PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858820

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858820

Microgrid Controller Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

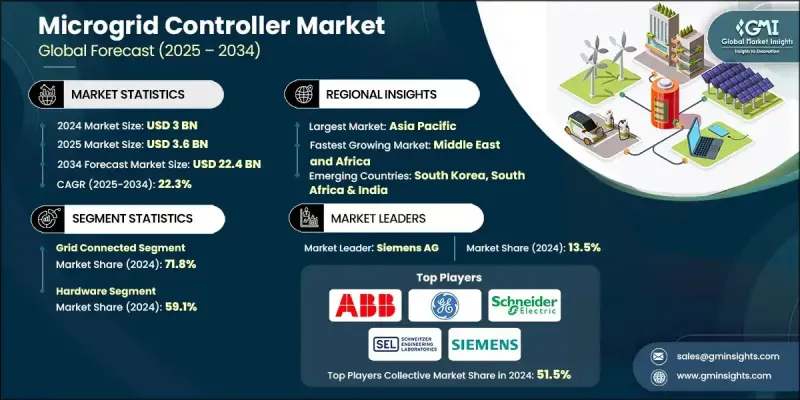

The Global Microgrid Controller Market was valued at USD 3 billion in 2024 and is estimated to grow at a CAGR of 22.3% to reach USD 22.4 billion by 2034.

The market is gaining momentum as the shift toward integrating renewables intensifies, particularly solar and wind, which are known for their intermittency. Microgrid controllers play a vital role in managing these fluctuating resources by optimizing energy flow, maintaining supply-demand equilibrium, and ensuring system stability. Their ability to enable real-time switching between various sources, energy storage units, and loads is making them increasingly critical for reliable and autonomous microgrid operations. As the global agenda shifts toward carbon reduction, microgrids are emerging as a flexible, localized solution to maximize renewable energy use, and controllers are key to unlocking this potential. These smart systems allow real-time forecasting, adjust power operations dynamically, and boost energy efficiency making them indispensable for supporting sustainability targets. As intelligent devices that manage, coordinate, and monitor energy usage, microgrid controllers are rapidly becoming foundational in future-ready energy infrastructure, especially for areas needing resilient, decentralized power systems capable of withstanding outages and disruptions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3 Billion |

| Forecast Value | $22.4 Billion |

| CAGR | 22.3% |

In 2024, the grid-connected segment held 71.8% share, and is expected to grow at a CAGR of 21.9% through 2034. Demand for these controllers continues to rise as they help distributed energy resources operate efficiently, reduce peak power consumption, and allow energy exports back to the main grid. They also support active participation in demand response initiatives and streamline regulatory compliance. With utilities around the world working to modernize energy infrastructure, microgrid controllers are seeing stronger uptake thanks to their compatibility with smart grid systems that improve energy distribution reliability and flexibility.

The hardware segment held 59.1% share in 2024 and is expected to grow at a 21.9% CAGR through 2034. As microgrids become more complex, the need for durable, high-performance control hardware rises. These components include communication devices, power electronics, sensors, and processors essential for real-time monitoring and fast-switching functionality. The expansion of renewable installations and battery systems has further fueled the need for sophisticated hardware that can manage variable loads and help maintain system stability, particularly when switching between grid-connected and islanded operating modes.

United States Microgrid Controller Market held an 81.5% share in 2024 and is projected to generate USD 1.6 billion by 2034. This dominance is supported by national and regional incentives offering financial support for microgrid development, which reduces capital burdens and speeds up deployment. At the same time, the growing vulnerability of centralized energy networks to climate-driven disruptions is accelerating the shift toward decentralized solutions. Microgrid controllers have become critical in these setups, ensuring uninterrupted power by enabling seamless islanding, fault detection, and intelligent load management.

Key companies driving innovation and competition in the Global Microgrid Controller Market include Power Analytics Corporation, Caterpillar Inn, Heila Technologies, Pxise Energy Solutions, AutoGrid Systems Inc, General Electric (GE), Honeywell International Inc, Tesla Energy, Eaton Corporation, Siemens AG, Enchanted Rock, Encorp Inc., ABB Ltd, Schneider Electric, HOMER Energy, Cummins Inc, S&C Electric Company, Schweitzer Engineering Laboratories, Hitachi Energy Ltd, and Emerson Electric Co. Leading players in the Global Microgrid Controller Market are expanding their presence through a mix of R&D investment, technology innovation, and strategic partnerships. Companies are developing advanced AI-powered control algorithms to enhance real-time performance, predictive analytics, and adaptive load balancing. Focus is shifting toward modular, plug-and-play hardware systems that integrate easily with existing infrastructure. Many are entering partnerships with utilities, government bodies, and private energy providers to accelerate microgrid deployments. Cloud-based platforms and edge computing solutions are also being adopted to enable remote monitoring and scalable control capabilities.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Connectivity trends

- 2.4 Offering trends

- 2.5 End use trends

- 2.6 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Manufacturing capacity assessment

- 3.1.3 Supply chain resilience & risk factors

- 3.1.4 Distribution network analysis

- 3.2 Cost structure analysis

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

- 3.7.1 Political factors

- 3.7.2 Economic factors

- 3.7.3 Social factors

- 3.7.4 Technological factors

- 3.7.5 Legal factors

- 3.7.6 Environmental factors

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Company benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Connectivity, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Grid connected

- 5.3 Off grid

Chapter 6 Market Size and Forecast, By Offering, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Hardware

- 6.3 Software & service

Chapter 7 Market Size and Forecast, By End Use, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 Healthcare

- 7.3 Educational institutes

- 7.4 Military

- 7.5 Utility

- 7.6 Industrial/ commercial

- 7.7 Remote

- 7.8 Others

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 France

- 8.3.3 UK

- 8.3.4 Russia

- 8.3.5 Spain

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 ABB Ltd

- 9.2 AutoGrid Systems Inc

- 9.3 Caterpillar Inn

- 9.4 Cummins Inc

- 9.5 Eaton Corporation

- 9.6 Emerson Electric Co.

- 9.7 Enchanted Rock

- 9.8 Encorp Inc.

- 9.9 General Electric (GE)

- 9.10 Heila Technologies

- 9.11 Hitachi Energy Ltd

- 9.12 HOMER Energy

- 9.13 Honeywell International Inc

- 9.14 Power Analytics Corporation

- 9.15 Pxise Energy Solutions

- 9.16 S&C Electric Company

- 9.17 Schneider Electric

- 9.18 Schweitzer Engineering Laboratories

- 9.19 Siemens AG

- 9.20 Tesla Energy