PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858870

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858870

Continuous Manufacturing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

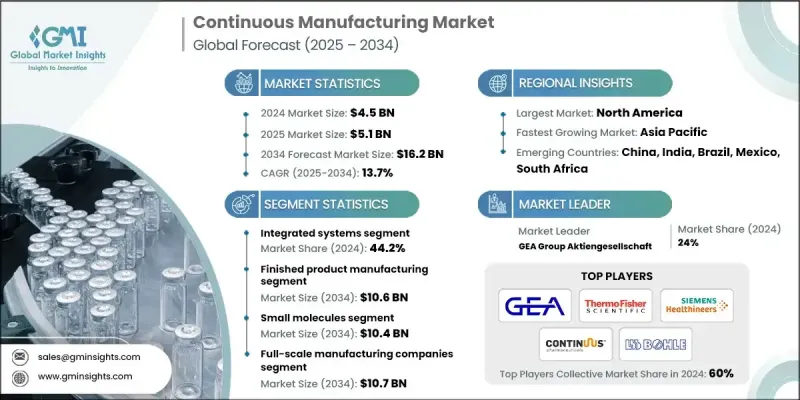

The Global Continuous Manufacturing Market was valued at USD 4.5 billion in 2024 and is estimated to grow at a CAGR of 13.7% to reach USD 16.2 billion by 2034.

The market is undergoing expansion as pharmaceutical manufacturers pivot toward faster, scalable, and more reliable production systems. Continuous manufacturing is gaining strong momentum with growing regulatory encouragement and rising demand for more agile drug manufacturing processes. Companies are transitioning away from conventional batch-based systems in favor of continuous technologies that provide improved process control, lower waste, and reduced lead times. As personalized medicine and small-batch therapeutics grow in demand, the need for production models that can adapt quickly and operate more efficiently has become critical. This technology enables real-time monitoring, streamlined operations, and better compliance factors that are rapidly transforming how drugs are produced. Both small molecule and biologics manufacturing are being revolutionized through these innovations, as the industry places greater emphasis on cost-efficiency, speed, and quality. As companies continue to prioritize faster market delivery and tighter operational control, continuous manufacturing is quickly becoming the new standard across the pharmaceutical production landscape.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.5 Billion |

| Forecast Value | $16.2 Billion |

| CAGR | 13.7% |

The finished product manufacturing segment is projected to reach USD 10.6 billion by 2034. This segment's expansion is fueled by the growing implementation of continuous technologies in the production of final drug products, helping manufacturers achieve quicker production timelines and reduced operational bottlenecks. Continuous platforms improve consistency and enable automated, high-throughput processes, significantly minimizing human intervention while enhancing quality assurance through in-line controls. These integrated systems are becoming essential in manufacturing oral dosage forms and injectable products with greater cost-effectiveness and process reliability.

The small molecules segment is forecasted to hit USD 10.4 billion by 2034. Its dominance stems from the widespread demand for small-molecule drugs across therapeutic areas like oncology, infectious diseases, and chronic illnesses. These compounds are highly compatible with continuous processes due to their well-established production methods, structural simplicity, and volume-driven manufacturing needs. As pharma companies look to optimize production lines, small molecules are at the forefront of continuous manufacturing adoption because they support high-efficiency production without compromising quality or scalability.

United States Continuous Manufacturing Market was valued at USD 1.8 billion in 2024. The market is advancing due to updated regulatory support, increased focus on resilient production models, and heavy investments in digitalized manufacturing technologies. The US plays a critical role in global pharmaceutical output, with continuous manufacturing becoming increasingly attractive as a strategy for enhancing supply chain robustness and maintaining high production standards. As domestic manufacturers seek to streamline workflows and reduce operational risks, adoption of continuous processes continues to gain ground.

Key players driving this transformation in the Global Continuous Manufacturing Market include Munson Machinery, Thermo Fisher Scientific, Syntegon Technology, Siemens Healthineers, STEER World, Gericke, FREUND CORPORATION, L.B. Bohle Maschinen und Verfahren, KORSCH, Continuus Pharmaceuticals, Scott Equipment Company, Sturtevant Inc., GEA Group Aktiengesellschaft, Coperion GmbH, Glatt, and Gebruder Lodige Maschinenbau. Companies in the Global Continuous Manufacturing Market are enhancing their market position through several targeted strategies. A key focus is on developing modular and scalable systems that offer flexibility across a range of pharmaceutical applications. Manufacturers are investing in automation and real-time data integration to boost production control and meet stringent regulatory standards.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product type trends

- 2.2.3 Application trends

- 2.2.4 Therapeutic type trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Regulatory support for continuous manufacturing

- 3.2.1.2 Operational efficiency and cost reduction

- 3.2.1.3 Real-time quality control and process monitoring

- 3.2.1.4 Rising demand for personalized and small-batch therapies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial capital investment

- 3.2.2.2 Limited skilled workforce

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in biologics and large molecule manufacturing

- 3.2.3.2 Growth in contract manufacturing services

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Patent analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Integrated systems

- 5.3 Semi-continuous systems

- 5.3.1 Continuous granulators

- 5.3.2 Continuous coaters

- 5.3.3 Continuous blenders

- 5.3.4 Continuous dryers

- 5.3.5 Continuous compressors

- 5.3.6 Other semi-continuous systems

- 5.4 Software

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Finished product manufacturing

- 6.2.1 Solid dosage

- 6.2.2 Semi solid dosage

- 6.2.3 Liquid dosage

- 6.3 API manufacturing

Chapter 7 Market Estimates and Forecast, By Therapeutic Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Small molecule

- 7.3 Large molecules

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 R&D departments

- 8.2.1 Research institutes

- 8.2.2 Contract research organizations (CROs)

- 8.3 Full-scale manufacturing companies

- 8.3.1 Contract manufacturing organizations (CMOs)

- 8.3.2 Pharmaceutical and biotechnological companies

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Continuus Pharmaceuticals

- 10.2 Coperion GmbH

- 10.3 FREUND CORPORATION

- 10.4 GEA Group Aktiengesellschaft

- 10.5 Gebruder Lodige Maschinenbau

- 10.6 Gericke

- 10.7 Glatt

- 10.8 KORSCH

- 10.9 L.B. Bohle Maschinen und Verfahren

- 10.10 Munson Machinery

- 10.11 Scott Equipment company

- 10.12 Siemens Healthineers

- 10.13 STEER World

- 10.14 Sturtevant Inc

- 10.15 Syntegon Technology

- 10.16 Thermo Fisher Scientific