PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858968

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858968

Pulmonary Arterial Hypertension Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

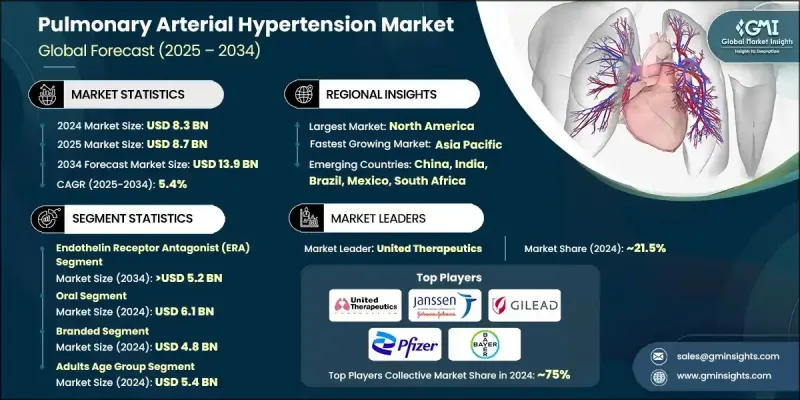

The Global Pulmonary Arterial Hypertension Market was valued at USD 8.3 billion in 2024 and is estimated to grow at a CAGR of 5.4% to reach USD 13.9 billion by 2034.

The rise in market demand is attributed to the increasing number of PAH cases worldwide, advancements in drug therapies, and ongoing efforts by regulatory agencies such as the FDA and EMA to support the development of new PAH treatments. As diagnostic technologies and biomarker screening methods improve, early detection of PAH has become more effective, contributing to better management of the disease. The growing investments in healthcare infrastructure, particularly in emerging regions like Asia-Pacific and Latin America, have also played a key role in expanding access to PAH treatments. Countries such as China, India, and Brazil are seeing enhanced availability of therapies due to improvements in healthcare systems and government-driven awareness initiatives. Biosimilars entering the market are helping to make treatments more affordable, further boosting accessibility in developing regions. Pharmaceutical companies are also leveraging strategic mergers, acquisitions, and partnerships to diversify their portfolios and accelerate innovation in PAH drug development.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.3 Billion |

| Forecast Value | $13.9 Billion |

| CAGR | 5.4% |

The endothelin receptor antagonist (ERA) segment held a 37.3% share in 2024, and it is projected to reach USD 5.2 billion by 2034, growing at a CAGR of 5.4%. ERAs, such as bosentan, ambrisentan, and macitentan, block endothelin-1, a key vasoconstrictor involved in the development of PAH. These drugs help reduce pulmonary vascular resistance and improve exercise capacity, making them a common choice for long-term disease management.

In 2024, the oral drug segment generated USD 6.1 billion, and it is preferred by many patients due to the convenience of administration, reducing the need for frequent hospital visits and complex medical equipment. Oral therapies are associated with fewer side effects and better safety profiles, which make them suitable for long-term use, especially among patients with other health conditions.

U.S. Pulmonary Arterial Hypertension Market was valued at USD 4 billion in 2024, driven by the rising prevalence of the disease, particularly among older populations and individuals with other comorbidities such as COPD. Early detection facilitated by advanced diagnostic methods, including echocardiography and biomarker testing, is contributing to a larger pool of patients seeking treatment, fueling demand for PAH therapies. U.S.-based companies are at the forefront of PAH research, driving innovation in the treatment space.

Prominent companies active in the Global Pulmonary Arterial Hypertension Market include Merck KGaA, Bayer, Gilead Sciences, GlaxoSmithKline (GSK), Pfizer, Janssen Pharmaceuticals (Johnson & Johnson), United Therapeutics, Gmax Biopharm, Resverlogix, Liquidia Technologies, Gossamer Bio, Galectin Therapeutics, and Novartis. To strengthen their position in the Pulmonary Arterial Hypertension Market, companies are focusing on expanding their product portfolios through research and development of new therapies and improving patient access to treatments. Many are investing in partnerships, mergers, and acquisitions, often with smaller biotech firms, to acquire innovative and late-stage assets. Companies are also prioritizing strategic regional investments in emerging markets to make treatments more affordable and available, especially by establishing local production facilities. This approach not only reduces costs but also aligns with the growing trend of biosimilars, which help lower pricing barriers in developing markets.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Drug class trends

- 2.2.3 Route of administration trends

- 2.2.4 Type trends

- 2.2.5 Age group trends

- 2.2.6 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of PAH and related conditions

- 3.2.1.2 Advancement in drug therapies

- 3.2.1.3 Increasing shift toward personalized treatment

- 3.2.1.4 Improved healthcare infrastructure in developing countries

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High treatment cost

- 3.2.2.2 Limited access to specialists

- 3.2.2.3 Regulatory challenges

- 3.2.3 Market opportunities

- 3.2.3.1 Growing usage of combination therapy

- 3.2.3.2 Rising integration of gene therapy and regenerative medicine

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.1 North America

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Pricing analysis

- 3.8 Clinical trial analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Drug Class, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Prostacyclin and prostacyclin analogs

- 5.3 Soluble guanylate cyclase (SGC) stimulators

- 5.4 Endothelin receptor antagonist (ERA)

- 5.5 Phosphodiesterase 5 (PDE-5)

- 5.6 Vasodilators

- 5.7 Other drug classes

Chapter 6 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Oral

- 6.3 Intravenous

- 6.4 Inhalation

Chapter 7 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Branded

- 7.3 Generics

Chapter 8 Market Estimates and Forecast, By Age Group, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Pediatrics

- 8.3 Adult

- 8.4 Geriatrics

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals

- 9.3 Specialty clinics

- 9.4 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Bayer

- 11.2 F. Hoffmann La Roche

- 11.3 GlaxoSmithKline (GSK)

- 11.4 Gilead Sciences

- 11.5 Gmax Biopharm

- 11.6 Gossamer Bio

- 11.7 Galectin Therapeutics

- 11.8 Janssen Pharmaceuticals (Johnson & Johnson)

- 11.9 Liquidia Technologies

- 11.10 Merck KGaA

- 11.11 Novartis

- 11.12 Pfizer

- 11.13 Resverlogix

- 11.14 United Therapeutics