PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858799

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858799

Phase Change Materials in Thermal Management Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

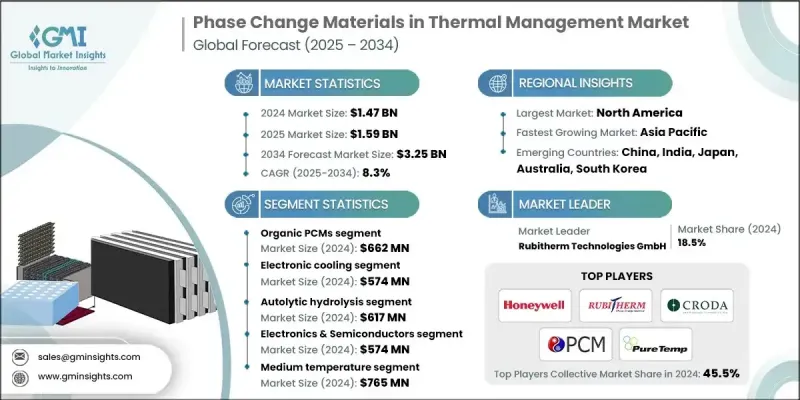

The Global Phase Change Materials in Thermal Management Market was valued at USD 1.47 billion in 2024 and is estimated to grow at a CAGR of 8.3% to reach USD 3.25 billion by 2034.

The market focuses on the development and deployment of materials capable of storing, absorbing, and releasing thermal energy during state changes such as melting or solidifying. These materials are widely applied in sectors like electronics, automotive, and buildings, helping regulate temperature while improving energy efficiency. The increasing need for efficient thermal control across industries is a major growth driver for PCM technologies. Global demand is rising for high-performance thermal regulation systems that support smaller, more powerful electronic devices, sustainable buildings, and advanced automotive systems. Innovations like nano-enhanced PCMs and microencapsulation have significantly boosted durability, thermal conductivity, and integration potential, improving heat transfer and lifecycle performance. These improvements have made PCMs more attractive for integration in printed circuit boards, batteries, heat sinks, and more, enabling wider adoption across thermal-critical applications. The market's growth reflects the broader push toward smarter energy use and optimized heat management.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.47 Billion |

| Forecast Value | $3.25 Billion |

| CAGR | 8.3% |

The organic PCMs segment generated USD 662 million in 2024. Their strong position comes from their reliable thermal characteristics, excellent latent heat storage capacity, and long-term chemical stability, all of which are essential in areas like electronic component cooling and thermal regulation in buildings. Paraffin-based PCMs are widely used due to their broad melting point range, while fatty acids and alcohol-based PCMs are gaining recognition for their cycling stability in automotive and electronics applications that demand repetitive phase transitions without material breakdown.

The electronics cooling segment generated USD 574 million in 2024, reflecting the increasing pressure to manage heat generated by compact, high-density devices. As devices shrink and power demands rise, managing heat spikes and maintaining safe operational temperatures becomes essential. Microencapsulated PCMs are tailored for use within electronic assemblies, offering seamless integration into heat-sensitive systems without compromising structural integrity or electrical performance.

US Phase Change Materials in Thermal Management Market generated USD 378 million in 2024. This leadership is attributed to strong industrial capabilities and government-backed energy initiatives aimed at improving efficiency in construction and manufacturing. Policies encouraging sustainable building practices and the adoption of advanced energy-saving technologies have given PCMs a significant foothold. Additionally, the country's advanced automotive and electronics sectors consistently seek out new solutions for thermal regulation, further driving PCM adoption.

Top companies active in the Global Phase Change Materials in Thermal Management Market are Cryopak Industries Inc., Sonoco ThermoSafe, Climate Change Materials, AeroSafe Global, Pelican BioThermal, Rubitherm Technologies GmbH, Pluss Advanced Technologies Pvt. Ltd., Cold Chain Technologies, Entropy Solutions Inc./PureTemp LLC, Cowa Thermal Solutions, Tetramer Technologies, Microtek Laboratories Inc., va-Q-tec, Salca BV, Outlast Technologies LLC, Datum Phase Change, PCM Energy Pvt. Ltd./Teappcm, Nanolope, Phase Change Material Products Limited (PlusICE), Advanced Cooling Technologies Inc., Mesa Laboratories Inc., Phase Change Energy Solutions, i-TES, Honeywell International Inc., Climator Sweden AB, Axiotherm GmbH, and Croda International Plc. Companies in the Phase Change Materials in Thermal Management Market are adopting a range of strategies to expand their market reach and stay competitive. Many are investing in advanced formulations such as nano-enhanced or bio-based PCMs to improve thermal conductivity, reduce environmental impact, and enhance cycling durability. Strategic collaborations with electronics and automotive OEMs are enabling easier integration of PCM solutions into high-performance systems. Additionally, leading manufacturers are expanding production capabilities and automating fabrication to meet growing global demand.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Material type

- 2.2.2 Application

- 2.2.3 Form factor

- 2.2.4 End Use Industry

- 2.2.5 Temperature Range

- 2.2.6 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Rising demand from electronics miniaturization

