PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858831

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858831

Personalized Nutrition AI Platforms Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

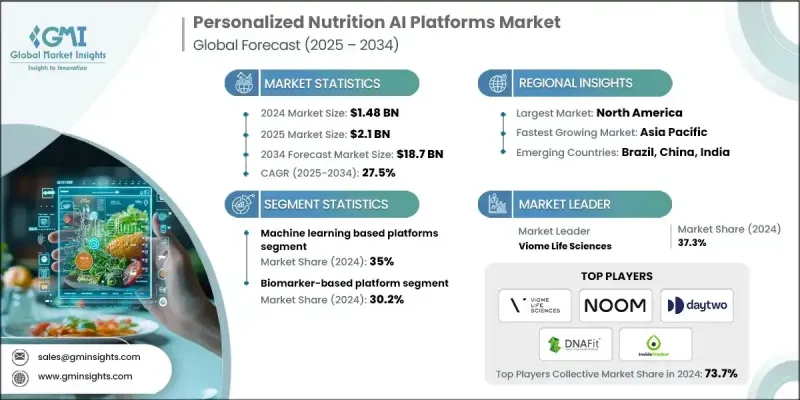

The Global Personalized Nutrition AI Platforms Market was valued at USD 1.48 billion in 2024 and is estimated to grow at a CAGR of 27.5% to reach USD 18.7 billion by 2034.

Market growth is fueled by increasing consumer demand for personalized health and wellness solutions that move beyond the conventional one-size-fits-all model. As people grow more health-conscious and seek preventive care, AI-powered platforms offering nutrition guidance tailored to each user's biological profile, lifestyle, and health goals are seeing a rapid rise in popularity. Consumers now prefer hyper-personalized meal planning and supplement services that factor in allergies, dietary goals, and medical history. The growing interest in performance optimization and fitness-focused diets among active individuals further contributes to market momentum. These platforms are increasingly integrated with complex biological data like genomics, proteomics, and microbiome analysis to deliver nutrition advice that's aligned with each individual's unique physiological traits. By harnessing this data, personalized AI-driven platforms offer a high degree of accuracy in recommendations, making them a trusted tool for both everyday users and health professionals. The convenience, precision, and real-time adaptability of these tools are helping reshape the way consumers approach their nutrition strategies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.48 Billion |

| Forecast Value | $18.7 Billion |

| CAGR | 27.5% |

The machine learning-based platforms segment held a 35% share in 2024. These platforms thrive on structured datasets such as wearable device outputs, medical test results, and food diaries. As datasets expand and become more accurately labeled, machine learning algorithms continue to evolve, offering increasingly precise, actionable nutrition advice. Enhanced learning models are driving innovation across digital nutrition ecosystems, enabling users to receive insights that improve over time and adapt to changes in behavior, environment, or health.

The biomarker-based segment accounted for a 30.2% share in 2024 and is forecast to grow at a CAGR of 27.5% through 2034. These platforms specialize in converting blood work and clinical marker data into individualized recommendations aimed at improving areas such as cardiovascular and metabolic health. Their ability to track how a user responds to interventions through measurable health data has earned trust from both medical professionals and end users, further solidifying their role in the healthcare and wellness landscape.

United States Personalized Nutrition AI Platforms Market generated USD 513.8 million in 2024, leading the North American region. Growth here is driven by a well-established healthcare ecosystem, increasing digital health investments, and strong market acceptance of AI-based nutrition platforms. Regulatory support for digital health tools like software as a medical device (SaMD) and clinical decision support (CDS) systems, along with the widespread use of sensor-based wearables and continuous glucose monitoring devices, is expanding the potential of personalized coaching in real time.

Key players dominating the Global Personalized Nutrition AI Platforms Market include Viome Life Sciences, Baze, Noom Inc., ZOE Limited, Nutrigenomix Inc., Rootine, DNAfit (Prenetics), InsideTracker, DayTwo Ltd., and Season Health. To solidify their position, companies are focusing on data-rich personalization engines powered by AI and machine learning. Firms are forming partnerships with genomic and diagnostic labs to enhance multi-omic integration and develop proprietary recommendation algorithms. These platforms also prioritize seamless user experience through mobile-first interfaces and connected wearables. Companies are investing heavily in regulatory compliance and clinical validations to gain credibility with both consumers and healthcare providers. Additionally, many brands are targeting niche consumer segments such as athletes, diabetics, and aging populations to tailor offerings for specific needs. Subscription-based service models are being adopted to ensure customer retention and sustained revenue streams. Some are even integrating telehealth and nutrition coaching features, creating end-to-end personalized health ecosystems.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology type

- 2.2.3 Data input type

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of chronic diseases

- 3.2.1.2 Rising demand for personalized health and wellness solutions

- 3.2.1.3 Advancements in AI and machine learning

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Regulatory complexity & compliance costs

- 3.2.2.2 Data privacy & security concerns

- 3.2.3 Market opportunities

- 3.2.3.1 Growing consumer demand for tailored health solutions

- 3.2.3.2 Integration with wearables and health devices

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation Landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By technology type

- 3.8 Future market trends

- 3.9 Patent Landscape

- 3.10 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.10.1 Major importing countries

- 3.10.2 Major exporting countries

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.12 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Technology Type, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Machine learning-based platforms

- 5.3 Multi-omics AI systems

- 5.4 Predictive analytics platforms

- 5.5 Large language model-based systems

Chapter 6 Market Estimates and Forecast, By Data Input Type, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Biomarker-based platforms

- 6.3 Microbiome analysis systems

- 6.4 Wearable device integration

- 6.5 Self-reported data platforms

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Rest of Europe

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.4.6 Rest of Asia Pacific

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Rest of Latin America

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

- 7.6.4 Rest of Middle East and Africa

Chapter 8 Company Profiles

- 8.1 Baze

- 8.2 DayTwo Ltd.

- 8.3 DNAfit (Prenetics)

- 8.4 InsideTracker

- 8.5 Noom Inc.

- 8.6 Nutrigenomix Inc.

- 8.7 Rootine

- 8.8 Season Health

- 8.9 Viome Life Sciences