PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858844

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858844

RNA Interference Therapeutics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

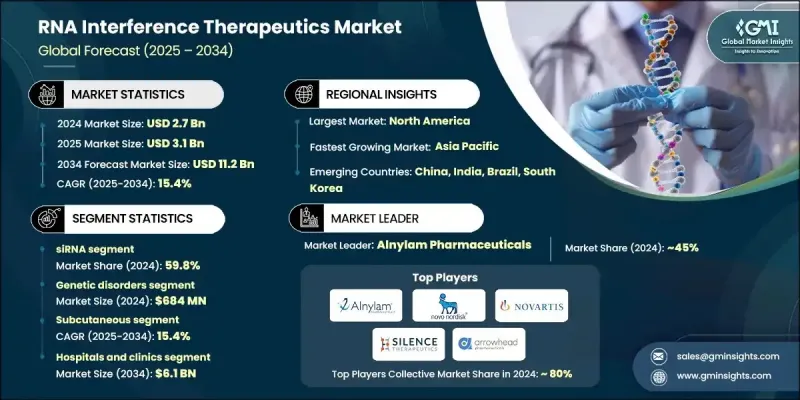

The Global RNA Interference Therapeutics Market was valued at USD 2.7 billion in 2024 and is estimated to grow at a CAGR of 15.4% to reach USD 11.2 billion by 2034.

The growing importance of RNAi-based therapies stems from a surge in genetic research, the rising burden of chronic diseases, and increasing diagnoses of rare genetic disorders. These therapies work by silencing disease-related genes, offering a precise and targeted approach to treatment. Technological innovations, particularly in delivery methods like lipid nanoparticles and conjugate systems, have significantly enhanced the safety and effectiveness of RNAi therapies. This has widened the scope for clinical application and encouraged collaborations within the biopharmaceutical industry. The expansion of RNAi into therapeutic areas previously difficult to reach, especially beyond the liver, marks a pivotal shift in its clinical utility. Personalized medicine, advancements in gene editing, and growing international momentum for gene therapies are key contributors to the market's momentum. Favorable regulatory conditions, especially those geared toward orphan drug development, offer accelerated pathways and longer exclusivity, making the RNAi space more attractive for pharmaceutical investments. The market continues to evolve with strong backing from both public and private sectors, supporting the transition of RNAi from niche science to mainstream therapy.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.7 Billion |

| Forecast Value | $11.2 Billion |

| CAGR | 15.4% |

The small interfering RNA (siRNA) segment held a 59.8% share in 2024 and is projected to reach USD 6.8 billion by 2034, driven by a CAGR of 15.5%. siRNA therapies are at the forefront of RNAi advancements due to their gene-silencing precision and lower off-target risks. The development of more sophisticated delivery technologies and a deeper understanding of gene expression patterns has enabled expansion into new therapeutic targets outside the liver. The ability of siRNA to modulate gene expression in cardiovascular, metabolic, and rare inherited disorders is contributing significantly to its rapid growth. This segment remains the most clinically mature and scientifically validated within the broader RNAi market.

The genetic disorders segment generated USD 684 million in 2024. This dominance is attributed to the precision of siRNA therapies in targeting genes responsible for various inherited conditions. These therapies hold strong potential for addressing diseases that previously lacked effective treatment options. The proven efficacy of siRNA-based solutions in treating rare and genetically rooted conditions supports continued clinical expansion and commercial interest in this application area.

North America RNA Interference Therapeutics Market held a 45.7% share in 2024. This leadership is primarily driven by a combination of advanced healthcare infrastructure, a highly developed research ecosystem, and early adoption of innovative treatments. Significant funding from major institutions like the National Institutes of Health, along with active participation from major pharmaceutical players and CDMOs, has accelerated drug development in the region. The growing demand for precision-based therapeutics and rising rates of genetic diseases further support regional dominance in this space.

Key companies contributing to the Global RNA Interference Therapeutics Market include Silence Therapeutics, Sirnaomics, Arrowhead Pharmaceuticals, Alnylam Pharmaceuticals, Novartis, Creative Biogene, Arbutus Biopharma, OliX Pharmaceuticals, Benitec Biopharma, Sanofi, Novo Nordisk, and Atalanta Therapeutics. To establish a stronger presence in the RNAi therapeutics market, leading firms are focusing heavily on strategic partnerships, technology sharing, and R&D investments. Collaborations between biotech innovators and large pharmaceutical firms enable rapid drug development, access to advanced delivery systems, and broader market reach. Companies are also prioritizing pipeline diversification to include therapies targeting both common and rare diseases. By securing orphan drug status and fast-track regulatory designations, firms gain competitive advantages such as extended exclusivity and reduced time-to-market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product type trends

- 2.2.3 Application trends

- 2.2.4 Route of administration trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of genetic disorders

- 3.2.1.2 Advancements in RNA delivery technologies

- 3.2.1.3 Rising investment in RNAi-based research

- 3.2.1.4 Approval of RNAi therapeutics for chronic and rare diseases

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Challenges in effective delivery of RNAi molecules

- 3.2.2.2 High cost of RNAi therapeutics development

- 3.2.3 Market opportunities

- 3.2.3.1 RNAi applications in neurology and neurodegenerative diseases

- 3.2.3.2 Personalized RNAi therapies for genetic diseases

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.1 North America

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Pipeline analysis

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Small interfering RNA (siRNA)

- 5.3 MicroRNA (miRNA)

- 5.4 Short hairpin RNA (shRNA)

- 5.5 Other product types

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Cancer

- 6.3 Genetic disorders

- 6.4 Cardiovascular diseases

- 6.5 Viral infections

- 6.6 Neurodegenerative diseases

- 6.7 Ophthalmic disorders

- 6.8 Respiratory disorders

- 6.9 Other applications

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Intravenous (IV)

- 7.3 Subcutaneous (SC)

- 7.4 Other route of administration

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals and clinics

- 8.3 Research laboratories

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Alnylam Pharmaceuticals

- 10.2 Arbutus Biopharma

- 10.3 Arrowhead Pharmaceuticals

- 10.4 Atalanta Therapeutics

- 10.5 Benitec Biopharma

- 10.6 Creative Biogene

- 10.7 Novartis

- 10.8 Novo Nordisk

- 10.9 OliX Pharmaceuticals

- 10.10 Sanofi

- 10.11 Silence Therapeutics

- 10.12 Sirnaomics