PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858865

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858865

V2X Communication Chips Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

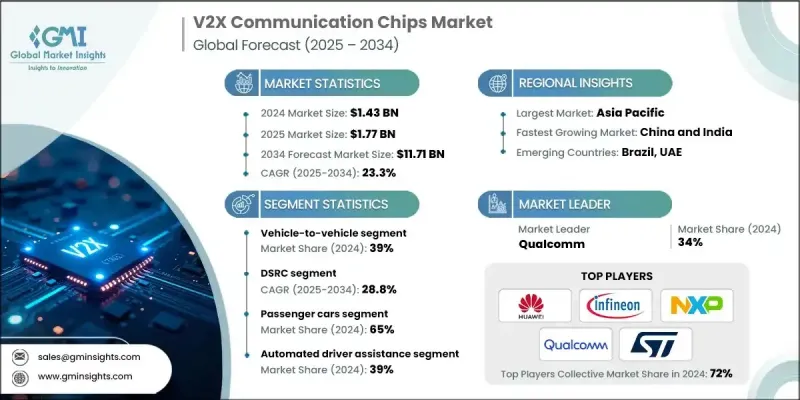

The Global V2X Communication Chips Market was valued at USD 1.43 billion in 2024 and is estimated to grow at a CAGR of 23.3% to reach USD 11.71 billion by 2034.

The growth is fueled by the rising integration of connected vehicle technologies across automotive and infrastructure ecosystems. V2X communication chips enable direct interaction between vehicles, traffic infrastructure, pedestrians, and networks beyond cellular connectivity, ensuring real-time communication that supports road safety, traffic efficiency, emergency response, and cooperative mobility. As automotive OEMs, government agencies, and tech providers move toward connected and autonomous driving, demand for these chips continues to grow. Semiconductor firms are actively developing scalable, secure, and low-latency V2X chipsets tailored for both urban and highway environments. Collaborations between automakers, chip developers, and telecom providers are accelerating the deployment of these systems. With regional preferences differing, major players are creating dual-compatible solutions supporting both DSRC and C-V2X. As adoption scales up, industry focus is shifting toward reducing unit costs and building resilient supply chains to support mass-market rollouts of V2X technologies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.43 Billion |

| Forecast Value | $11.71 Billion |

| CAGR | 23.3% |

The vehicle-to-vehicle (V2V) communication segment held a 39% share in 2024, reflecting its pivotal role in core V2X applications. These chips facilitate the direct exchange of information between vehicles, which is vital for enabling features like blind spot monitoring, collision avoidance, and lane-change assistance. OEMs are embedding V2V communication functions in both commercial and passenger vehicles to comply with safety regulations and support autonomous driving functionalities. As regulatory bodies push for higher standards in vehicle safety, this segment is expected to witness continued acceleration.

In 2024, the DSRC (Dedicated Short-Range Communications) segment will grow at a CAGR of 28.8% through 2034. Operating in the 5.9 GHz spectrum, DSRC provides short-range, low-latency communication between vehicles and surrounding infrastructure. It is widely used for safety-critical applications, including emergency braking, accident alerts, and vehicle prioritization in traffic scenarios. With early-stage adoption already visible in North America and certain parts of Europe, DSRC continues to play a strong role in initial V2X infrastructure deployments supported by regional regulatory frameworks.

China V2X Communication Chips Market generated USD 417 million in 2024. The country's rapid expansion in vehicle production, totaling 31.3 million units in 2024 with a 4% annual increase, is bolstering V2X chip adoption. Government-led initiatives focused on smart transportation, autonomous mobility, and digital infrastructure are accelerating the deployment of V2X systems. National policies, pilot projects, and the growing need for intelligent traffic solutions are expected to strengthen the country's leadership position in the region.

Key players in the Global V2X Communication Chips Market include Qualcomm, NXP Semiconductors, Infineon Technologies, STMicroelectronics, Robert Bosch, Denso, Huawei Technologies, Harman, and Continental. To solidify their presence, companies in the V2X Communication Chips Market are focusing on several core strategies. These include developing dual-mode chipsets that support both DSRC and cellular V2X standards to cater to varied global regulatory environments. Leaders are also prioritizing ultra-low-latency and power-efficient architectures to meet real-time safety demands and extend battery life in EV platforms. Strategic collaborations with automakers and network providers help align chip designs with vehicle development timelines and infrastructure readiness.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Communication

- 2.2.3 Connectivity

- 2.2.4 Vehicle

- 2.2.5 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing deployment of connected and autonomous vehicles

- 3.2.1.2 Government mandates road safety and ITS infrastructure

- 3.2.1.3 Transition toward C-V2X with 5G compatibility

- 3.2.1.4 OEM-semiconductor partnerships for scalability

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High integration and testing costs

- 3.2.2.2 Fragmentation between DSRC and C-V2X standards

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of smart city infrastructure and 5G rollout

- 3.2.3.2 Integration with ADAS and autonomous driving systems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 Pestel analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Patent analysis

- 3.9 Sustainability & environmental aspects

- 3.9.1 Sustainable practices

- 3.9.2 Waste reduction strategies

- 3.9.3 Energy efficiency in production

- 3.9.4 Eco-friendly Initiatives

- 3.9.5 Carbon footprint considerations

- 3.10 Use cases and applications

- 3.11 Best-case scenario

- 3.12 Regional Infrastructure Readiness

- 3.12.1. 5 G network penetration

- 3.12.2 Smart city development status

- 3.12.3. Road infrastructure for V2 X testing

- 3.13 Benchmarking & KPIs

- 3.13.1 Performance metrics for chips (latency, range, reliability)

- 3.13.2 Benchmarking of key players

- 3.13.3 Industry standards and certifications

- 3.14 Market Adoption Scenarios

- 3.14.1 Short-term (1-3 years) adoption forecast

- 3.14.2 Mid-term (4-7 years) adoption forecast

- 3.14.3 Long-term (8-10 years) adoption forecast

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Communication, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Vehicle-to-Vehicle

- 5.3 Vehicle-to-Infrastructure

- 5.4 Vehicle-to-Pedestrian

- 5.5 Vehicle-to-Network

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Connectivity, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 DSRC

- 6.3 C-V2X

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.1.1 Passenger Vehicles

- 7.1.1.1 Hatchback

- 7.1.1.2 Sedan

- 7.1.1.3 SUV

- 7.1.2 Commercial Vehicles

- 7.1.2.1 Light Commercial Vehicles (LCV)

- 7.1.2.2 Medium Commercial Vehicles (MCV)

- 7.1.2.3 Heavy Commercial Vehicles (HCV)

- 7.1.1 Passenger Vehicles

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Automated Driver Assistance

- 8.3 Traffic Management

- 8.4 Emergency Vehicle Notification

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 Qualcomm

- 10.1.2 NXP Semiconductors

- 10.1.3 Huawei Technologies

- 10.1.4 Infineon Technologies

- 10.1.5 STMicroelectronics

- 10.1.6 Continental

- 10.1.7 Robert Bosch

- 10.1.8 Denso Corporation

- 10.1.9 Harman

- 10.1.10 Intel Corporation

- 10.2 Regional Players

- 10.2.1 Autotalks

- 10.2.2 Commsignia

- 10.2.3 Cohda Wireless

- 10.2.4 Savari

- 10.2.5 Panasonic Automotive

- 10.3 Emerging Players / Disruptors

- 10.3.1 Veoneer

- 10.3.2 Excelfore

- 10.3.3 Visteon Corporation

- 10.3.4 NXP Labs Startup Ventures

- 10.3.5 KT Corporation Automotive Solutions