PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1859022

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1859022

Smart Sensor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

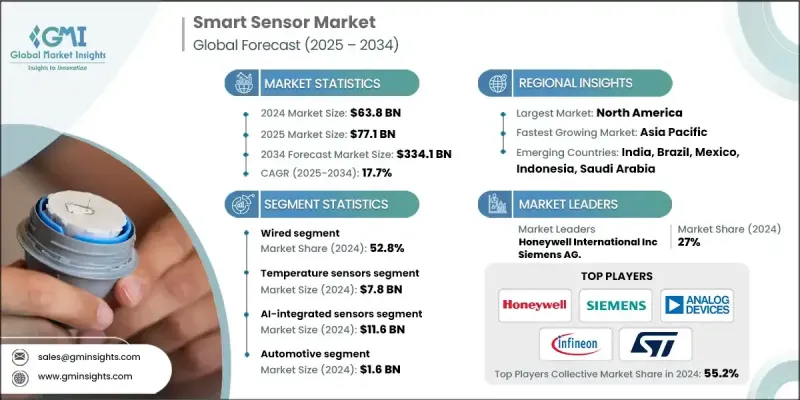

The Global Smart Sensor Market was valued at USD 63.8 billion in 2024 and is estimated to grow at a CAGR of 17.7% to reach USD 334.1 billion by 2034.

This growth is driven by the widespread adoption of IoT-enabled solutions across various industrial and commercial sectors. The increasing focus on predictive maintenance and real-time operational dashboards, which rely heavily on advanced sensor technologies, is further propelling the market. Industries like manufacturing, automotive, and smart infrastructure are integrating these technologies to improve efficiency and reduce operational risks. Sectors such as healthcare are also embracing smart sensors for remote monitoring and diagnostics. The rise of smart cities, especially in North America and Europe, is contributing to the growth, as more cities implement intelligent infrastructure to optimize energy use and improve urban living. Additionally, the automotive sector is a key growth driver, especially with the rise of electrification and autonomous driving technologies. As these trends continue, the market for smart sensors is expanding rapidly across multiple sectors, offering opportunities for further innovations in sensor design and applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $63.8 Billion |

| Forecast Value | $334.1 Billion |

| CAGR | 17.7% |

The wired smart sensor segment held a 52.8% share in 2024. This segment's dominance is fueled by the growing demand for remote monitoring and control, made possible by the proliferation of IoT. Wired sensors are known for their flexibility in installation, scalability, and ability to collect data from hard-to-reach areas, making them essential for smart cities, industrial applications, and environmental monitoring.

The temperature sensors segment generated USD 7.8 billion in 2024 and is another key component of the market. Their widespread use across industries such as automation, healthcare, and home systems is due to their role in ensuring energy efficiency, safety, and process monitoring. Temperature sensors also play an important role in optimizing operations and improving the reliability of critical systems.

U.S. Smart Sensor Market was valued at USD 17.2 billion in 2024, with healthcare applications, particularly in wearable devices and remote patient monitoring, driving significant growth. The increasing prevalence of chronic diseases and the shift towards telemedicine are factors fueling this demand.

Leading companies in the Global Smart Sensor Industry include Siemens AG, Honeywell International Inc., STMicroelectronics, Analog Devices, Inc., and Infineon Technologies AG. These companies are leveraging advanced technologies to strengthen their market position by focusing on product innovation, strategic partnerships, and expansion into emerging markets. Some key strategies include the development of sensors that are smaller, more accurate, and highly integrated with IoT systems. Companies are also enhancing sensor functionalities, enabling them to provide real-time data analytics and AI-powered insights, which are increasingly in demand for applications in smart cities, healthcare, and industrial IoT.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Sensor type trends

- 2.2.2 Network trends

- 2.2.3 Technology trends

- 2.2.4 End use trends

- 2.2.5 Regional trends

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Automotive Sensor Adoption

- 3.2.1.2 Healthcare & Wearables

- 3.2.1.3 Industrial Automation & Industry 4.0

- 3.2.1.4 IoT & Smart Infrastructure

- 3.2.1.5 Advanced Technology Integration

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High Implementation and Integration Costs

- 3.2.2.2 Market Fragmentation & Interoperability

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging business models

- 3.9 Compliance requirements

- 3.10 Consumer sentiment analysis

- 3.11 Patent and IP analysis

- 3.12 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.2 Market concentration analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Digital Transformation Initiatives

- 4.5 Emerging/ Startup Competitors Landscape

Chapter 5 Market Estimates & Forecast, By Sensor Type, 2021-2034 (USD Billion & Units)

- 5.1 Key trends

- 5.2 Temperature Sensor

- 5.3 Pressure Sensors

- 5.4 Touch Sensors (Includes Force Sensors)

- 5.5 Position Sensor

- 5.6 Motion Sensors

- 5.7 Image Sensors

- 5.8 Flow Sensors

- 5.9 Level Sensors

- 5.10 Gas Sensors

- 5.11 Humidity Sensors

- 5.12 Biosensors / Chemical Sensors

- 5.13 Optical / Photonic Sensors

- 5.14 Piezoelectric Sensors

- 5.15 Others

Chapter 6 Market Estimates & Forecast, By Network, 2021-2034 (USD Billion & Units)

- 6.1 Key trends

- 6.2 Wired

- 6.3 Wireless

Chapter 7 Market Estimates & Forecast, By Technology, 2021-2034 (USD Billion & Units)

- 7.1 Key trends

- 7.2 Quantum Sensors

- 7.3 AI-Integrated Sensors

- 7.4 Advanced MEMS

- 7.5 Photonic & Optical Advanced

- 7.6 Bio-Integrated Sensors

- 7.7 Edge Computing Integration

- 7.8 Cybersecurity-Hardened Sensors

- 7.9 Others

Chapter 8 Market Estimates & Forecast, By End use, 2021-2034 (USD Billion & Units)

- 8.1 Key trends

- 8.2 Commercial/Industrial Building

- 8.3 Residential Building/Smart Homes

- 8.4 Consumer Electronics

- 8.5 Automotive

- 8.6 Oil & Gas

- 8.7 Aerospace & Defense

- 8.8 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 Honeywell International Inc.

- 10.1.2 Siemens AG

- 10.1.3 Analog Devices, Inc.

- 10.1.4 Infineon Technologies AG

- 10.1.5 STMicroelectronics

- 10.2 Regional Market Champions

- 10.2.1 DENSO CORPORATION

- 10.2.2 Bosch Sensortec GmbH

- 10.2.3 TE Connectivity

- 10.2.4 NXP Semiconductors

- 10.2.5 OmniVision Technologies, Inc.

- 10.3 Emerging Technology Innovators

- 10.3.1 PixArt Imaging Inc.

- 10.3.2 Aeva Technologies

- 10.3.3 Oura Health Ltd.

- 10.3.4 Myriota

- 10.3.5 LiXiA

- 10.4 Specialized Solution Providers

- 10.4.1 Advantech Co., Ltd.

- 10.4.2 Raritan Inc.

- 10.4.3 Alpha MOS

- 10.4.4 Figaro Engineering Inc.

- 10.4.5 BorgWarner Inc.