PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850221

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850221

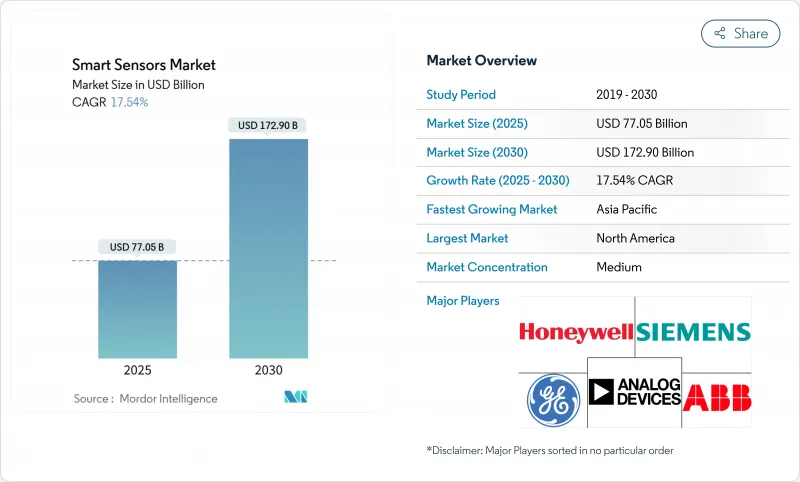

Smart Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The smart sensors market reached USD 77.05 billion in 2025 and is forecast to rise to USD 172.90 billion by 2030, translating into a robust 17.54% CAGR.

This growth trajectory is propelled by the convergence of edge artificial intelligence, tightening automotive and healthcare regulations, and industrial automation programs that are moving enterprises from reactive monitoring to predictive intelligence. Mandatory safety features such as automatic emergency braking in vehicles and continuous patient monitoring in medical devices are translating into non-discretionary sensor demand across developed markets. At the same time, edge-AI cores embedded in the latest sensor generations eliminate latency and bandwidth bottlenecks, allowing real-time analytics within power-constrained environments. Supply-chain pressures around gallium and germanium and the race for semiconductor self-sufficiency are keeping average selling prices firm even as unit volumes rise, giving manufacturers headroom for sustained R&D investment. Over the forecast period, performance differentiation is shifting from raw sensitivity metrics to on-board intelligence, cyber-security compliance, and integration flexibility-factors now decisive in procurement shortlists.

Global Smart Sensors Market Trends and Insights

Energy-efficiency Push Across Industrial IoT

Legally binding sustainability reporting is prompting manufacturers to deploy intelligent sensors that deliver measurable kWh savings and CO2 reductions. The European Corporate Sustainability Reporting Directive requires granular energy metrics, pushing factories to install edge-AI sensors that continuously optimise HVAC, lighting, and machine utilisation. SECO's smart CNC retrofit cut production waste by 30% and spare-parts spend by 10%, showcasing hard-dollar returns that justify fleet-wide rollouts. Similar results at Lech-Stahlwerke's 5G-enabled mill have turned energy-efficiency projects into board-level priorities. As early adopters report double-digit cost reductions, laggards face competitive pressure to follow suit, creating a self-reinforcing demand cycle for intelligent sensors.

Consumer-electronics Sensor Proliferation

Smartphone and wearable OEMs now integrate up to a dozen sensor types per device, supporting features such as air-quality measurement, advanced biometrics, and self-learning activity tracking. Bosch confirms that more than half of 2025 handset launches ship with its multi-sensor modules. High-volume consumer demand delivers scale economies that drive per-unit cost down across industrial and automotive tiers, opening new price-performance thresholds. Miniaturisation and milliwatt-level power consumption perfected for wearables are now migrating into factory condition-monitoring nodes and autonomous delivery robots, accelerating cross-industry adoption of edge-ready sensor stacks.

