PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858980

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858980

Europe District Heating Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

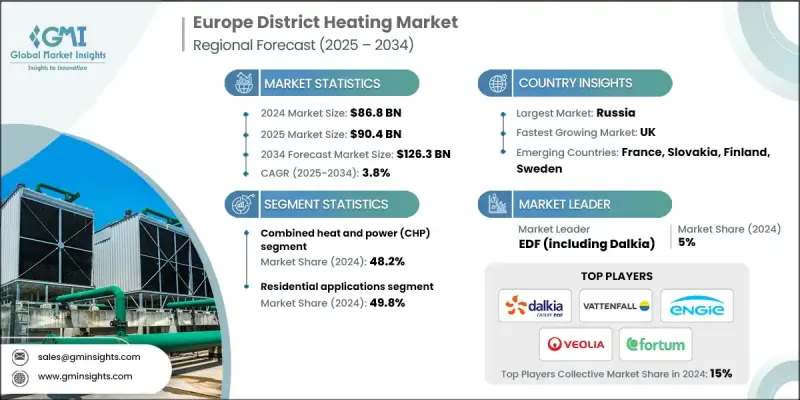

Europe District Heating Market was valued at USD 86.8 billion in 2024 and is estimated to grow at a CAGR of 3.8% to reach USD 126.3 billion by 2034.

The growth is driven by region-wide decarbonization targets and evolving climate policies. The European Union has laid out ambitious plans to transition the heating sector toward full carbon neutrality by 2050, positioning district heating systems as a vital part of this transformation. Investments are pouring into renewable heat generation, infrastructure upgrades, and next-generation distribution systems. Countries across Europe are scaling up domestic heat production with advanced technologies such as 5th-generation heating and cooling networks, waste heat recovery solutions, and large-scale heat pumps. Rising geopolitical instability and the push for energy sovereignty are accelerating shifts away from fossil-based heating systems. In addition, new EU directives now require municipalities with over 45,000 residents to draft structured heating and cooling plans. These initiatives are reinforcing demand for efficient, decentralized thermal energy networks across urban centers. Enhanced geothermal systems and heat recovery technologies are further supporting cost reductions and efficiency gains across the region's heating infrastructure.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $86.8 Billion |

| Forecast Value | $126.3 Billion |

| CAGR | 3.8% |

In 2024, the combined heat and power (CHP) systems captured a 48.2% share, due to widespread deployment and operational efficiency. CHP units simultaneously produce electricity and usable heat, delivering higher efficiency than separate heat and power systems. This segment continues to benefit from strong regulatory incentives, particularly in countries with energy-intensive industrial bases. Emerging developments include power-to-heat integration and thermal storage systems that boost flexibility and support grid balancing. High-efficiency cogeneration has been acknowledged by EU policies as a critical pathway for boosting overall energy performance, which further fuels investment in this space.

The residential sector held a 49.8% share in 2024 and is forecast to grow at a 3.6% CAGR through 2034. High urban density, strong connection rates, and policy backing for clean heating technologies make this segment a key growth area. New housing developments, upgrades to existing homes, and efforts to phase out standalone boilers are enhancing demand for centralized heat supply. In addition to cost advantages in urban settings, the residential sector benefits from financial incentives for heat pump adoption and building efficiency enhancements. Increasing adoption of digital heating controls, smart metering, and demand-side management tools is also helping optimize energy use and reduce costs for homeowners.

Russia District Heating Market accounted for 48.9% share in 2024 and is anticipated to grow at 3% CAGR through 2034. The country has one of the most mature and expansive heating networks in the region, largely driven by cold climate needs and historical infrastructure development. While system coverage is vast, growth remains tempered by limited investment in upgrading aging assets and integrating renewable energy sources.

Key players active in the Europe District Heating Market include Goteborg Energi, EnBW, Fortum, Veolia, ALFA LAVAL, EDF (including Dalkia), Orsted A/S, Danfoss, ENGIE, Uniper SE, Kamstrup, Hafslund AS, Ramboll Group A/S, Vattenfall AB, LOGSTOR Denmark Holding ApS, SUEZ, KELAG Energy & Heat GmbH, E.ON SE, Statkraft AS, RWE, and STEAG GmbH. To strengthen their presence in the Europe District Heating Market, leading companies are investing in hybrid and renewable-powered heat generation assets and embracing intelligent distribution networks. Many players are upgrading existing infrastructure to enhance efficiency while integrating digital monitoring systems for real-time performance tracking. Collaborations with municipalities and utility providers are common, ensuring tailored solutions aligned with local heating and cooling plans. Several firms are also expanding their service portfolios to include engineering, maintenance, and energy optimization services.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.3 Forecast model

