PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858838

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858838

Gallium Nitride (GaN) Power Chips for EVs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

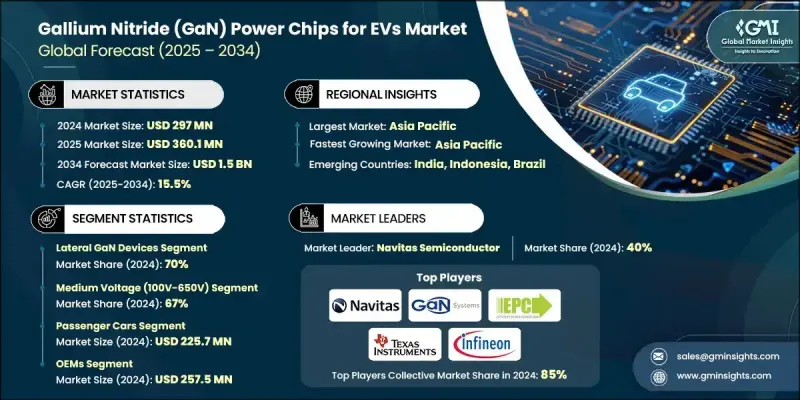

The Global Gallium Nitride (GaN) Power Chips for EVs Market was valued at USD 297 million in 2024 and is estimated to grow at a CAGR of 15.5% to reach USD 1.5 billion by 2034.

The robust expansion aligns with automakers increasingly integrating high-frequency, high-density conversion architectures at scale. As EV adoption grows alongside expanding charging infrastructure, the overall demand for efficient power electronics in both vehicles and supporting systems is accelerating. In 2024, global EV sales reached 17 million and accounted for over 20% of all new car sales. The global EV fleet has grown to nearly 58 million, fueling consistent demand for more efficient power conversion solutions. GaN-based onboard chargers are gaining traction due to their significant advantages in efficiency and size reduction. They enable increased power density and lower weight, improving EV range and system integration. Recent advancements in GaN technology also support high-density, bidirectional operations, a key feature for future vehicle-to-grid applications. The transition from discrete components to integrated GaN modules combining drivers, switches, and protection circuits has further enhanced system performance, reduced electromagnetic interference, and improved thermal management. Public-private efforts have been instrumental in accelerating the commercialization of these wide-bandgap solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $297 Million |

| Forecast Value | $1.5 Billion |

| CAGR | 15.5% |

In 2024, the lateral GaN devices segment held a 70% share and is projected to grow at a CAGR of 16.1% through 2034. These devices have become the backbone of EV power electronics due to their suitability for onboard chargers, auxiliary systems, and DC-DC converters operating up to 650 V. Their high electron mobility and elevated breakdown field strength, enabled by AlGaN/GaN HEMT architecture on silicon, allow for significantly lower on-resistance at higher voltages when compared to traditional silicon-based components.

The medium-voltage GaN devices, ranging from 100 V to 650 V, held a 67% share in 2024 and are forecasted to grow at a CAGR of 16% between 2025 and 2034. This voltage class covers many EV applications, including onboard chargers and DC-DC converters in both current 400 V battery platforms and future 800 V architectures. Within this range, GaN devices deliver superior switching speeds and efficiency, enabling compact and lightweight power conversion systems critical for high-density EV applications.

China Gallium Nitride (GaN) Power Chips for EVs Market generated USD 73.4 million in 2024. As the largest EV market globally, China accounted for roughly two-thirds of global EV sales, delivering over 8 million units in 2023 alone. This massive scale has created a vast addressable market for GaN components, as every vehicle and charging site requires high-performance power electronics. Additionally, strong government support for NEVs, domestic semiconductor development, and widespread deployment of EV infrastructure continue to solidify China's leadership over other regional players such as India, South Korea, and Japan.

Key companies actively shaping the Gallium Nitride (GaN) Power Chips for EVs Market include Transphorm, GaN Systems, Infineon Technologies, ROHM Semiconductor, Navitas, EPC, Power Integrations, Innoscience, STMicroelectronics, and Texas Instruments. To enhance their positioning, leading companies in the GaN power chip sector are heavily investing in R&D to develop high-performance, automotive-qualified GaN solutions that support higher power densities and better thermal efficiency. Many players are shifting from discrete products to integrated solutions such as co-packaged half-bridge modules combining drivers, switches, and protection features to simplify design, minimize EMI, and improve reliability. Strategic partnerships with automakers and Tier 1 suppliers are also being pursued to accelerate design wins in EV platforms.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Device architecture

- 2.2.3 Voltage

- 2.2.4 Application

- 2.2.5 Propulsion

- 2.2.6 Package

- 2.2.7 Vehicle

- 2.2.8 Sales Channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material

- 3.1.1.2 Epitaxy & wafer fabrication

- 3.1.1.3 Manufacturers

- 3.1.1.4 Module & system integrators

- 3.1.1.5 OEMs

- 3.1.1.6 Charging infrastructure & energy operators

- 3.1.2 Cost structure

- 3.1.3 Profit margin

- 3.1.4 Value addition at each stage

- 3.1.5 Factors impacting the supply chain

- 3.1.6 Disruptors

- 3.1.1 Supplier landscape

- 3.2 Impact on forces

- 3.2.1 Growth drivers

- 3.2.1.1 Government EV adoption mandates and policy support

- 3.2.1.2 Rising demand for high-efficiency power electronics

- 3.2.1.3 Automotive industry push for lightweight and compact solutions

- 3.2.1.4 Growth in fast-charging infrastructure development

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial device and manufacturing costs