- 3.2.3 Growth in electric vehicle thermal management

- 3.2.4 Technological advancements boosting PCM performance

- 3.2.5 Focus on energy efficiency in buildings

- 3.3 Industry pitfalls and challenges

- 3.3.1 High production and integration costs

- 3.3.2 Material stability and lifecycle concerns

- 3.4 Market opportunities

- 3.4.1 Expansion in electric vehicle applications

- 3.4.2 Integration in renewable energy systems

- 3.4.3 Advancements in smart building materials

- 3.5 Growth potential analysis

- 3.6 Regulatory landscape

- 3.6.1 North America

- 3.6.2 Europe

- 3.6.3 Asia Pacific

- 3.6.4 Latin America

- 3.6.5 Middle East & Africa

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Price trends

- 3.10.1 By region

- 3.10.2 By material type

- 3.11 Future market trends

- 3.12 Patent landscape

- 3.13 Trade statistics (HS code)( Note: the trade statistics will be provided for key countries only)

- 3.13.1 Major importing countries

- 3.13.2 Major exporting countries

- 3.14 Sustainability and environmental aspects

- 3.14.1 Sustainable practices

- 3.14.2 Waste reduction strategies

- 3.14.3 Energy efficiency in production

- 3.14.4 Eco-friendly initiatives

- 3.15 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Material Type, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Organic PCMs

- 5.2.1 Paraffin waxes

- 5.2.2 Fatty acids

- 5.2.3 Non-paraffin organics

- 5.3 Inorganic PCMs

- 5.3.1 Salt hydrates

- 5.3.2 Metallic alloys

- 5.3.3 Eutectic salts

- 5.4 Bio-based PCMs

- 5.4.1 Vegetable-based compounds

- 5.4.2 Natural fatty acids

- 5.5 Composite & Enhanced PCMs

- 5.5.1 Nano-enhanced

- 5.5.2 Graphite-enhanced

- 5.5.3 Metal foam composites

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Building & construction

- 6.2.1 HVAC systems

- 6.2.2 Wallboard & gypsum

- 6.2.3 Concrete & structural

- 6.2.4 Insulation & building

- 6.3 Electronics cooling

- 6.3.1 Semiconductor thermal

- 6.3.2 Data center cooling

- 6.3.3 Consumer electronics

- 6.3.4 Power electronics cooling

- 6.4 Battery thermal

- 6.4.1 Electric vehicle battery

- 6.4.2 Grid energy storage

- 6.4.3 Portable device batteries

- 6.5 Automotive

- 6.5.1 Engine thermal

- 6.5.2 Cabin comfort

- 6.5.3 EV thermal

- 6.6 Textiles & wearables

- 6.7 Cold chain & logistics

Chapter 7 Market Estimates and Forecast, By Form Factor, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Bulk & raw PCMs

- 7.3 Microencapsulated

- 7.3.1 Polymer-shell encapsulation

- 7.3.2 Inorganic shell encapsulation

- 7.4 Macroencapsulated

- 7.4.1 Container-based

- 7.4.2 Panel & tube

- 7.5 Shape-stabilized

- 7.5.1 Porous support

- 7.5.2 Composite matrix

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Construction & building materials

- 8.3 Electronics & semiconductors

- 8.4 Automotive & transportation

- 8.5 Energy & utilities

- 8.6 Aerospace & defense

- 8.7 Healthcare & pharmaceuticals

Chapter 9 Market Estimates and Forecast, By Temperature range, 2021-2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 Low Temperature PCMs (-50°C to 15°C)

- 9.3 Comfort Range PCMs (15°C to 32°C)

- 9.4 Medium Temperature PCMs (32°C to 100°C)

- 9.5 High Temperature PCMs (100°C to 800°C)

Chapter 10 Market Estimates and Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.2.3 Mexico

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

- 10.6.4 Rest of Middle East and Africa

Chapter 11 Company Profiles

- 11.1 AeroSafe Global

- 11.2 Advanced Cooling Technologies Inc.

- 11.3 Axiotherm GmbH

- 11.4 Climator Sweden AB

- 11.5 Climate Change Materials

- 11.6 Cold Chain Technologies

- 11.7 Croda International Plc

- 11.8 Cowa Thermal Solutions

- 11.9 Datum Phase Change

- 11.10 Entropy Solutions Inc./PureTemp LLC

- 11.11 Honeywell International Inc.

- 11.12 i-TES

- 11.13 Microtek Laboratories Inc.

- 11.14 Mesa Laboratories Inc.

- 11.15 Nanolope

- 11.16 Outlast Technologies LLC

- 11.17 Pelican BioThermal

- 11.18 Phase Change Energy Solutions

- 11.19 Phase Change Material Products Limited (PlusICE)

- 11.20 Pluss Advanced Technologies Pvt. Ltd.

- 11.21 PCM Energy Pvt. Ltd./Teappcm

- 11.22 Rubitherm Technologies GmbH

- 11.23 Salca BV

- 11.24 Sonoco ThermoSafe

- 11.25 Sunamp

- 11.26 Tetramer Technologies

- 11.27 va-Q-tec

- 11.28 Cryopak Industries Inc.