PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858868

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858868

Asia Pacific Household Paper Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

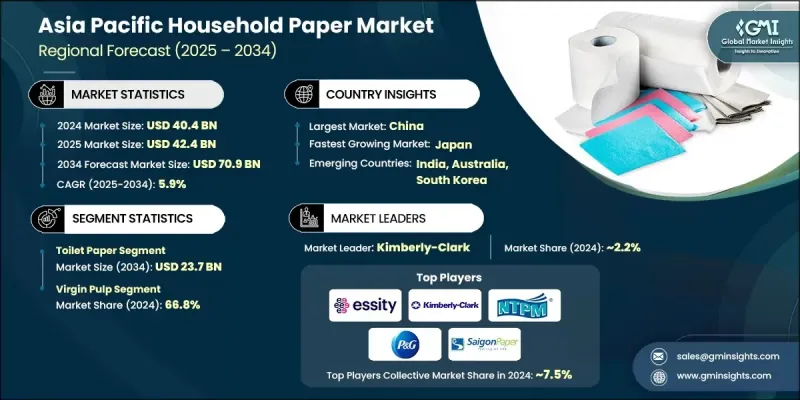

Asia Pacific Household Paper Market was valued at USD 40.4 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 70.9 billion by 2034.

Market expansion is driven by evolving consumer behavior, increased hygiene awareness, and rapid digitalization across retail channels. E-commerce has seen strong momentum post-pandemic, changing how consumers purchase household paper products. Online sales have shown significant growth across various countries, with at-home consumption remaining high. These shifts are influencing packaging requirements, with more focus on e-commerce-ready designs and flexible pack sizes. As grocery shopping habits vary regionally, manufacturers are adapting by offering diverse sizes and value-based product ranges. The market is also experiencing growing private label penetration, intensifying price competition in modern retail. Roughly 29% of sales in these channels now come through promotional campaigns. In parallel, regional regulations focused on sustainability and circular economy practices are pushing brands to reassess sourcing strategies. Policy adjustments in China's recovered paper sector have redirected supply chains toward India and Southeast Asia, encouraging diversification and resilience. These dynamics are reshaping production, pricing, and sourcing decisions, positioning the region for long-term growth backed by strong urbanization and shifting consumer priorities.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $40.4 billion |

| Forecast Value | $70.9 billion |

| CAGR | 5.9% |

The toilet paper segment generated USD 15 billion in 2024 and is expected to reach USD 23.7 billion by 2034. As a daily necessity with strong consumer demand, this segment continues to dominate due to increasing disposable incomes, evolving hygiene standards, and urban lifestyle shifts. Consumers are leaning toward options that offer softness, added scent, and premium finishes, which is driving innovation and product premiumization within this category.

The virgin pulp segment generated USD 27 billion and held a 66.8% share in 2024. Its widespread use is driven by consumer preference for strength, softness, and overall product quality. Countries such as South Korea, Australia, and Japan are among the key markets where virgin pulp-based products remain popular due to high expectations for performance and comfort. However, growing environmental awareness in regions like China and India is creating a stronger push toward recycled paper and bamboo alternatives, which may gradually influence raw material sourcing strategies across the region.

China Household Paper Market generated USD 14.1 billion in 2024 and is forecast to grow at a CAGR of 5.5% from 2025 to 2034. The growth trajectory is supported by rising hygiene standards and urban population expansion. Toilet paper and facial tissues are among the top-selling categories in the country. The competitive landscape features a strong presence of domestic and international players, with increasing emphasis on sustainable product development in response to government-led environmental policies.

Leading brands shaping the Asia Pacific Household Paper Market include Nippon Paper Industries, PT Sun Paper, Essity, Procter & Gamble, Hengan International Group, Vinda International Holdings, Eco Wipes Viet Nam Corporation, Kimberly-Clark, NTPM Holdings Berhad, Asia Pulp & Paper, Nano Tissue, Saigon Paper Corporation, Green Vietnam Paper, Gold Hongye, and Xuan Mai Paper Co Ltd. To reinforce their position in the Asia Pacific Household Paper Market, companies are adopting multi-pronged strategies. Key efforts include expanding local production facilities to optimize distribution and reduce lead times. Many are strengthening their digital presence through e-commerce platforms and direct-to-consumer channels to match shifting buying behaviors. Sustainability has become a core focus, with firms investing in eco-friendly materials, including bamboo fiber and recycled pulp.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Country wise trends

- 2.2.2 Product type trends

- 2.2.3 Material trends

- 2.2.4 Price range trends

- 2.2.5 Distribution channel trends

- 2.3 CXO perspective: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

- 2.5 Strategic recommendations

- 2.5.1 Supply chain diversification strategy

- 2.5.2 Product portfolio enhancement

- 2.5.3 Partnership and alliance opportunities

- 2.5.4 Cost management and pricing strategy

- 2.6 Decision framework

- 2.6.1 Investment priority matrix

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising urbanization, increasing disposable incomes