- 1.3.1 Key trends for market estimates

- 1.3.2 Quantified market impact analysis

- 1.3.2.1 Mathematical impact of growth parameters on forecast

- 1.3.3 Scenario analysis framework

- 1.4 Primary research and validation

- 1.4.1 Some of the primary sources (but not limited to)

- 1.4.2 Data mining sources

- 1.4.3 Paid Sources

- 1.4.3.1 Sources, by region

- 1.5 Research Trail & confidence scoring

- 1.5.1 Research trail components

- 1.5.2 Scoring components

- 1.6 Research transparency addendum

- 1.6.1 Source attribution framework

- 1.6.2 Quality assurance metrics

- 1.6.3 Our commitment to trust

- 1.7 Market definitions

Chapter 2 Europe District Heating Industry Insights

- 2.1 Industry ecosystem analysis

- 2.1.1 Key suppliers and technology providers

- 2.1.2 Logistics, distribution, and services

- 2.2 Regulatory landscape

- 2.3 Industry impact forces

- 2.3.1 Growth drivers

- 2.3.1.1 Government norms toward zero emission buildings

- 2.3.1.2 Extreme climatic conditions

- 2.3.1.3 Government incentives towards adoption of district heating systems

- 2.3.2 Industry pitfalls & challenges

- 2.3.1 Growth drivers

- 2.4 Growth potential analysis

- 2.5 Porter's Analysis

- 2.5.1 Bargaining power of suppliers

- 2.5.2 Bargaining power of buyers

- 2.5.3 Threat of new entrants

- 2.5.4 Threat of substitutes

- 2.6 PESTEL Analysis

- 2.6.1 Political factors

- 2.6.2 Economic factors

- 2.6.3 Social factors

- 2.6.4 Technological factors

- 2.6.5 Environmental factors

- 2.6.6 Legal factors

- 2.7 Cost structure analysis of district heating system

- 2.8 Price trend analysis, by country

- 2.9 Future market outlook & emerging opportunities

- 2.10 Case study analysis - Integrated DHC system in Stockholm

- 2.10.1 Project overview

- 2.10.2 Key facts & figures

- 2.10.3 Customer segmentation

- 2.10.4 Policies & incentives supporting the DHC

Chapter 3 Competitive Benchmarking

- 3.1 Introduction

- 3.2 Company market share analysis, 2024

- 3.3 Strategic dashboard

- 3.4 Strategic initiatives

- 3.4.1 Major M&A activities

- 3.4.2 Key partnerships and collaborations

- 3.4.3 Product innovations and launches

- 3.4.4 Market expansion strategies

- 3.5 Competitive benchmarking

- 3.6 Innovation & sustainability landscape

Chapter 4 Market Size & Forecast, By Source, 2021 - 2034 (PJ & USD Billion)

- 4.1 Key trends

- 4.2 CHP

- 4.3 Geothermal

- 4.4 Solar

- 4.5 Heat only boilers

- 4.6 Others

Chapter 5 Market Size & Forecast, By Application, 2021 - 2034 (PJ & USD Billion)

- 5.1 Key trends

- 5.2 Residential

- 5.3 Commercial

- 5.3.1 College/University

- 5.3.2 Office buildings

- 5.3.3 Government/Military

- 5.3.4 Others

- 5.4 Industrial

- 5.4.1 Chemical

- 5.4.2 Refinery

- 5.4.3 Paper

- 5.4.4 Others

Chapter 6 Market Size & Forecast, By Country, 2021 - 2034 (PJ & USD Billion)

- 6.1 Key trends

- 6.2 Germany

- 6.3 Poland

- 6.4 Russia

- 6.5 Sweden

- 6.6 Finland

- 6.7 Italy

- 6.8 Denmark

- 6.9 UK

- 6.10 Slovakia

- 6.11 Austria

- 6.12 Czech Republic

- 6.13 France

Chapter 7 Company Profiles

- 7.1 ALFA LAVAL

- 7.2 Danfoss

- 7.3 E.ON SE

- 7.4 ENGIE

- 7.5 EnBW

- 7.6 EDF (including Dalkia)

- 7.7 Fortum

- 7.8 Goteborg Energi

- 7.9 Hafslund AS

- 7.10 Kamstrup

- 7.11 KELAG Energy & Heat GmbH

- 7.12 LOGSTOR Denmark Holding ApS

- 7.13 Orsted A/S

- 7.14 Ramboll Group A/S

- 7.15 RWE

- 7.16 Statkraft AS

- 7.17 STEAG GmbH

- 7.18 SUEZ

- 7.19 Uniper SE

- 7.20 Vattenfall AB

- 7.21 Veolia