High Upfront Deployment Cost

Comprehensive smart sensor rollouts frequently require parallel investment in edge gateways, private 5G networks, and workforce reskilling. For many small and midsized plants, total outlay can exceed 0.5% of annual revenue, deferring breakeven beyond four fiscal quarters. Milesight's turnkey IoT kit for Seoul SMEs bundles LoRaWAN gateways and controllers to lower integration friction, yet even this "all-in-one" package strains capital budgets. Cost headwinds are easing as MEMS volumes scale, but budgetary caution is expected to temper adoption among cash-constrained operators over the next 24 months.

Other drivers and restraints analyzed in the detailed report include:

- Automotive & E-health Safety Mandates

- On-sensor Edge-AI Lowers Latency

- Complex Design & Integration Skill Gap

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Pressure sensors contributed USD 21.88 billion in 2024, translating to the largest 28.40% share of the smart sensors market. The segment's durability stems from its irreplaceable role in ADAS braking, EV battery management, and medical ventilators. Parallel innovation in silicon-carbide diaphragms now extends operating envelopes above 600 °C for aerospace and hydrogen fuel-cell stacks. Image sensors, while smaller in revenue terms, are forecast to grow at 19.20% CAGR as autonomous driving mandates make pedestrian-detection cameras standard equipment. Integration of global-shutter and event-based pixels is allowing high-contrast performance under rapidly changing lighting, enabling vehicle OEMs to comply with AEB regulations without expensive LiDAR redundancy.

Demand diversification is also reshaping unit economics. Temperature, humidity, and flow sensors are piggy-backing on smart-city water-grid and data-center thermal-management projects, while six-axis position sensors are becoming mandatory in collaborative robots. Hybrid modules that blend pressure, temperature, and relative humidity sensing deliver installation savings and strengthen vendor lock-in by raising switching costs for OEMs.

MEMS devices captured 46.00% of smart sensors market share in 2024 due to mature foundry ecosystems and cost structures tuned for smartphone volumes. Bosch alone shipped over 6 billion MEMS units in 2024, underscoring the scale advantage. However, photonic and quantum-enhanced sensors are projected to expand at 21.50% CAGR and could clip MEMS share in high-precision navigation and medical diagnostics. Citigroup estimates the quantum sensing addressable market could reach USD 1.4 billion by 2030, catalyzing venture capital inflows. MEMS incumbents are responding by co-integrating BioMEMS channels and edge-AI DSP cores to keep volume buyers within their technology roadmap.

Industry consortia such as the US-JOINT program, which includes 3M, are accelerating material R&D to secure domestic supply chains for advanced substrates. A parallel push into neuromorphic compute tiles embedded in MEMS modules aims to deliver cognitive functionality without sacrificing the size-cost advantage that underpin MEMS leadership.

The Smart Sensors Market is Segmented by Type (Flow Sensor, Humidity Sensor, Position Sensor, Pressure Sensor, and More), by Technology (MEMS, CMOS, Optical Spectroscopy, and More), by Component (Analog-To-Digital Converter, Digital-To-Analog Converter, Amplifier, and More), by Application (Aerospace and Defense, Automotive and Transportation, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific delivered 44.30% of 2024 global revenue and is expected to record a 19.70% CAGR through 2030, underpinned by China's 14th Five-Year Plan subsidies for domestic sensing ICs and Japan's coordinated quantum-sensing R&D grants. China's domestic market hit CNY 285 billion (USD 39.8 billion) in 2024, with automotive, factory automation, and network communications each capturing above-20% share. Regional foundries benefit from captive demand and lower input-cost inflation, prompting vertically integrated OEMs to localise entire supply chains.

North America remains technological bellwether, particularly in automotive ADAS and aerospace sensing. Honeywell's strategic partnership with NXP to co-develop AI-ready avionics exemplifies the region's focus on functional safety and edge compute. Ongoing US industrial-policy incentives, including CHIPS Act grants, are encouraging on-shoring of MEMS lines by ams OSRAM and GlobalFoundries, improving regional resilience.

