PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858854

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858854

Vehicle-Integrated Solar Cell Semiconductors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

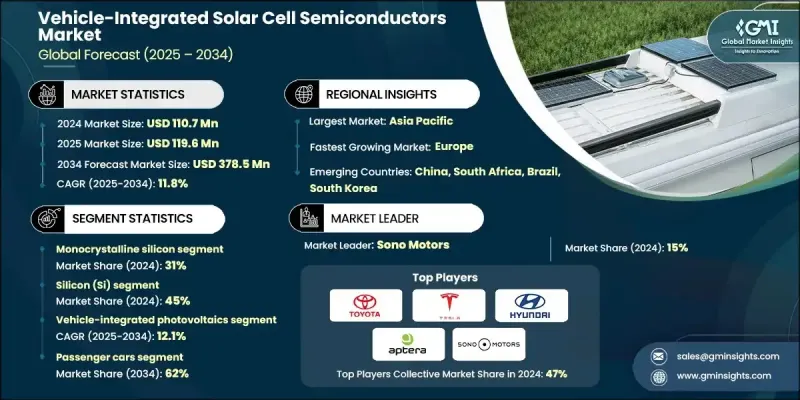

The Global Vehicle-Integrated Solar Cell Semiconductors Market was valued at USD 110.7 million in 2024 and is estimated to grow at a CAGR of 11.8% to reach USD 378.5 million by 2034.

Market growth is fueled by the acceleration of electric vehicle adoption, ongoing advances in semiconductor technology, and increasing demand for energy-efficient and secure power solutions. This momentum is largely influenced by the convergence of smart mobility innovations, enhanced vehicle electronics, and shifting competitive dynamics within the automotive semiconductor ecosystem. Post-pandemic emphasis on chip localization and supply chain resilience has also contributed to this growth, particularly across Asia and Europe. These regions are becoming hotspots for advanced semiconductor manufacturing, supported by rising investments in electrified transportation and digital infrastructure.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $110.7 Million |

| Forecast Value | $378.5 Million |

| CAGR | 11.8% |

Global vehicle electrification and the demand for in-vehicle energy efficiency are pushing automakers and Tier-1 suppliers to invest in chip-level integration, where solar cells work seamlessly with smart inverters, zonal controllers, and advanced power management ICs. These components are now being developed to operate directly with photovoltaic modules, enabling greater energy efficiency and more compact system designs. As vehicles evolve into intelligent, connected systems, innovations in semiconductor networking and architecture are becoming crucial in supporting this transformation.

In terms of materials, the silicon segment held a 45% share in 2024 and is forecasted to grow at a 12% CAGR through 2034. Silicon's dominance is backed by its high reliability, mature supply chains, and performance in diverse lighting conditions. At the same time, copper indium gallium selenide (CIGS) is seeing rising adoption due to its flexibility and suitability for curved vehicle surfaces.

The monocrystalline silicon segment accounted for a 31% share in 2024 and is expected to grow at a CAGR of 12.6% during 2025-2034. Its consistent power delivery and durability make it ideal for body-integrated and rooftop solar panels in EVs and hybrid models.

Asia-Pacific Vehicle-Integrated Solar Cell Semiconductors Market held 42.3% share in 2024, driven by strong progress in automotive and electronics manufacturing. Meanwhile, Europe is emerging as the fastest-growing region due to stringent safety regulations, rapid EV integration, and increasing fusion of solar technology with semiconductor logic to create efficient, vehicle-ready energy solutions.

Key players shaping the Global Vehicle-Integrated Solar Cell Semiconductors Market include Tesla, BYD, Aptera, Toyota, Go Ford, Lightyear, PlanetSolar, Hyundai, and Sono Motors. These companies are actively contributing to the evolution of smart, energy-producing vehicles by integrating next-gen semiconductors with solar technologies. Leading companies in the Vehicle-Integrated Solar Cell Semiconductors Market are leveraging a mix of innovation, collaboration, and vertical integration to expand their market presence. Many are investing heavily in R&D to develop semiconductors that enable high-efficiency energy conversion and seamless integration with solar cells. Strategic partnerships with automakers and Tier-1 suppliers are facilitating the co-development of energy management systems that optimize solar energy usage in EVs.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Semiconductor

- 2.2.3 Material Type

- 2.2.4 Integration Type

- 2.2.5 Vehicle

- 2.2.6 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1.1 Growth drivers

- 3.2.1.2 Rising adoption of electric and hybrid vehicles

- 3.2.1.3 Advancements in solar semiconductor efficiency

- 3.2.1.4 Government incentives for green mobility and energy-efficient vehicles

- 3.2.1.5 Shift toward energy-autonomous and smart vehicles

- 3.2.1.6 Growing consumer demand for sustainable and premium vehicle designs

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Durability and reliability under harsh automotive conditions

- 3.2.2.2 High manufacturing and integration costs

- 3.2.3 Market opportunities

- 3.2.3.1 Rising investments in perovskite and tandem semiconductor R&D

- 3.2.3.2 Integration with EV and hybrid platforms for range extension

- 3.2.3.3 Expansion into two- and three-wheeler markets

- 3.2.3.4 Emergence of transparent and glass-integrated PV systems

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 Regional solar integration regulations

