PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858818

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858818

Off-Highway Equipment Transmission Component Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

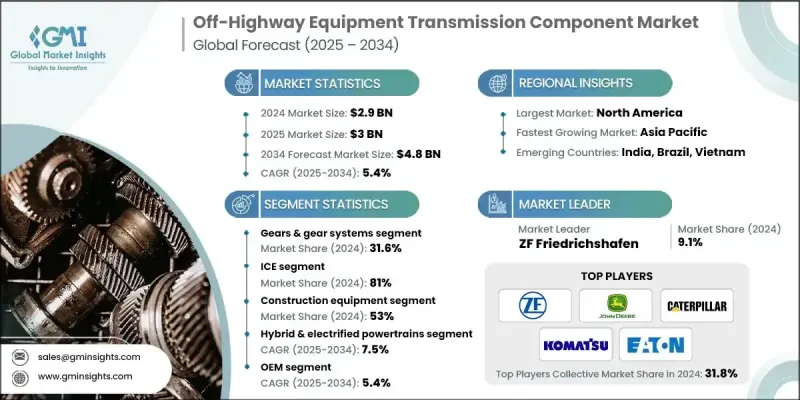

The Global Off-Highway Equipment Transmission Component Market was valued at USD 2.9 billion in 2024 and is estimated to grow at a CAGR of 5.4% to reach USD 4.8 billion by 2034.

The market growth is driven by increasing investments in infrastructure projects, including roads, bridges, and housing developments. These projects require construction equipment equipped with durable transmission systems capable of handling heavy loads for extended periods. The demand for off-highway machinery is also rising due to rapid urbanization, particularly in Asia and Africa. Moreover, the agriculture sector, especially in developing countries, is embracing mechanization, with advanced transmission systems becoming more common in tractors, harvesters, and sprayers. These systems, such as hydrostatic and electro-hydraulic transmissions, are gaining popularity because of their efficiency, precision, and ease of operation. Similarly, the mining industry continues to grow as demand for minerals and fossil fuels remains high, leading to greater reliance on robust transmission systems in heavy-duty machinery. Although the electrification of mining equipment is a growing trend, diesel-powered machinery still relies on durable transmissions to function efficiently in challenging environments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.9 Billion |

| Forecast Value | $4.8 Billion |

| CAGR | 5.4% |

The gears & gear systems segment accounted for a 31.6% share in 2024 and is expected to grow at a CAGR of 6.1% through 2034. This segment is benefiting from the increasing adoption of planetary gear sets, which provide compact, high-torque solutions that are more efficient, reliable, and space-efficient in off-highway machinery. The use of lightweight materials such as alloys and composites is also growing, helping to reduce overall weight while maintaining strength. Additionally, advancements in noise and vibration suppression technologies are being integrated into gear systems to improve both operator comfort and the longevity of machine parts.

The internal combustion engine (ICE) segment held an 81% share in 2024 and is expected to grow at a CAGR of 5.2% through 2034. Despite the growing trend toward electrification, ICEs are still preferred in off-highway applications due to their reliability and power. Manufacturers are focusing on improving fuel efficiency and reducing emissions to meet stringent environmental standards.

U.S. Off-Highway Equipment Transmission Component Market held 86.1% in 2024, with USD 728.9 million. The country's rapid urbanization, growing disposable incomes, and increasing demand for premium vehicles are all contributing factors to this dominance. In the U.S., hydrostatic transmissions are becoming more widely used in off-highway machinery due to their flexibility, efficiency, and smooth power delivery. These systems are particularly beneficial in applications that require variable speed control, such as construction and agricultural machinery.

Key companies leading the Global Off-Highway Equipment Transmission Component Market include Allison Transmission, BorgWarner, Bosch Rexroth, Caterpillar, CNH Industrial, Eaton Corporation, John Deere, Komatsu, and ZF Friedrichshafen. To strengthen their position, companies in the Off-Highway Equipment Transmission Component Market are focusing on technological innovation and product diversification. Many are investing in the development of advanced transmission systems, such as hydrostatic and electro-hydraulic solutions, to improve the efficiency, durability, and energy performance of off-highway machinery. Companies are also forming strategic partnerships with OEMs to integrate their transmission technologies directly into new-generation off-highway equipment. Furthermore, these players are expanding their manufacturing capabilities, particularly in regions with growing infrastructure needs, like North America and Asia.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Propulsion

- 2.2.4 Vehicle

- 2.2.5 Technology

- 2.2.6 Sales channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Value chain analysis

- 3.2.1 Upstream value chain

- 3.2.2 Midstream value chain

- 3.2.3 Downstream value chain

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Increasing Demand for Construction and Mining Equipment

- 3.3.1.2 Shift Towards Electrification and Hybrid Powertrains

- 3.3.1.3 Technological Advancements in Transmission Systems

- 3.3.1.4 Growth in Emerging Markets

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High Capital Investment for Electrified Systems

- 3.3.2.2 Volatility in Raw Material Prices

- 3.3.2.3 Complex Maintenance Requirements

- 3.3.2.4 Infrastructure Limitations in Emerging Markets

- 3.3.3 Market opportunities

- 3.3.3.1 Expansion of Aftermarket Services

- 3.3.3.2 Adoption of Autonomous and Smart Equipment

- 3.3.3.3 Government Subsidies and Incentives

- 3.3.3.4 Emerging Applications in Specialty Equipment

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.5.1 EPA Tier 4 Final Standards Implementation