Europe, while trailing APAC in volume, benefits from regulatory pull. The EU General Safety Regulation II sets a baseline of mandatory sensor suites in every new vehicle, guaranteeing steady volume ramps even in economic downturns. Additionally, corporate carbon-reduction targets are stimulating demand for building-automation and industrial-efficiency sensors across Germany, France, and the Nordics.

Emerging markets in the Middle East, Africa, and South America show accelerating sensor uptake through smart-city and resource-sector digitisation agendas. Saudi Arabia's giga-projects require dense environmental and traffic-management sensor grids, whereas Chilean copper mines are installing ruggedised vibration sensors to raise extraction efficiency. Low-latency satellite backhaul solutions are easing connectivity barriers, allowing these regions to adopt advanced sensing without legacy telecom infrastructure.

- ABB

- Honeywell International

- Eaton Corporation

- Analog Devices

- Infineon Technologies

- NXP Semiconductors

- STMicroelectronics

- Siemens AG

- TE Connectivity

- Legrand

- General Electric

- Vishay Intertechnology

- Bosch Sensortec

- Texas Instruments

- Omron Corporation

- Sensirion AG

- Murata Manufacturing

- Sony Semiconductor

- Samsung Electronics

- Robert Bosch GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Energy-efficiency push across industrial IoT

- 4.2.2 Consumer-electronics sensor proliferation

- 4.2.3 Automotive and e-health safety mandates

- 4.2.4 Miniaturisation and wireless advances

- 4.2.5 On-sensor edge-AI lowers latency

- 4.2.6 ESG-driven live-monitoring adoption

- 4.3 Market Restraints

- 4.3.1 High upfront deployment cost

- 4.3.2 Complex design and integration skill gap

- 4.3.3 IoT cybersecurity exposure

- 4.3.4 Rare-earth packaging supply risk

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Flow Sensors

- 5.1.2 Humidity Sensors

- 5.1.3 Position Sensors

- 5.1.4 Pressure Sensors

- 5.1.5 Temperature Sensors

- 5.1.6 Image/Optical Sensors

- 5.1.7 Other Types

- 5.2 By Technology

- 5.2.1 MEMS

- 5.2.2 CMOS

- 5.2.3 Optical Spectroscopy

- 5.2.4 Quantum and Photonic

- 5.2.5 Other Technologies

- 5.3 By Component

- 5.3.1 Analog-to-Digital Converter

- 5.3.2 Digital-to-Analog Converter

- 5.3.3 Amplifier

- 5.3.4 Transceiver / RF Front-End

- 5.3.5 Embedded AI Core

- 5.3.6 Other Components

- 5.4 By Application

- 5.4.1 Aerospace and Defence

- 5.4.2 Automotive and Transportation

- 5.4.3 Healthcare and Medical Devices

- 5.4.4 Industrial Automation

- 5.4.5 Building and Home Automation

- 5.4.6 Consumer Electronics

- 5.4.7 Agriculture and Environmental

- 5.4.8 Other Applications

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 APAC

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Rest of APAC

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 UAE

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Kenya

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 ABB

- 6.4.2 Honeywell International

- 6.4.3 Eaton Corporation

- 6.4.4 Analog Devices

- 6.4.5 Infineon Technologies

- 6.4.6 NXP Semiconductors

- 6.4.7 STMicroelectronics

- 6.4.8 Siemens AG

- 6.4.9 TE Connectivity

- 6.4.10 Legrand

- 6.4.11 General Electric

- 6.4.12 Vishay Intertechnology

- 6.4.13 Bosch Sensortec

- 6.4.14 Texas Instruments

- 6.4.15 Omron Corporation

- 6.4.16 Sensirion AG

- 6.4.17 Murata Manufacturing

- 6.4.18 Sony Semiconductor

- 6.4.19 Samsung Electronics

- 6.4.20 Robert Bosch GmbH

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment