PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871085

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871085

Cultivated Seafood Production Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

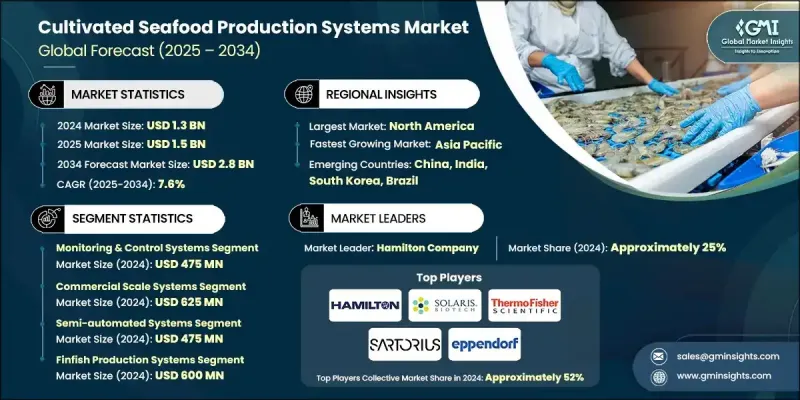

The Global Cultivated Seafood Production Systems Market was valued at USD 1.3 Billion in 2024 and is estimated to grow at a CAGR of 7.6% to reach USD 2.8 Billion by 2034.

Growing investment in cellular agriculture and rapid advancements in recirculating aquaculture systems (RAS) are major factors driving this growth. The industry is witnessing a clear transition toward commercial-scale production, with demand for advanced bioreactor systems and smart monitoring technologies accelerating. Supportive regulatory frameworks from the FDA and USDA, along with the establishment of quality standards for biotechnology and sustainable protein manufacturing, are providing a strong foundation for market expansion. Cultivated seafood systems are revolutionizing modern aquaculture by integrating automation, smart sensors, and precision control technologies that optimize production efficiency. As sustainable protein alternatives gain global traction, these systems are being positioned as a viable solution for meeting future food demands while maintaining environmental balance. Enhanced scalability and process optimization in cellular aquaculture are key to the rapid commercialization of these technologies. The market's momentum is further fueled by significant funding for research, coupled with innovations that make large-scale seafood cultivation a realistic and sustainable prospect.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.3 Billion |

| Forecast Value | $2.8 Billion |

| CAGR | 7.6% |

The 3D bioprinting systems segment will grow at a CAGR of 12.9% through 2034. This technology is transforming the production of structured seafood with complex tissue composition, enabling the development of high-value, premium products. The growing adoption of 3D bioprinting is attributed to its ability to deliver unique product textures and advanced differentiation compared to conventional production processes.

The pilot-scale systems segment accounted for USD 437.5 million in 2024, representing a 35% share. These systems play an essential role in process validation, scalability testing, and regulatory readiness. Modular RAS and pilot bioreactors are gaining popularity for their flexibility and cost-effectiveness in testing production efficiency before full-scale deployment. The adoption of pilot-scale technologies supports gradual expansion strategies in both cellular agriculture and modern aquaculture, ensuring optimal process performance and risk reduction during commercialization.

North America Cultivated Seafood Production Systems Market was valued at USD 437.5 million in 2024 and is anticipated to grow at a CAGR of 8.7% from 2025 to 2034. North America maintains its dominance in this industry due to its advanced biotechnology infrastructure and strong regulatory environment. The region demonstrates a high rate of adoption for automated systems and biotechnological innovations in cultivated seafood production. Ongoing technological developments in the United States and progressive aquaculture advancements in Canada continue to strengthen the region's market position.

Major players in the Global Cultivated Seafood Production Systems Market include Solaris Biotech (Donaldson), Hamilton Company, Thermo Fisher Scientific, Sartorius, Eppendorf, Steakholder Foods, CytoNest, Culture Biosciences, Prolific Machines, Molecular Devices, Ark Biotech, E-Tech Group, Cytiva (Danaher), Merck KGaA/EMD, Applikon Biotechnology, Matrix Meats, EdiMembre, and Hitachi Zosen. Leading companies are focusing on expanding their production capacities through the development of scalable and automated bioprocessing systems. Strategic collaborations with research institutions and startups are being pursued to accelerate innovation in cell culture and tissue engineering. Firms are heavily investing in smart monitoring technologies and digital automation to enhance system efficiency and reduce operational costs. Product differentiation through advanced design, precision control, and integrated IoT capabilities is a major area of focus.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Production technology trends

- 2.2.2 Scale of operation trends

- 2.2.3 Automation level trends

- 2.2.4 Product application trends

- 2.2.5 Regional trends

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Drivers

- 3.2.2 Pitfalls & Challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product format

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Production Technology, 2021-2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Monitoring & control systems

- 5.3 Bioreactor systems

- 5.4 Cell culture systems

- 5.5 Scaffolding systems

- 5.6 3d bioprinting systems

Chapter 6 Market Estimates and Forecast, By Scale of Operation, 2021-2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Laboratory scale systems

- 6.3 Pilot scale systems

- 6.4 Commercial scale systems

Chapter 7 Market Estimates and Forecast, By Automation Level, 2021-2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Manual operation systems

- 7.3 Semi-automated systems

- 7.4 Fully automated systems

- 7.5 Integrated turnkey solutions

Chapter 8 Market Estimates and Forecast, By Product Application, 2021-2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 Finfish production systems

- 8.3 Shellfish production systems

- 8.4 Structured product manufacturing

- 8.5 Unstructured product processing

- 8.6 Hybrid product manufacturing

- 8.7 Specialty & premium products

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 (USD Million & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Solaris Biotech (Donaldson)

- 10.2 Hamilton Company

- 10.3 Thermo Fisher Scientific

- 10.4 Sartorius

- 10.5 Eppendorf

- 10.6 Steakholder Foods

- 10.7 CytoNest

- 10.8 Culture Biosciences

- 10.9 Prolific Machines

- 10.10 Molecular Devices

- 10.11 Ark Biotech

- 10.12 E-Tech Group

- 10.13 Cytiva (Danaher)

- 10.14 Merck KGaA/EMD

- 10.15 Applikon Biotechnology