancestry testing segment generated USD 1.5 billion in 2024. Consumers are increasingly drawn to the affordability, ease of understanding, and personal curiosity that ancestry testing satisfies. These tests offer a way to trace heritage, discover global ethnic backgrounds, and explore family connections. Companies driving this segment are leveraging large-scale DNA databases, consumer-friendly platforms, and aggressive marketing strategies to expand reach. Their ability to deliver comprehensive and engaging ancestry insights in an accessible format has significantly strengthened the popularity of this segment.

In 2024, the single-nucleotide polymorphism (SNP) technology held a 49.5% share. Its scalability and efficiency in identifying thousands of genetic variants across large datasets make it ideal for consumer-facing applications. SNP chips are extensively used for analyzing genetic traits, health predispositions, and ancestry. The technology offers fast processing, reduced testing costs, and high reliability, which are critical for maintaining affordability and speed in high-volume direct-to-consumer testing. This scalability has positioned SNP technology as the backbone of many leading genetic testing products available today.

North America Direct-to-Consumer Genetic Testing Market held a 48.6% share in 2024. The region benefits from a strong mix of consumer awareness, advanced digital health infrastructure, and an early adoption mindset. High engagement with personalized health tools, supportive regulatory frameworks, and strong public interest in health optimization are further boosting the DTC testing ecosystem in the U.S. and Canada. In addition, the active presence of key industry players and increasing alignment between genetic testing and digital wellness platforms are accelerating market growth and strengthening regional leadership.

Some of the major players shaping the Global Direct-to-Consumer Genetic Testing Market include DNA Genotek, Dante Lab, The SkinDNA Company, Family Tree DNA (Gene By Gene), Easy DNA, Tempus AI, MedGenome, Helix, MyHeritage, Nutrigenomix, HomeDNA, Veritas Intercontinental, Mapmygenome, Blueprint Genetics, Fulgent Genetics, Pathway Genomics, Genova Diagnostics (GDX), DNA Complete, Myriad Genetics, Inc., Living DNA, Ancestry, Quest Diagnostics, Genesis Healthcare, and Identigene. Companies in the DTC genetic testing market are focusing on expanding their global presence through multilingual platforms and local partnerships. Key players are investing in user-friendly mobile apps that integrate real-time health data with genetic insights to enhance customer engagement. Regular updates to testing panels and the introduction of niche test categories, such as skincare and wellness genetics, are helping companies reach new demographics.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Test type trends

- 2.2.3 Technology trends

- 2.2.4 Distribution channel trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for personalized solutions based on genetic insights

- 3.2.1.2 Growing technology advancement in genomic sequencing

- 3.2.1.3 Increased awareness of genetic disorders

- 3.2.1.4 Expanding accessibility of DTC through online channels

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Privacy and data security

- 3.2.2.2 Stringent regulatory challenges

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of online distribution channels

- 3.2.3.2 Strategic alliances and partnerships

- 3.2.3.3 Increasing penetration in emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Europe

- 3.4.2.1 Germany

- 3.4.2.2 UK

- 3.4.2.3 France

- 3.4.2.4 Spain

- 3.4.2.5 Italy

- 3.4.3 Asia Pacific

- 3.4.3.1 China

- 3.4.3.2 Japan

- 3.4.3.3 India

- 3.4.3.4 Australia

- 3.4.4 Latin America

- 3.4.5 MEA

- 3.5 Investment and funding landscape in the genetic testing industry

- 3.6 Technological landscape

- 3.6.1 Emerging technologies

- 3.6.2 Current technologies

- 3.7 Data privacy concerns

- 3.8 Value chain analysis

- 3.9 Reimbursement scenario

- 3.10 Pricing analysis

- 3.11 Future market trends

- 3.12 Porter’s analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Test Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Carrier screening

- 5.3 Predictive testing

- 5.4 Ancestry testing

- 5.5 Nutrigenomic testing

- 5.6 Pharmacogenomic testing

- 5.7 Skincare testing

- 5.8 Other test types

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Microarray-based testing

- 6.3 Single-nucleotide polymorphism (SNP) chips

- 6.4 Whole genome sequencing (WGS)

- 6.5 Other technologies

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Online channels

- 7.3 Over-the-counter (OTC)

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Ancestry

- 9.2 Blueprint Genetics

- 9.3 Counsyl

- 9.4 Dante Lab

- 9.5 DNA Complete

- 9.6 DNA Genotek

- 9.7 Easy DNA

- 9.8 Family Tree DNA (Gene By Gene)

- 9.9 Fulgent Genetics

- 9.10 Genesis Healthcare

- 9.11 Genova Diagnostics (GDX)

- 9.12 Helix

- 9.13 HomeDNA

- 9.14 Identigene

- 9.15 Living DNA

- 9.16 Mapmygenome

- 9.17 MedGenome

- 9.18 MyHeritage

- 9.19 Myriad Genetics, Inc.

- 9.20 Nutrigenomix

- 9.21 Pathway genomics

- 9.22 Quest Diagnostics

- 9.23 Tempus AI

- 9.24 The SkinDNA Company

- 9.25 Veritas Intercontinental