PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858878

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858878

Europe Pancreatic Cancer Diagnostic Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

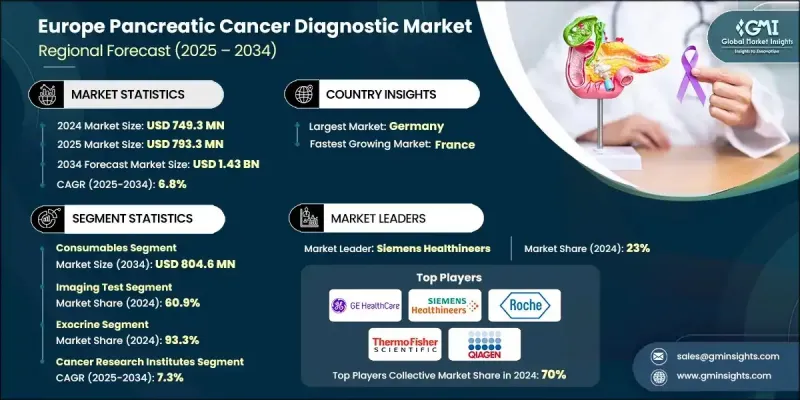

Europe Pancreatic Cancer Diagnostic Market was valued at USD 749.3 million in 2024 and is estimated to grow at a CAGR of 6.8% to reach USD 1.43 billion by 2034.

The growth trend is driven by the increasing incidence of pancreatic disorders, continuous advancements in diagnostic technologies, higher healthcare spending, and rising awareness through early screening efforts. Since pancreatic cancer is often detected in later stages due to a lack of early symptoms, there is a growing focus on early diagnosis and precision-based testing methods. Healthcare providers across Europe are integrating more accurate, non-invasive, and high-sensitivity diagnostic tools into their systems. These include imaging-based modalities, molecular diagnostics, and biomarker-driven tests. Favorable regulatory initiatives and rising public health awareness are also enhancing access to modern diagnostic services. In addition, significant investment from both public and private sectors in healthcare infrastructure is helping accelerate early detection efforts for high-fatality diseases such as pancreatic cancer. Countries in Europe are prioritizing early-stage detection and personalized medicine, supporting the shift toward more effective diagnostic solutions tailored to individual patient profiles. These changes are creating strong opportunities for innovation and expanding the footprint of advanced diagnostic products across the European landscape.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $749.3 Million |

| Forecast Value | $1.43 Billion |

| CAGR | 6.8% |

In 2024, the consumables segment generated USD 427.8 million and is projected to grow to USD 804.6 million by 2034, registering a CAGR of 6.6%. The high demand for consumables stems from their critical role in a variety of diagnostic applications, especially molecular testing and liquid biopsy. These include reagents, buffers, and assay kits used in advanced technologies like immunoassays, image-guided biopsies, and next-generation sequencing. As diagnostic laboratories and research centers increasingly adopt precision testing platforms, the need for high-quality, scalable consumables continues to rise.

The imaging tests segment held a 60.9% share in 2024. Imaging remains a cornerstone in pancreatic cancer diagnostics due to its ability to provide non-invasive, real-time anatomical insights. These modalities are vital in identifying tumor presence, mapping disease progression, and assisting in treatment planning. Since the pancreas is located deep within the abdominal cavity, these imaging techniques offer a reliable means to assess tumor size, stage, and spread without requiring invasive procedures. Advanced imaging systems offer clinicians precise visualization, which is key for diagnosis and therapeutic decisions.

Germany Pancreatic Cancer Diagnostic Market generated USD 156 million in 2024. The country is witnessing a rising number of pancreatic cancer cases, with the disease ranking as a major cause of cancer-related deaths. Due to the disease's typically late diagnosis and rapid progression, there is a heightened need for advanced and efficient diagnostic tools. As Germany continues to face an increasing patient burden, demand is rising for technologies capable of early detection and accurate cancer staging, further stimulating market expansion within the country.

Key companies operating in the Europe Pancreatic Cancer Diagnostic Market include Thermo Fisher Scientific, GE Healthcare, Olympus Corporation, Hitachi, Abbott Laboratories, Danaher Corporation, Canon, Siemens Healthineers, F Hoffmann-La Roche, Myriad Genetics, Illumina, QIAGEN, Agilent Technologies, Boston Scientific Corporation, Esaote, Koninklijke Philips, Becton, Dickinson and Company, and Sysmex Corporation. Leading players in the European pancreatic cancer diagnostics market are pursuing targeted strategies to bolster their competitive edge. Companies are investing in R&D to advance biomarker discovery, develop non-invasive liquid biopsy tests, and enhance imaging software for earlier cancer detection. Strategic collaborations with research institutes and clinical centers are helping accelerate technology validation and clinical adoption. Several firms are expanding their presence through partnerships with hospitals and diagnostic labs to offer integrated diagnostic solutions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Country trends

- 2.2.2 Product trends

- 2.2.3 Test type trends

- 2.2.4 Cancer type trends

- 2.2.5 End Use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of pancreatitis and pancreatic cancer

- 3.2.1.2 Advancements in diagnostic technologies

- 3.2.1.3 Growing healthcare expenditure

- 3.2.1.4 Growing awareness and screening initiatives

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory scenarios

- 3.2.2.2 High cost of diagnostic tests

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of AI-enhanced imaging technology

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Reimbursement scenario

- 3.8 Pricing analysis, 2024

- 3.9 Future market trends

- 3.10 Gap analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Instruments

- 5.3 Consumables

Chapter 6 Market Estimates and Forecast, By Test Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Imaging test

- 6.2.1 CT scan

- 6.2.2 MRI

- 6.2.3 Ultrasound

- 6.2.4 PET

- 6.2.5 Other imaging tests

- 6.3 Biopsy

- 6.4 Blood test

- 6.4.1 Liver function tests

- 6.4.2 Tumor markers

- 6.4.3 Other blood tests

- 6.5 Other test types

Chapter 7 Market Estimates and Forecast, By Cancer Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Exocrine

- 7.2.1 Adenocarcinoma

- 7.2.2 Colloid carcinoma

- 7.2.3 Adenosquamous carcinoma

- 7.2.4 Squamous cell carcinoma

- 7.3 Endocrine

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Cancer research institutes

- 8.3 Hospitals and clinics

- 8.4 Diagnostic laboratories

- 8.5 Diagnostic imaging centers

Chapter 9 Market Estimates and Forecast, By Country, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Germany

- 9.3 UK

- 9.4 France

- 9.5 Spain

- 9.6 Italy

- 9.7 Netherlands

Chapter 10 Company Profiles

- 10.1 Abbott Laboratories

- 10.2 Agilent Technologies

- 10.3 Becton, Dickinson and Company

- 10.4 Boston Scientific Corporation

- 10.5 Canon

- 10.6 Danaher Corporation

- 10.7 Esaote

- 10.8 F Hoffmann-La Roche

- 10.9 GE Healthcare

- 10.10 Hitachi

- 10.11 Illumina

- 10.12 Koninklijke Philips

- 10.13 Myriad Genetics

- 10.14 Olympus Corporation

- 10.15 QIAGEN

- 10.16 Siemens Healthineers

- 10.17 Sysmex Corporation

- 10.18 Thermo Fisher Scientific