- 3.4.2 International standards harmonization

- 3.4.3 Environmental Regulation Impact

- 3.4.4 Import/Export Restrictions

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Patent analysis

- 3.9 Cost breakdown analysis

- 3.10 Sustainability and environmental aspects

- 3.10.1 Sustainable practices

- 3.10.2 Waste reduction strategies

- 3.10.3 Energy efficiency in production

- 3.10.4 Eco-friendly Initiatives

- 3.11 Carbon footprint considerations

- 3.12 Future outlook and roadmap

- 3.12.1 Sustainable energy solutions

- 3.12.2 Cross-industry convergence trends

- 3.12.3 Regulatory evolution and standards development

- 3.12.4 Market consolidation and partnership strategies

- 3.13 Automotive-Grade Solar Semiconductor Supply Chain

- 3.13.1 Automotive qualification requirements

- 3.13.2 Long-term supply assurance strategies

- 3.13.3 Quality management system requirements

- 3.13.4 Supply chain risk mitigation

- 3.13.5 Geopolitical impact on solar supply

- 3.14 Cost-Effectiveness vs Energy Generation Optimization

- 3.1.1 Solar cell cost per watt analysis

- 3.14.2 Installation & integration cost factors

- 3.14.3 Energy payback time calculations

- 3.14.4 Total cost of ownership models

- 3.14.5 Performance vs price trade-off analysis

- 3.15 Automotive Safety Standards & Solar Integration

- 3.15.1 Electrical safety requirements (iso 6469)

- 3.15.2 Fire safety & thermal runaway prevention

- 3.15.3 Crash safety & solar panel behavior

- 3.15.4 High voltage system integration safety

- 3.15.5 Emergency response procedures

- 3.16 Next-Generation Solar Technology Evolution

- 3.16.1 Perovskite solar cell development

- 3.16.2 Organic photovoltaic advancement

- 3.16.3 Transparent solar cell innovation

- 3.16.4 Flexible solar film evolution

- 3.16.5 Multi-junction cell integration

- 3.16.6 Concentrated photovoltaic applications

- 3.17 Energy Management & Vehicle System Integration

- 3.17.1 Solar energy harvesting optimization

- 3.17.2 Battery management system integration

- 3.17.3 Power electronics & conversion efficiency

- 3.17.4 Energy storage strategy optimization

- 3.17.5 Load management & prioritization

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Semiconductor, 2021 - 2034 (USD Mn, Units)

- 5.1 Key trends

- 5.2 Monocrystalline Silicon

- 5.3 Polycrystalline Silicon

- 5.4 Thin-Film

- 5.5 Perovskite Solar Cells

- 5.6 Multi-Junction

- 5.7 Organic Photovoltaics (OPV)

Chapter 6 Market Estimates & Forecast, By Material Type, 2021 - 2034 (USD Mn, Units)

- 6.1 Key trends

- 6.2 Silicon (Si)

- 6.3 Copper Indium Gallium Selenide

- 6.4 Cadmium Telluride (CdTe)

- 6.5 Perovskite compounds

- 6.6 Transparent conductive oxides

- 6.7 Polymer substrates

Chapter 7 Market Estimates & Forecast, By Integration Type, 2021 - 2034 (USD Mn, Units)

- 7.1 Key trends

- 7.2 Vehicle-Integrated Photovoltaics

- 7.3 Vehicle-Applied Photovoltaics

- 7.4 Glass-Integrated PV

- 7.5 Body Panel-Embedded PV

Chapter 8 Market Estimates & Forecast, By Vehicle Type, 2021 - 2034 (USD Mn, Units)

- 8.1 Key trends

- 8.2 Passenger Cars

- 8.3 Commercial Vehicles

- 8.4 Electric Vehicles

- 8.5 Two/Three-Wheelers

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Mn, Units)

- 9.1 Key trends

- 9.2 Traction Power Supplement

- 9.3 Battery Charging

- 9.4 HVAC

- 9.5 Telematics

- 9.6 Energy Harvesting

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.3.8 Portugal

- 10.3.9 Croatia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Singapore

- 10.4.7 Thailand

- 10.4.8 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

- 10.6.4 Turkey

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Toyota

- 11.1.2 Hyundai

- 11.1.3 Lightyear

- 11.1.4 BMW Group

- 11.1.5 Mercedes-Benz

- 11.1.6 Audi AG

- 11.1.7 Nissan Motor

- 11.1.8 BYD Company

- 11.1.9 Tesla

- 11.1.10 Suno

- 11.1.11 Aptera

- 11.1.12 Goford

- 11.2 Regional Players

- 11.2.1 Panasonic

- 11.2.2 Sharp

- 11.2.3 SunPower

- 11.2.4 Hanwha Q CELLS

- 11.2.5 First Solar

- 11.2.6 Canadian Solar

- 11.2.7 JinkoSolar Holding

- 11.2.8 LONGi Solar

- 11.3 Emerging Players

- 11.3.1 Ubiquitous Energy

- 11.3.2 Heliatek

- 11.3.3 Oxford Photovoltaics

- 11.3.4 Saule Technologies

- 11.3.5 Solarmer Energy

- 11.3.6 Armor

- 11.3.7 Infinite Power Solutions