PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858885

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858885

Wind Turbine Operation and Maintenance Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

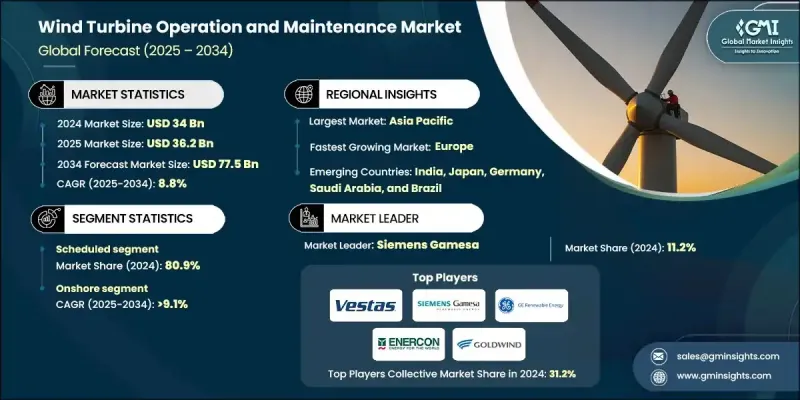

The Global Wind Turbine Operation and Maintenance Market was valued at USD 34 billion in 2024 and is estimated to grow at a CAGR of 8.8% to reach USD 77.5 billion by 2034.

The increasing maturity of global wind energy infrastructure continues to drive demand for scalable and cost-effective O&M services. As wind power claims a larger share of the global energy portfolio, the need for efficient, technology-integrated maintenance becomes more critical. Innovations in automated diagnostics, machine learning, and data-driven systems are significantly enhancing turbine efficiency and reducing operational downtime. These smart tools are reshaping the O&M landscape by offering predictive insights and real-time monitoring. Additionally, with energy producers shifting toward sustainability and lifecycle efficiency, the role of proactive maintenance strategies is growing rapidly. Predictive analytics and remote access tools are replacing traditional maintenance models to ensure minimal disruptions and optimized asset performance. Drone technology and robotic automation are further transforming the way turbines are serviced, especially in hard-to-reach locations. These advancements are fostering a more streamlined and sustainable O&M ecosystem, reinforcing the market's steady expansion across both onshore and offshore assets. Digitalization, combined with policy support for clean energy, continues to accelerate the evolution of wind turbine servicing across global markets.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $34 Billion |

| Forecast Value | $77.5 Billion |

| CAGR | 8.8% |

In 2024, the scheduled maintenance services segment held an 80.9% share and is forecasted to grow at a CAGR of 9.3% through 2034. This dominance reflects the widespread adoption of proactive service models supported by digital platforms. Operators are increasingly using advanced diagnostics and performance data to optimize turbine life cycles and avoid costly breakdowns. As wind energy assets age and new installations emerge in remote or offshore areas, demand is rising for smart scheduling, asset tracking, and predictive insights to support complex maintenance operations.

The onshore segment held an 88.5% share in 2024 and is expected to grow at a CAGR of 9.1% from 2025 to 2034. Onshore wind farms are focusing on digital transformation to reduce maintenance costs and improve reliability. With older wind farms requiring more specialized care, operators are deploying AI-driven analytics, IoT-enabled sensors, and advanced monitoring tools to anticipate component failures and extend turbine life. This shift toward connected, proactive maintenance solutions allows operators to streamline workflows, improve uptime, and drive long-term value from their assets.

Europe Wind Turbine Operation and Maintenance Market will reach USD 19 billion by 2034. This growth is propelled by rising investments in offshore wind projects and increasing integration of intelligent technologies like AI-based diagnostics, robotics, and remote control systems. Many onshore fleets across the region are undergoing repowering, which is creating fresh demand for tailored O&M services. Government policy, environmental targets, and regulatory backing for low-emission energy sources are encouraging operators to invest in smart and sustainable maintenance solutions, which in turn boosts overall market growth.

Leading companies active in the Global Wind Turbine Operation and Maintenance Market include Vestas Wind Systems A/S, Enercon GmbH, Suzlon Energy Ltd, Fred. Olsen Windcarrier, RTS Wind AG, B9 Energy Group, Moventas Gears Oy, GoldWind, Deutsche Windtechnik, ABB Ltd., Bilfinger Inc., Dana SAC UK Ltd, Global Wind Service company, ZF Friedrichshafen AG, Mistras Group, Mitarsh Energy, NORDEX SE, REETEC, Siemens Gamesa, and Blue Water Shipping. To strengthen their foothold in the Global Wind Turbine Operation and Maintenance Market, major players are embracing digital transformation and investing in advanced technologies. Companies are increasingly adopting predictive maintenance platforms that utilize AI, big data, and sensor-based diagnostics to monitor turbine health in real time. Strategic collaborations with software providers and tech innovators help integrate automation, drones, and robotics into their service offerings, reducing costs and improving worker safety.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.1.3 Base estimates and calculations

- 1.1.4 Base year calculation

- 1.1.5 Key trends for market estimates

- 1.2 Forecast model

- 1.3 Primary research & validation

- 1.3.1 Primary sources

- 1.4 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Type trends

- 2.4 Location trends

- 2.5 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Price trend analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Company benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Type, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Scheduled

- 5.3 Unscheduled

Chapter 6 Market Size and Forecast, By Location, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Onshore

- 6.3 Offshore

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 France

- 7.3.3 Sweden

- 7.3.4 UK

- 7.3.5 Spain

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.5 Middle East & Africa

- 7.5.1 Egypt

- 7.5.2 South Africa

- 7.5.3 Morocco

- 7.5.4 Saudi Arabia

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Mexico

- 7.6.3 Chile

Chapter 8 Company Profiles

- 8.1 ABB

- 8.2 B9 Energy Group

- 8.3 Bilfinger Inc.

- 8.4 Dana SAC UK Ltd

- 8.5 Deutsche Windtechnik

- 8.6 Enercon GmbH

- 8.7 Fred. Olsen Windcarrier

- 8.8 Global Wind Service company

- 8.9 GoldWind

- 8.10 Mistras Group,

- 8.11 Mitarsh Energy

- 8.12 Moventas Gears Oy

- 8.13 NORDEX SE

- 8.14 REETEC

- 8.15 RTS Wind AG

- 8.16 Siemens Gamesa

- 8.17 Suzlon Energy Limited

- 8.18 Suzlon Energy Ltd

- 8.19 Vestas Wind Systems A/S

- 8.20 ZF Friedrichshafen AG