PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858843

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858843

Metal-Organic Frameworks (MOFs) for Gas Separation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

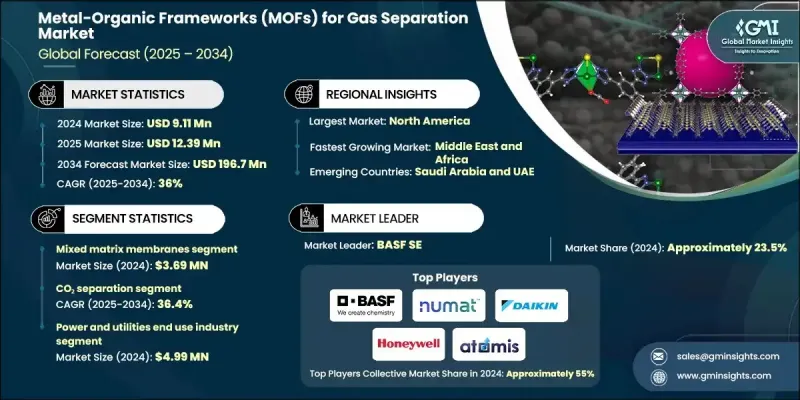

The Global Metal-Organic Frameworks (MOFs) for Gas Separation Market was valued at USD 9.11 million in 2024 and is estimated to grow at a CAGR of 36% to reach USD 196.70 million by 2034.

The rapid market expansion is fueled by the growing demand for low-energy gas separation alternatives. Traditional techniques such as cryogenic distillation and pressure swing adsorption are energy-intensive, pushing industries to shift toward MOF-based systems due to their superior efficiency and selectivity. These materials provide an innovative solution by offering high surface area and tunable pore structures, which allow for effective gas separation at significantly reduced energy requirements. Additionally, the global push toward carbon reduction and environmental sustainability is accelerating investments in carbon capture, utilization, and storage technologies. MOFs are proving especially valuable in this domain due to their performance in selective CO2 capture. Technological advancements in scalable production techniques, such as solvothermal, mechanochemical, and microwave-assisted synthesis, are further lowering fabrication costs while enhancing production volumes. The development of durable and recyclable MOFs is also helping bridge the gap between lab-scale innovation and real-world industrial deployment, contributing to the overall market's upward trajectory.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.11 Million |

| Forecast Value | $196.70 Million |

| CAGR | 36% |

The CO2 separation segment reached USD 4.41 million in 2024 and is forecast to grow at a CAGR of 36.4% from 2025 to 2034. This application leads the market due to its strong role in global decarbonization efforts. The inherent porosity and selectivity of MOFs make them ideal for CO2 adsorption in natural gas and flue gas environments, encouraging more widespread adoption in emission-intensive sectors. As the urgency to limit industrial carbon output intensifies, the deployment of MOF-based capture systems is seeing greater momentum across energy and heavy manufacturing segments.

The power and utilities sector was valued at USD 4.99 million in 2024. The segment's dominance is supported by rising installations of MOF-integrated carbon capture systems across power generation facilities. The ability of MOFs to deliver high regeneration efficiency and selectivity makes them suitable for post-combustion capture applications, especially in emissions-heavy energy infrastructure.

North America Metal-Organic Frameworks (MOFs) for Gas Separation Market held 39.8% share in 2024. The region's growth is driven by substantial investments in clean energy initiatives and carbon reduction strategies. Sectors such as petrochemicals and electricity generation are deploying MOF-based gas separation units to improve energy efficiency and meet tightening environmental regulations. Continuous progress in MOF membrane development and synthesis technologies, backed by active R&D, is further elevating adoption across the region.

Key players active in the Global Metal-Organic Frameworks (MOFs) for Gas Separation Market include Numat Technologies, Atomis Inc., Honeywell International, BASF SE, Daikin Industries, and others. Leading companies in the Metal-Organic Frameworks (MOFs) for Gas Separation Market are prioritizing innovation, scalability, and strategic collaboration to strengthen their market positions. They are investing significantly in R&D to develop highly stable and recyclable MOFs with enhanced separation efficiency and lower regeneration costs. Many firms are focusing on optimizing synthesis techniques such as microwave-assisted or mechanochemical processes to reduce production expenses and improve material consistency.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology

- 2.2.3 Application

- 2.2.4 End use Industry

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Supply chain complexity

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Technology, 2021- 2034 (USD Million, Kilo Tons)

- 5.1 Key trends

- 5.2 Packed bed adsorbents

- 5.2.1 Pressure swing adsorption applications

- 5.2.2 Temperature swing adsorption systems

- 5.2.3 Vacuum swing adsorption implementations

- 5.3 Pure MOF membranes

- 5.4 Mixed matrix membranes

- 5.5 Structured adsorbents

- 5.5.1 Monolith and honeycomb coating technologies

- 5.5.2 Heat and mass transfer optimization

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million, , Kilo Tons)

- 6.1 Key trends

- 6.2 CO? separation

- 6.2.1 Post-combustion capture applications

- 6.2.2 Pre-combustion and industrial process integration

- 6.2.3 Direct air capture technology integration

- 6.3 Hydrocarbon separation

- 6.3.1 Natural gas sweetening and processing

- 6.3.2 Olefin/paraffin separation technologies

- 6.3.3 C2/C3 recovery and purification systems

- 6.4 Light gas separation

- 6.4.1 Hydrogen purification and recovery

- 6.4.2 Oxygen/nitrogen separation technologies

- 6.4.3 Noble gas recovery and recycling

- 6.5 Specialty gas separation

- 6.5.1 Toxic gas capture and neutralization

- 6.5.2 Refrigerant recovery and recycling systems

- 6.5.3 Trace contaminant removal technologies

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Million, , Kilo Tons)

- 7.1 Key trends

- 7.2 Power and utilities sector

- 7.2.1 Coal-fired power plant retrofit applications

- 7.2.2 Natural gas combined cycle integration

- 7.2.3 Grid-scale energy storage applications

- 7.2.4 Utility-scale direct air capture projects

- 7.3 Oil, gas and petrochemicals sector

- 7.3.1 Refinery gas processing applications

- 7.3.2 Natural gas treatment and sweetening

- 7.3.3 Petrochemical process integration

- 7.4 Manufacturing industries sector

- 7.4.1 Cement industry CO2 capture applications

- 7.4.2 Steel and aluminum process integration

- 7.4.3 Ammonia and hydrogen production purification

- 7.4.4 Chemical manufacturing process optimization

- 7.5 Electronics and specialty applications sector

- 7.5.1 Semiconductor toxic gas handling

- 7.5.2 Pharmaceutical process applications

- 7.5.3 Research and laboratory systems

- 7.5.4 Specialty chemical production

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million, Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East & Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East & Africa

Chapter 9 Company Profiles

- 9.1 BASF SE

- 9.2 Numat Technologies

- 9.3 Daikin Industries

- 9.4 Honeywell International

- 9.5 Atomis Inc

- 9.6 Air Liquide

- 9.7 novoMOF AG

- 9.8 Nuada (formerly MOF Technologies Ltd)

- 9.9 Framergy Inc

- 9.10 ProfMOF

- 9.11 MOF Apps

- 9.12 Immaterial Labs

- 9.13 Mosaic Materials

- 9.14 promethean particles

- 9.15 MOFgen