- 3.5.2 EU Stage V Emissions Compliance Requirements

- 3.5.3 Regional Regulatory Framework Variations

- 3.5.4 Future Emissions Standards Development

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

- 3.8 Technology and Innovation landscape

- 3.8.1 Next-Generation Transmission Technologies

- 3.8.2 Full Equipment Electrification Timeline

- 3.8.3 Autonomous Equipment Integration

- 3.8.4 Digital Twin & Simulation Technologies

- 3.8.5 Sustainable Manufacturing Trends

- 3.9 Price trends

- 3.9.1 Vehicles

- 3.9.2 Region

- 3.10 Patent analysis

- 3.11 Production statistics

- 3.11.1 Production hubs

- 3.11.2 Consumption hubs

- 3.11.3 Export and import

- 3.12 Cost breakdown analysis

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly Initiatives

- 3.13.5 Carbon footprint considerations

- 3.14 OEM vs Aftermarket Competition Dynamics

- 3.14.1 Original Equipment Integration Strategies

- 3.14.2 Aftermarket Service & Replacement Models

- 3.14.3 Remanufacturing & Circular Economy Trends

- 3.14.4 Channel Conflict & Partnership Management

- 3.15 Equipment Automation & Connectivity Integration

- 3.15.1 Autonomous Equipment Transmission Requirements

- 3.15.2 IoT & Telematics Integration

- 3.15.3 Predictive Maintenance & Diagnostics

- 3.15.4 Remote Monitoring & Control Systems

- 3.16 Manufacturing & Production Challenges

- 3.16.1 Regional Manufacturing Strategies

- 3.16.2 Production Capacity & Scalability

- 3.16.3 Quality Control & Testing Standards

- 3.16.4 Lean Manufacturing & Process Optimization

- 3.17 Equipment Lifecycle & Service Considerations

- 3.17.1 Component Durability & Reliability Requirements

- 3.17.2 Service Interval Optimization

- 3.17.3 Field Service & Support Strategies

- 3.17.4 End-of-Life Component Management

- 3.18 Equipment Electrification & Technology Transition

- 3.18.1 Electric Transmission Technology Adoption

- 3.18.2 Hybrid Powertrain Integration Challenges

- 3.18.3 Battery Technology & Power Management

- 3.18.4 Traditional vs Electric System Comparison

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Gears & Gear Systems

- 5.3 Clutches & Brakes

- 5.4 Torque Converters

- 5.5 Hydraulic Components

- 5.6 Control Systems

- 5.7 Power Transfer Components

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 ICE

- 6.3 Electric

- 6.3.1 Battery electric vehicles (BEVs)

- 6.3.2 Hybrid electric vehicles (HEVs)

- 6.3.3 Plug-in hybrid electric vehicles (PHEVs)

- 6.4 Hybrid

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Construction Equipment

- 7.2.1 Excavators & Backhoes

- 7.2.2 Bulldozers & Scrapers

- 7.2.3 Wheel Loaders & Skid Steers

- 7.2.4 Motor Graders & Compactors

- 7.3 Agricultural Machinery

- 7.3.1 Tractors & Utility Vehicles

- 7.3.2 Combines & Harvesters

- 7.3.3 Sprayers & Applicators

- 7.3.4 Tillage & Planting Equipment

- 7.4 Mining Equipment

- 7.4.1 Haul Trucks & Dump Trucks

- 7.4.2 Draglines & Shovels

- 7.4.3 Underground Equipment

- 7.4.4 Crushing & Processing Equipment

- 7.5 Forestry Equipment

- 7.5.1 Harvesters & Processors

- 7.5.2 Forwarders & Skidders

- 7.5.3 Feller Bunchers

- 7.5.4 Log Loaders & Delimbers

- 7.6 Material Handling Equipment

- 7.6.1 Forklifts & Telehandlers

- 7.6.2 Rough Terrain Cranes

- 7.6.3 Aerial Work Platforms

- 7.6.4 Container Handlers

Chapter 8 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Mechanical Transmission Systems

- 8.3 Hydrostatic & Hydro-mechanical Systems

- 8.4 Hybrid & Electrified Powertrains

- 8.5 Control & Actuation Technologies

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.3.8 Poland

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Vietnam

- 10.4.7 Singapore

- 10.4.8 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1.1 Global Leaders

- 11.1.1.1 ZF Friedrichshafen

- 11.1.1.2 Allison Transmission

- 11.1.1.3 Eaton

- 11.1.1.4 Bosch Rexroth

- 11.1.1.5 Parker Hannifin

- 11.1.1.6 Caterpillar

- 11.1.1.7 John Deere

- 11.1.1.8 CNH Industrial

- 11.1.1.9 BorgWarner

- 11.1.2 Regional Champions

- 11.1.2.1 Komatsu

- 11.1.2.2 Volvo

- 11.1.2.3 Liebherr

- 11.1.2.4 Doosan

- 11.1.2.5 Hitachi

- 11.1.2.6 SANY

- 11.1.2.7 XCMG

- 11.1.2.8 JCB

- 11.1.3 Emerging Players

- 11.1.3.1 Carraro

- 11.1.3.2 Twin Disc

- 11.1.3.3 Bondioli & Pavesi

- 11.1.3.4 Hydro-Gear

- 11.1.3.5 Poclain

- 11.1.3.6 Brevini

- 11.1.3.7 Rexnord