PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858877

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858877

Pet Chews and Treats Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

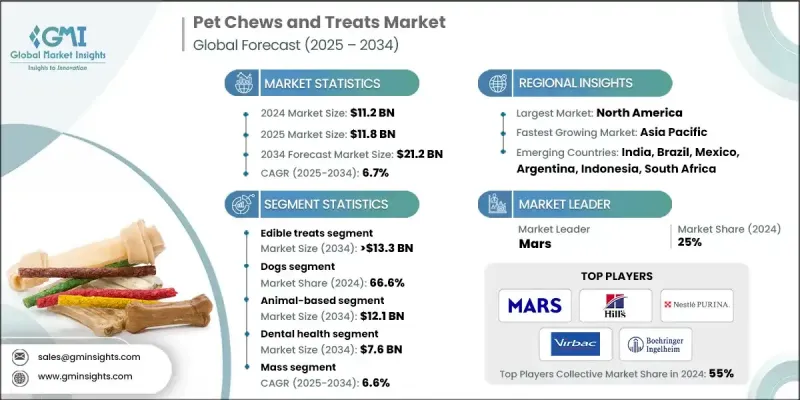

The Global Pet Chews and Treats Market was valued at USD 11.2 billion in 2024 and is estimated to grow at a CAGR of 6.7% to reach USD 21.2 billion by 2034.

The growth is driven by rising pet owners' awareness of the importance of pet health, particularly gut health. Along with this, research into microbiomes, immunity, mental well-being, and chronic disease prevention is also accelerating the market's expansion. Additionally, younger generations, particularly Millennials and Gen Z, are increasingly seeking functional foods, such as prebiotics and probiotics, for their pets. The rise of personalized nutrition and diagnostics technologies has also played a major role, allowing for custom health solutions that further boost the adoption of pet chews and treats. As innovation in functional ingredients increases, the market is witnessing the launch of targeted products like probiotics for gut health, collagen for joint support, and plant-based calming options. This shift toward holistic wellness solutions is in line with the growing trend of pet humanization, which is driving greater demand for functional treats. As a result, the market for specialized pet chews, including dental chews, calming products, and vitamin- and probiotic-enriched treats, is set to expand significantly.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11.2 Billion |

| Forecast Value | $21.2 Billion |

| CAGR | 6.7% |

The edible treats segment generated USD 7.2 billion in 2024, driven by changing consumer preferences and an increase in pet humanization. Pet owners are now looking for treats that not only serve as rewards but also offer health benefits. These treats come in various forms, from protein-rich options to joint health support, making them suitable for daily use. Their appeal has grown due to the inclusion of clean-label ingredients, natural formulations, and products tailored for specific breeds. Additionally, with the rise of e-commerce, these treats are more accessible to pet owners, boosting purchase frequency and driving market growth.

The dog segment held a 66.6% share in 2024, attributed to the high rate of dog ownership and a growing awareness of canine health. Dogs are increasingly viewed as family members, prompting owners to prioritize premium, functional products that address various health needs, such as joint care, digestion, and dental hygiene. The emotional bond between dog owners and their pets continues to fuel demand for specialized, high-quality treats designed for specific health benefits.

North America Pet Chews and Treats Market held a 45% share in 2024. The region is the largest consumer of pet products, driven by a high pet ownership rate and increased spending on pet wellness. Approximately 68 million households in the U.S. own dogs, while 49 million own cats, providing a substantial consumer base for pet foods and health-oriented treats.

Key players in the Global Pet Chews and Treats Market include companies such as Mars, Purina PetCare (Nestle), Vetoquinol, Virbac, Boehringer Ingelheim, Ceva Sante Animale, Hills Pet Nutrition (Colgate-Palmolive), PetDine, and HeroDogTreats, among others. These companies are continually innovating to stay competitive in a rapidly expanding market. To strengthen their position, companies in the pet chews and treats industry are focusing on several strategic approaches. A primary tactic is the continuous innovation of functional ingredients that offer specific health benefits, such as probiotics for gut health, joint care products, and calming solutions. Additionally, many companies are investing in clean-label products to meet the rising consumer demand for transparency in ingredient sourcing. Expanding their product lines to cater to specific pet breeds, sizes, and health needs is also a key strategy.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Pet type

- 2.2.4 Ingredient type

- 2.2.5 Application

- 2.2.6 Price range

- 2.2.7 Sales channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising pet ownership rate

- 3.2.1.2 Increasing pet care expenditure

- 3.2.1.3 Growing awareness for pet health and wellness

- 3.2.1.4 Increasing cases of pet dental problems

- 3.2.1.5 Expanding e-commerce platform

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Ingredient allergies and sensitivities

- 3.2.2.2 Regulatory challenges

- 3.2.3 Market opportunities

- 3.2.3.1 Growing focus on functional ingredient innovation

- 3.2.3.2 Technology integration

- 3.2.3.3 Growing natural and organic product demand

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Technology landscape

- 3.4.1 Current technological trends

- 3.4.2 Emerging technologies

- 3.5 Regulatory landscape

- 3.6 Pet population statistics 2024

- 3.7 Pricing analysis

- 3.8 Investment and funding landscape in the animal health industry

- 3.9 Future market trends

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Key developments

- 4.5.1 Merger and acquisition

- 4.5.2 Partnership and collaboration

- 4.5.3 New product launches

- 4.5.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Edible treats

- 5.3 Edible chews

Chapter 6 Market Estimates and Forecast, By Pet Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Dogs

- 6.3 Cats

- 6.4 Other pet types

Chapter 7 Market Estimates and Forecast, By Ingredient Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Plant-based

- 7.3 Animal-based

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Dental health

- 8.3 Mobility and joint health

- 8.4 Digestive health

- 8.5 Skin and coat health

- 8.6 Calming and behavioral

- 8.7 Other applications

Chapter 9 Market Estimates and Forecast, By Price Range, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Mass

- 9.3 Premium

Chapter 10 Market Estimates and Forecast, By Sales Channel, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 Online channels

- 10.3 Offline channels

- 10.3.1 Pet specialty stores

- 10.3.2 Hypermarkets/ supermarkets

- 10.3.3 Convenience store

- 10.3.4 Other offline channels

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 BarkBox

- 12.2 Boehringer Ingelheim

- 12.3 Ceva Sante Animale

- 12.4 D.C. Enterprises

- 12.5 Dechra Pharmaceuticals

- 12.6 Dogseechew

- 12.7 Foshan Phoenix Pet Products

- 12.8 H. von Gimborn

- 12.9 HeroDogTreats

- 12.10 Hills Pet Nutrition (Colgate-Palmolive)

- 12.11 Mars

- 12.12 Packnpride

- 12.13 PetDine

- 12.14 Petmex

- 12.15 Petsona

- 12.16 Purina PetCare (Nestle)

- 12.17 Vetoquinol

- 12.18 Virbac