- 3.2.2.2 Limited availability of high-voltage GaN devices

- 3.2.2.3 Automotive qualification and reliability challenges

- 3.2.3 Market opportunities

- 3.2.3.1 Emerging 48V mild hybrid vehicle segment

- 3.2.3.2 Megawatt charging infrastructure development

- 3.2.3.3 Vertical GaN technology commercialization

- 3.2.3.4 Regional manufacturing localization initiatives

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology trends & innovation ecosystem

- 3.7.1 Current technologies

- 3.7.1.1 Enhancement-mode vs depletion-mode architectures

- 3.7.1.2 Silicon vs SiC vs native GaN substrates

- 3.7.1.3 Gate drive technology and integration

- 3.7.1.4 Thermal management solutions

- 3.7.2 Emerging technologies

- 3.7.2.1 Vertical GaN device development

- 3.7.2.2 GaN-on-diamond cooling technology

- 3.7.2.3 Monolithic integration and system-in-package

- 3.7.2.4 AI-driven device optimization

- 3.7.1 Current technologies

- 3.8 Price trend analysis

- 3.8.1 By region

- 3.8.2 By Products

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Best case scenario

- 3.14 Packaging Innovation & Advanced Technologies

- 3.14.1 Current Packaging Technologies

- 3.14.2 Advanced Packaging Innovations

- 3.14.3 Thermal Management Innovations

- 3.14.4 Interconnect Technologies

- 3.15 GaN vs SiC Competitive Analysis

- 3.15.1 Comparison Matrix

- 3.15.2 Total Cost of Ownership (TCO)

- 3.16 OEM Adoption Roadmap & Strategy

- 3.17 Design-In Process & Qualification

- 3.18 Gate Driver Technology & Integration

- 3.19 Fast-Charging Infrastructure Impact

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Device Architecture, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Lateral GaN devices

- 5.3 Vertical GaN devices

Chapter 6 Market Estimates & Forecast, By Voltage, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Low voltage (≤100V)

- 6.3 Medium voltage (100V-650V)

- 6.4 High voltage (>650V)

Chapter 7 Market Estimates & Forecast, By Package, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Discrete packages

- 7.3 Power modules

- 7.4 Integrated power stages

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Traction inverters

- 8.3 On-board chargers (OBC)

- 8.4 DC-DC converters

- 8.5 Charging infrastructure

- 8.6 Auxiliary power systems

Chapter 9 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Battery electric vehicles (BEV)

- 9.3 Plug-in hybrid electric vehicles (PHEV)

- 9.4 Mild hybrid electric vehicles (MHEV)

- 9.5 Fuel cell electric vehicles (FCEV)

Chapter 10 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 Passenger cars

- 10.2.1 Hatchback

- 10.2.2 Sedan

- 10.2.3 SUV

- 10.3 Commercial vehicles

- 10.3.1 LCV

- 10.3.2 MCV

- 10.3.3 HCV

- 10.4 Two & three wheelers

Chapter 11 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 11.1 Key trends

- 11.2 OEM

- 11.3 Aftermarket

Chapter 12 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 US

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.3.6 Russia

- 12.3.7 Nordics

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.4.6 Philippines

- 12.4.7 Indonesia

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 MEA

- 12.6.1 South Africa

- 12.6.2 Saudi Arabia

- 12.6.3 UAE

Chapter 13 Company Profiles

- 13.1 Global Leaders

- 13.1.1 EPC

- 13.1.2 Transphorm

- 13.1.3 GaN Systems

- 13.1.4 Navitas

- 13.1.5 Infineon Technologies

- 13.1.6 STMicroelectronics

- 13.1.7 Rohm

- 13.1.8 Texas Instruments

- 13.1.9 Nexperia

- 13.1.10 Vishay

- 13.2 Regional Champions

- 13.2.1 Innoscience

- 13.2.2 NexGen Power Systems

- 13.2.3 Cambridge GaN Devices

- 13.2.4 Fuji Electric

- 13.2.5 Littelfuse

- 13.2.6 Toshiba

- 13.2.7 Renesas

- 13.2.8 Semikron

- 13.3 Emerging Players

- 13.3.1 VisIC Technologies

- 13.3.2 Qorvo

- 13.3.3 Macom

- 13.3.4 Integra Technologies

- 13.3.5 Akash Systems

- 13.3.6 Kyma Technologies

- 13.3.7 Power Integrations

- 13.3.8 Panasonic

- 13.3.9 SweGaN

- 13.3.10 GeneSiC

- 13.3.11 Fujitsu