PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858861

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858861

U.S. Real World Evidence Solutions Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

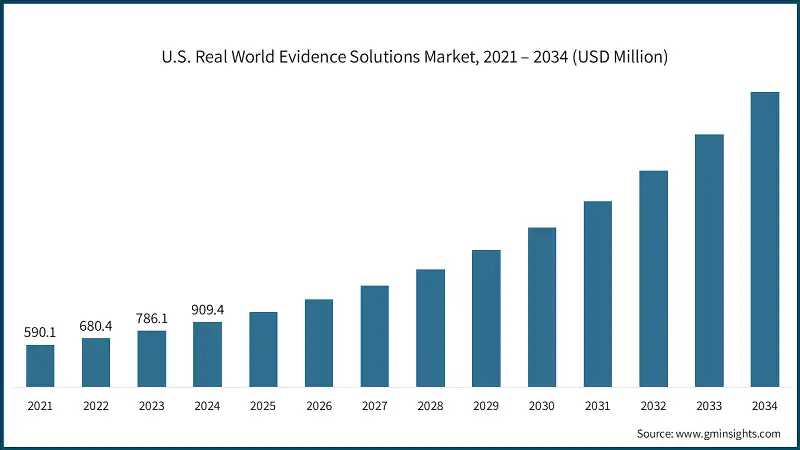

U.S. Real World Evidence Solutions Market was valued at USD 909.4 million in 2024 and is estimated to grow at a CAGR of 16.3% to reach USD 4.1 billion by 2034.

The robust growth is fueled by increased emphasis on expediting drug development, lowering costs, and enhancing post-market safety and efficacy evaluation. Stakeholders are placing greater reliance on real-world evidence to guide reimbursement strategies and clinical decision-making. RWE solutions gather, analyze, and interpret data from everyday healthcare environments such as electronic health records, claims databases, registries, and wearable devices to derive clinical insights beyond conventional trial settings. As payers, regulators, and clinicians demand more real-time evidence, the role of RWE is becoming critical throughout the lifecycle of medical products. This dynamic shift toward evidence-driven strategies, plus growing investments in analytics, is reshaping how drugs and devices are developed, approved, and monitored in the U.S. market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $909.4 Million |

| Forecast Value | $4.1 Billion |

| CAGR | 16.3% |

In 2024, the services segment held a 58.4% share. Its leading position is supported by the widespread offering of subscription models and advanced analytics platforms, and by growing uptake of RWE services among life sciences firms. These services encompass study planning, data integration, quality control, and regulatory support. They harmonize diverse data streams from health records to wearable outputs to enable robust real-world studies that meet compliance standards and decision-making needs.

The drug development and approvals segment is expected to reach USD 1.6 billion by 2034. This growth is driven by increased clinical trial activity, the need to optimize trial designs, and the use of RWE to support regulatory submissions and accelerate approvals. The segment includes protocol formulation, patient recruitment, trial optimization, safety and efficacy monitoring, and evidence generation for regulatory bodies.

The pharmaceutical and medical device companies segment held a 60.4% share in 2024. These organizations are the primary adopters of RWE tools and platforms, deploying them across product lifecycle stages. RWE helps them pinpoint patient cohorts, refine trial protocols, and produce real-world data aligned with regulatory and market access demands, either supplementing or, in some cases, substituting traditional randomized controlled trials.

Prominent participants in the U.S. Real World Evidence Solutions Market include ICON plc, Oracle Corporation, Aetion, Inc., TriNetX, Cytel Inc., Merative, Flatiron Health Inc., Tempus, Syneos Health Inc., Medidata Solutions, Inc., Thermo Fisher Scientific, Inc., UnitedHealth Group Incorporated, IQVIA Holdings Inc., Parexel International Corporation, and Fortrea Holdings Inc. Firms in the U.S. real world evidence solutions market are pursuing several strategic initiatives to solidify their market position. Many are investing heavily in AI and machine learning to improve predictive modeling, causal inference, and data analytics capabilities. Partnerships and alliances with healthcare systems, payers, and research institutions are helping to access richer, more diverse real-world datasets. Acquisitions and mergers are being used to broaden service offerings, add novel technology, or expand geographic reach.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Country trends

- 2.2.2 Component trends

- 2.2.3 Application trends

- 2.2.4 Revenue model trends

- 2.2.5 Deployment model trends

- 2.2.6 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing focus towards accelerating drug development and cost reduction

- 3.2.1.2 Growing demand for real-time safety and efficacy monitoring of drugs and medical devices

- 3.2.1.3 Increasing adoption of RWE Solutions for informed reimbursement decision-making

- 3.2.1.4 Increasing adoption of data analytics services in clinical decision making

- 3.2.2 Industry Pitfalls and challenges:

- 3.2.2.1 Lack of standardization in integration and interoperability of real-world data

- 3.2.2.2 Shortage of skilled professionals

- 3.2.3 Market opportunities:

- 3.2.3.1 Emerging therapeutic areas expansion beyond oncology

- 3.2.3.2 Focus on patient-generated health data integration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.1.1 Artificial intelligence and machine learning integration

- 3.5.1.2 Cloud computing and data infrastructure

- 3.5.1.3 Natural language processing (NLP) for clinical data extraction

- 3.5.2 Emerging technologies

- 3.5.2.1 Blockchain and distributed ledger technologies

- 3.5.2.2 Quantum computing applications

- 3.5.2.3 Federated learning and privacy-preserving analytics

- 3.5.1 Current technological trends

- 3.6 Future market trends

- 3.6.1 Regulatory integration of RWE in drug development and market access

- 3.6.2 AI-driven real world data analytics for precision medicine

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Component, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Services

- 5.2.1 Data collection and integration

- 5.2.2 Study design and execution

- 5.2.2.1 Prospective observational studies

- 5.2.2.2 Retrospective database studies

- 5.2.2.3 Site-centric studies

- 5.2.2.4 Registry-based studies

- 5.2.2.5 Hybrid studies

- 5.2.3 Regulatory and market access support

- 5.2.4 Evidence network

- 5.2.5 Other services

- 5.3 Data sets

- 5.3.1 Disparate data sets

- 5.3.1.1 Clinical settings data

- 5.3.1.2 Claims data sets

- 5.3.1.3 Pharmacy data sets

- 5.3.1.4 Patient powered data sets

- 5.3.1.5 Registry-based data sets

- 5.3.2 Integrated data sets

- 5.3.1 Disparate data sets

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Drug development and approval

- 6.2.1 Oncology

- 6.2.2 Cardiovascular disease

- 6.2.3 Neurology

- 6.2.4 Immunology

- 6.2.5 Other therapeutic areas

- 6.3 Medical device development and approvals

- 6.4 Post-market surveillance

- 6.5 Market access and reimbursement/coverage decision-making

- 6.6 Clinical and regulatory decision-making

Chapter 7 Market Estimates and Forecast, By Revenue Model, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Pay-per-use (value-based pricing)

- 7.3 Subscription

Chapter 8 Market Estimates and Forecast, By Deployment Model, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 On-premise

- 8.3 Cloud-based

Chapter 9 Market Estimates and Forecast, By End use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Pharmaceutical and medical device companies

- 9.3 Healthcare payers

- 9.4 Healthcare providers

- 9.5 Other end use

Chapter 10 Company Profiles

- 10.1 Aetion, Inc.

- 10.2 Cytel Inc

- 10.3 Flatiron Health Inc

- 10.4 Fortrea Holdings Inc

- 10.5 IBM Corporation

- 10.6 ICON plc

- 10.7 IQVIA Holdings Inc

- 10.8 Medidata Solutions, Inc.

- 10.9 Merative

- 10.10 Oracle Corporation

- 10.11 Parexel International Corporation

- 10.12 Syneos Health Inc

- 10.13 Tempus

- 10.14 TriNetX

- 10.15 Thermo Fisher Scientific, Inc.

- 10.16 UnitedHealth Group Incorporated