- 3.2.1.2 Growing focus on health and hygiene standards

- 3.2.1.3 Technological advancements and product innovations

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Environmental concerns and regulations

- 3.2.2.2 Fluctuating raw material prices

- 3.2.3 Opportunities

- 3.2.3.1 Expansion of eco-friendly and sustainable product lines

- 3.2.3.2 Penetration into rural and tier-2/tier-3 cities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Emerging Trends & Technologies

- 3.6 Product innovation landscape

- 3.6.1 Current market trends

- 3.6.2 Emerging market trends

- 3.7 Raw material analysis

- 3.8 Pricing trends

- 3.8.1 By country and product type

- 3.8.2 Raw material cost

- 3.8.3 Real vs. perceived capacity constraints in supply of raw materials

- 3.8.4 Supplier price increase validation

- 3.9 Regulatory framework

- 3.9.1 China

- 3.9.2 Japan

- 3.9.3 India

- 3.9.4 South Korea

- 3.9.5 Australia

- 3.9.6 Malaysia

- 3.9.7 Indonesia

- 3.9.8 Vietnam

- 3.9.9 Rest of Asia Pacific

- 3.10 Trade statistics (HS code - 48021010)

- 3.10.1 Major importing countries

- 3.10.2 Major exporting countries

- 3.11 Investment Opportunities

- 3.12 Porter's five forces analysis

- 3.13 PESTEL analysis

- 3.14 Consumer behavior analysis

- 3.14.1 Purchasing patterns

- 3.14.2 Preference analysis

- 3.14.3 Country variations in consumer behavior

- 3.14.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Country

- 4.2.1.1 China

- 4.2.1.2 Japan

- 4.2.1.3 India

- 4.2.1.4 South Korea

- 4.2.1.5 Australia

- 4.2.1.6 Malaysia

- 4.2.1.7 Indonesia

- 4.2.1.8 Vietnam

- 4.2.1 By Country

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Product portfolio benchmarking

- 4.7 Key developments

- 4.7.1 Mergers & acquisitions

- 4.7.2 Partnerships & collaborations

- 4.7.3 New Product Launches

- 4.7.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 (USD Billion) (Tons)

- 5.1 Key trends

- 5.2 Toilet paper

- 5.2.1 Standard toilet paper

- 5.2.2 Premium/ultra-soft toilet paper

- 5.2.3 Recycled/eco-friendly toilet paper

- 5.2.4 Bamboo toilet paper

- 5.3 Wet wipes

- 5.3.1 Baby wipes

- 5.3.2 Personal care wipes

- 5.3.3 Household cleaning wipes

- 5.3.4 Flushable wipes

- 5.4 Paper towels and kitchen rolls

- 5.5 Facial tissues

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Material, 2021 - 2034 (USD Billion) (Tons)

- 6.1 Key trends

- 6.2 Virgin pulp

- 6.3 Recycled pulp

Chapter 7 Market Estimates & Forecast, By Price Range, 2021 - 2034 (USD Billion) (Tons)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Tons)

- 8.1 Key trends

- 8.2 Traditional trade

- 8.2.1 Independent retailers

- 8.2.2 Local distributors

- 8.3 Modern Trade

- 8.3.1 Hypermarkets and supermarkets

- 8.3.2 Convenience stores

- 8.3.3 Cash & carry outlets

- 8.4 E-commerce

- 8.4.1 Online marketplaces

- 8.4.2 Direct-to-consumer platforms

Chapter 9 Market Estimates & Forecast, By Country, 2021 - 2034, (USD Billion) (Tons)

- 9.1 Key trends

- 9.2 China

- 9.3 Japan

- 9.4 India

- 9.5 South Korea

- 9.6 Australia

- 9.7 Malaysia

- 9.8 Indonesia

- 9.9 Vietnam

Chapter 10 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 10.1 Asia Pulp & Paper

- 10.2 Eco Wipes Viet Nam Corporation

- 10.3 Essity

- 10.4 Gold Hongye

- 10.5 Green Vietnam Paper

- 10.6 Hengan International Group

- 10.7 Kimberly-Clark

- 10.8 Nano Tissue

- 10.9 Nippon Paper Industries

- 10.10 NTPM HOLDINGS BERHAD

- 10.11 Procter & Gamble

- 10.12 PT Sun Paper

- 10.13 Saigon Paper Corporation

- 10.14 Vinda International Holdings

- 10.15 Xuan Mai Paper Co Ltd