PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858886

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858886

Algae-Based Omega-3 Production Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast

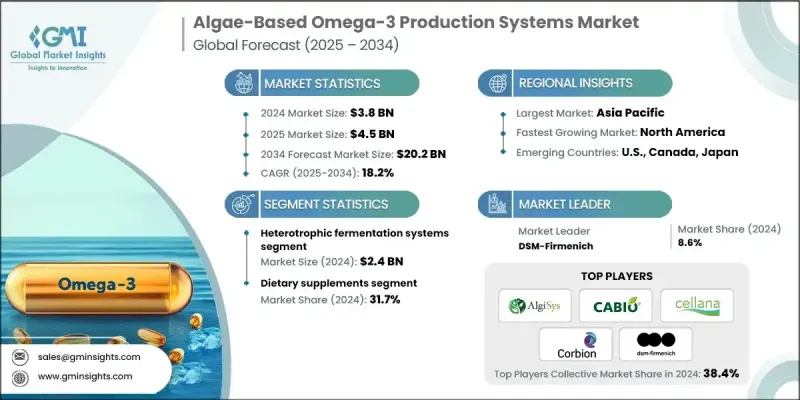

The Global Algae-Based Omega-3 Production Systems Market was valued at USD 3.8 billion in 2024 and is estimated to grow at a CAGR of 18.2% to reach USD 20.2 billion by 2034.

This growth is driven by rising consumer demand for sustainable, plant-based omega-3 fatty acids as alternatives to traditional fish oil. With increasing health awareness, environmental concerns, and dietary restrictions, more individuals are turning toward algae-derived omega-3s, which meet clean-label standards and avoid allergens. Advances in algal biotechnology, including closed-loop systems and photobioreactors, are significantly enhancing production efficiency and scalability. These systems enable higher biomass yields and offer a controlled environment that minimizes contamination risks and ensures product consistency. Consumers are pushing companies to deliver transparent, allergen-free products that align with eco-conscious values. The rising popularity of herbal and plant-based health supplements is evident in the U.S., with an annual 5.4% growth in the herbals category, which continues to support demand for algae-derived omega-3. As the global wellness trend grows stronger, companies are racing to innovate in both technology and product formulation to meet this rising demand.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.8 Billion |

| Forecast Value | $20.2 Billion |

| CAGR | 18.2% |

The heterotrophic fermentation systems segment held 64.4% share and is projected to maintain a CAGR of 18.2% through 2034. These systems have proven to be the most viable and scalable method for commercial algae-based omega-3 production. Operating under controlled conditions, heterotrophic fermentation allows algae to metabolize carbohydrate sources such as glucose, sucrose, or industrial byproducts for optimal omega-3 yield. Their industrial-scale compatibility and reduced risk of environmental contamination have positioned them as the backbone of production for key industry players.

The dietary supplements segment held a 31.7% share in 2024 and is gaining traction as more consumers prioritize plant-based health products. This segment benefits from strong retail networks, trusted brand names, and attractive margins, which make it a primary application area for algae-derived omega-3s. The increased awareness of omega-3's health benefits, particularly in cardiovascular, cognitive, and inflammatory health, is further supporting supplement uptake.

North America Algae-Based Omega-3 Production Systems Market is forecast to grow at a CAGR of 18.3% between 2025 and 2034, driven by a health-conscious consumer base and increasing adoption of plant-forward lifestyles. Innovations centered around non-GMO, organic, and environmentally friendly formulations continue to attract attention from consumers seeking sustainable wellness solutions.

Leading companies operating in the Global Algae-Based Omega-3 Production Systems Market include DSM-Firmenich, Fermentalg, Cellana Inc., Algatech, CABIO Biotech, Evonik Industries AG, Nuseed, Corbion N.V., Algisys, Qualitas Health, and Mara Renewables Corporation. Companies in the Global Algae-Based Omega-3 Production Systems Market are pursuing multiple strategies to secure and grow their market share. Key players are heavily investing in R&D to improve strain selection and boost lipid yield, while optimizing production technologies like heterotrophic fermentation for cost-effective scalability. Collaborations with nutrition and pharmaceutical brands help expand distribution channels and increase product visibility. Firms are also working toward obtaining clean-label certifications and aligning with non-GMO, allergen-free, and vegan-friendly standards to capture niche markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Production technology trends

- 2.2.2 Application trends

- 2.2.3 Regional trends

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for sustainable omega-3 alternatives

- 3.2.1.2 Rising aquaculture industry growth

- 3.2.1.3 Depletion of marine fish stocks & ocean conservation

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Technology transfer & commercialization gaps

- 3.2.2.2 Feedstock availability & quality consistency

- 3.2.3 Market opportunities

- 3.2.3.1 Waste-to-omega-3 production systems

- 3.2.3.2 AI-driven process optimization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By production technology

- 3.9 Future market trends

- 3.10 Technology and Innovation landscape

- 3.10.1 Current technological trends

- 3.10.2 Emerging technologies

- 3.11 Patent Landscape

- 3.12 Trade statistics (HS code)

( Note: the trade statistics will be provided for key countries only)

- 3.12.1 Major importing countries

- 3.12.2 Major exporting countries

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.14 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Production Technology, 2021-2034 (USD Billion)

- 5.1 Key trends

- 5.2 Heterotrophic fermentation systems

- 5.3 Phototrophic cultivation systems

- 5.4 Hybrid cultivation systems

- 5.5 Advanced photobioreactor systems

- 5.6 Others

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Billion)

- 6.1 Key trends

- 6.2 Infant formula

- 6.3 Dietary supplements

- 6.3.1 Capsule & softgel

- 6.3.2 Liquid & powder supplement

- 6.4 Functional foods & beverages

- 6.5 Aquaculture feed

- 6.5.1 Fish feed

- 6.5.2 Shrimp & crustacean

- 6.6 Animal feed & pet food

- 6.6.1 Livestock nutrition

- 6.6.2 Feed additive

- 6.7 Pharmaceutical

- 6.7.1 Medical nutrition & therapeutic

- 6.7.2 Clinical trial

- 6.7.3 Drug delivery & formulation

- 6.8 Cosmetics & personal care

- 6.8.1 Anti-aging & skin health

- 6.8.2 Hair care & scalp health

Chapter 7 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Rest of Europe

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.4.6 Rest of Asia Pacific

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.5.4 Rest of Latin America

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

- 7.6.4 Rest of Middle East and Africa

Chapter 8 Company Profiles

- 8.1 Algatech

- 8.2 Algisys

- 8.3 CABIO Biotech

- 8.4 Cellana Inc

- 8.5 Corbion N.V.

- 8.6 DSM-Firmenich

- 8.7 Evonik Industries AG

- 8.8 Fermentalg

- 8.9 Mara Renewables Corporation

- 8.10 Nuseed

- 8.11 Qualitas Health