PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858979

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858979

Europe Veterinary Assistive Reproduction Technology Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

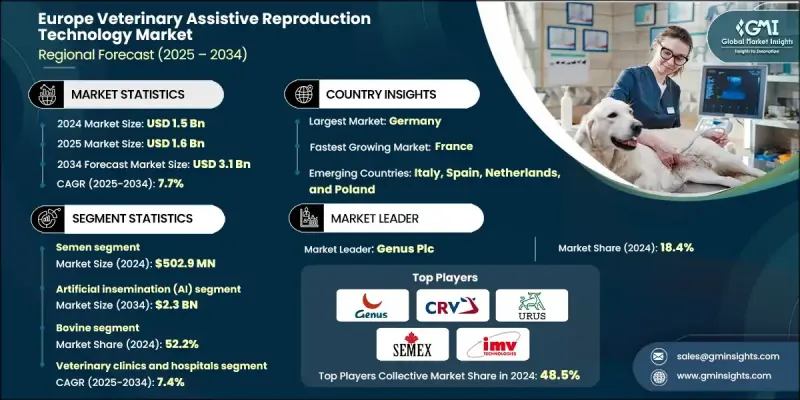

Europe Veterinary Assistive Reproduction Technology Market was valued at USD 1.5 billion in 2024 and is estimated to grow at a CAGR of 7.7% to reach USD 3.1 billion by 2034.

The rising demand for efficient livestock breeding and increased meat and dairy production is accelerating the adoption of advanced reproductive techniques across the region. Assistive reproduction technologies are enabling farmers to enhance herd genetics, reduce breeding cycles, and boost productivity. These solutions help optimize animal yield using advanced genetic material and controlled breeding protocols. With a growing focus on food security and sustainable farming practices, government support in the form of subsidies and livestock-focused initiatives is encouraging the uptake of these technologies. Veterinary ART is also proving effective in reducing disease transmission risks linked to traditional mating practices. In addition, advances in veterinary science and the integration of digital tools are widening the accessibility of such technologies to both large-scale operations and smaller clinics. The combination of increased market awareness, improving veterinary infrastructure, and expanding livestock populations across Europe is fueling steady growth in the Europe veterinary assistive reproduction technology market across the region.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.5 Billion |

| Forecast Value | $3.1 Billion |

| CAGR | 7.7% |

Veterinary assistive reproduction technology refers to a group of specialized breeding solutions designed to improve reproductive performance in animals. These include processes like embryo transfer, in vitro fertilization, artificial insemination, and related techniques. Recent technological developments in cryopreservation, ovum pick-up (OPU), and precision breeding are enabling easier and more cost-effective application of these methods across various settings. Improvements in the cold chain logistics and advanced semen storage capabilities have also enhanced the viability and efficiency of ART procedures in remote and underserved regions. These developments are not only improving reproductive outcomes but also expanding the reach of ART to more farms and veterinary facilities.

The semen segment generated USD 502.9 million in 2024. Semen remains a key component of artificial insemination due to its ability to enable genetic selection, improve herd quality, and prevent disease transmission. The use of semen from genetically superior animals allows breeders to implement effective selective breeding programs. This segment continues to gain traction among farmers who prioritize reproductive control and herd optimization as part of their livestock management strategy.

The bovine segment held a 52.2% share in 2024. Cattle farming continues to lead in the adoption of veterinary ART as producers strive to boost milk and beef production. These techniques help improve genetics, minimize hereditary conditions, and elevate the overall productivity of herds. The sustained demand for high-quality meat and dairy products is reinforcing the use of ART technologies in cattle breeding programs throughout the region.

Germany Veterinary Assistive Reproduction Technology Market generated USD 290.5 million in 2024. The country's strong veterinary infrastructure, combined with significant investment in animal healthcare services, is supporting market expansion. A large livestock base and growing reliance on specialized reproductive technologies are further strengthening Germany's market presence, especially in areas such as artificial insemination and embryo transfer.

Key players shaping the competitive landscape of the Europe Veterinary Assistive Reproduction Technology Market include CRV Holdings, Avantea, STgenetics, Select Sires, VikingGenetics, Minitube Group, AB Europe, SEMEX, Stallion AI Services, Genus Plc, URUS Group, IMV Technologies, Bovine Elite, Geno SA, and Besamungsstation Greifenberg. To reinforce their presence in the Europe veterinary assistive reproduction technology market, leading companies are focusing on a range of strategic initiatives. These include broadening their service portfolios with next-generation ART tools and technologies and investing in research for more precise and scalable reproductive solutions. Collaborations with veterinary institutions and agricultural organizations are being pursued to increase awareness and adoption of ART among end-users.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional

- 1.3.2 Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Country

- 2.2.2 Type trends

- 2.2.3 Technology trends

- 2.2.4 Animal type trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for genetic improvement in livestock

- 3.2.1.2 Advancements in genomics and reproductive technologies

- 3.2.1.3 Rising government and industry support programs

- 3.2.1.4 Improved veterinary infrastructure and spending

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High costs of ART procedures

- 3.2.2.2 Regulatory complexity across Europe

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion into equine and companion animal sectors

- 3.2.3.2 Emerging markets within Europe

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Livestock population, by country

- 3.7 Europe milk production, by country ('000 tons)

- 3.8 Europe meat production

- 3.8.1 Leading veal and beef producers (% share)

- 3.8.2 Leading pigmeat producers (% share)

- 3.8.3 Leading poultry meat producers (% share)

- 3.8.4 Leading producers of chicken meat (% share)

- 3.9 Future market trends

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Services

- 5.3 Semen

- 5.3.1 Normal semen

- 5.3.2 Sexed semen

- 5.4 Instruments

- 5.5 Kits and consumables

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Artificial insemination (AI)

- 6.3 In vitro fertilization (IVF)

- 6.4 Embryo transfer (MOET)

- 6.5 Other technologies

Chapter 7 Market Estimates and Forecast, By Animal Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Bovine

- 7.3 Swine

- 7.4 Ovine

- 7.5 Caprine

- 7.6 Equine

- 7.7 Other animal types

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Veterinary clinics and hospitals

- 8.3 Animal breeding centers

- 8.4 Research institutes and universities

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Country, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Germany

- 9.3 UK

- 9.4 France

- 9.5 Italy

- 9.6 Spain

- 9.7 Poland

- 9.8 Netherlands

Chapter 10 Company Profiles

- 10.1 Avantea

- 10.2 AB Europe

- 10.3 Besamungsstation Greifenberg

- 10.4 Bovine Elite

- 10.5 CRV Holdings

- 10.6 Geno SA

- 10.7 Genus Plc

- 10.8 IMV Technologies

- 10.9 Minitube Group

- 10.10 SEMEX

- 10.11 Select Sires

- 10.12 STgenetics

- 10.13 Stallion AI Services

- 10.14 URUS Group

- 10.15 VikingGenetics