PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1859024

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1859024

Transport Fuel Cell Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

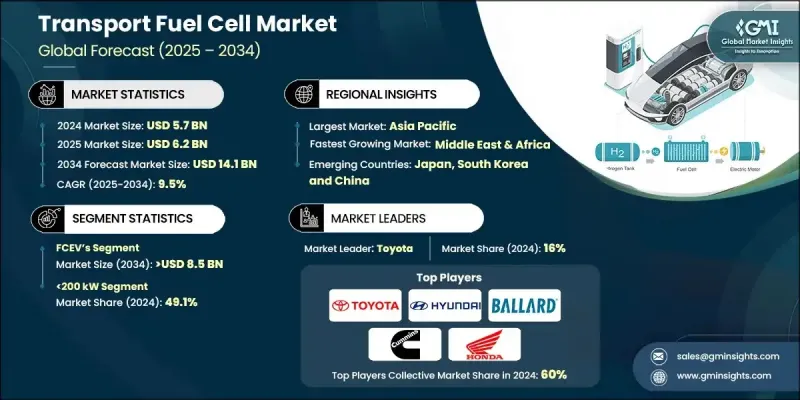

The Global Transport Fuel Cell Market was valued at USD 5.7 billion in 2024 and is estimated to grow at a CAGR of 9.5% to reach USD 14.1 billion by 2034.

This growth trajectory is fueled by the rising push for decarbonization and clean energy adoption across global transportation networks. Enhanced performance metrics in modern fuel cell systems, such as improved durability, cost optimization, and better efficiency, are making them a preferred solution in various transport applications. As hydrogen infrastructure continues to mature and national hydrogen targets are being rolled out by leading economies, the viability of fuel cells is expanding rapidly. Government mandates focused on slashing emissions across the mobility sector are prompting a large-scale shift toward zero-emission solutions, where fuel cells offer a strong alternative, particularly for heavy-duty, long-haul, and off-grid applications. These systems generate electricity to power electric motors, eliminating tailpipe emissions while delivering consistent output performance like combustion engines. Despite clear momentum, the market still contends with high upfront capital costs, operational reliability issues in extreme conditions, and underdeveloped hydrogen logistics, particularly in less mature regions. However, ongoing investment and public-private partnerships are working to mitigate these constraints and enhance global accessibility.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.7 Billion |

| Forecast Value | $14.1 Billion |

| CAGR | 9.5% |

The railway segment will grow at a CAGR of 9.5% through 2034, driven by the increasing use of fuel cells in both passenger and freight transport. These fuel cell-powered trains enable emission-free operations on rail networks lacking electrification, minimizing infrastructure costs and offering lower maintenance and quieter service. The technology is proving especially attractive in countries with vast rail networks needing sustainable retrofitting.

The fuel cells in the 200 kW to 1 MW capacity segment held a 34.7% share in 2024 and are projected to grow at an 8.5% CAGR through 2034. This power band is ideally suited for medium-duty commercial fleets, freight locomotives, and mid-sized marine vessels. It strikes a balance between energy output, system complexity, and cost, making it optimal for many real-world transport applications.

Europe Transport Fuel Cell Market is expected to reach USD 3 billion by 2034, influenced by the European Green Deal and heavy investment in hydrogen infrastructure. The region is witnessing strong deployment in rail applications and growing uptake in marine systems. Countries including Germany, Norway, and the Netherlands are actively shaping fuel cell transportation innovation, boosting overall product demand and infrastructure support.

Leading companies in the Global Transport Fuel Cell Market include Toyota Motor Corporation, Ballard Power Systems, Hyundai Motor Company, Honda Motor, BorgWarner Inc., Doosan Fuel Cell, Intelligent Energy Limited, ZF Friedrichshafen AG, Freudenberg, PowerCell Sweden, ElringKlinger, AISIN Corporation, Symbio, Nuvera Fuel Cells, Oorja Fuel Cells, AFC Energy PLC, Cummins, Wuhan Tiger Fuel Cell, Toshiba Corporation, and Nedstack Fuel Cell Technology. To strengthen their position in the transport fuel cell industry, key players are heavily investing in research and development to enhance the efficiency and lifecycle of their fuel cell systems. Many companies are forming partnerships with automotive and rail manufacturers to integrate their technologies into commercial vehicles and fleets. Several firms are scaling up production capacity and regional manufacturing hubs to support global demand and reduce supply chain friction.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.1.3 Base estimates and calculations

- 1.1.4 Base year calculation

- 1.1.5 Key trends for market estimates

- 1.2 Forecast model

- 1.3 Primary research & validation

- 1.3.1 Primary sources

- 1.4 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Product trends

- 2.4 Capacity trends

- 2.5 End use trends

- 2.6 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Price trend analysis, 2021-2034

- 3.5.1 By end use

- 3.5.2 By region

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Company benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Product, 2021 - 2034 (USD Million & MW)

- 5.1 Key trends

- 5.2 PEMFC

- 5.3 SOFC

- 5.4 DMFC

- 5.5 PAFC & AFC

- 5.6 MCFC

Chapter 6 Market Size and Forecast, By Capacity, 2021 - 2034 (USD Million & MW)

- 6.1 Key trends

- 6.2 <200 kW

- 6.3 200 kW - 1 MW

- 6.4 ≥ 1 MW

Chapter 7 Market Size and Forecast, By End Use, 2021 - 2034 (USD Million & MW)

- 7.1 Key trends

- 7.2 Marine

- 7.3 Railways

- 7.4 FCEVs

- 7.5 Others

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & MW)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Austria

- 8.4 Asia Pacific

- 8.4.1 Japan

- 8.4.2 South Korea

- 8.4.3 China

- 8.4.4 India

- 8.4.5 Philippines

- 8.4.6 Vietnam

- 8.5 Middle East & Africa

- 8.5.1 South Africa

- 8.5.2 UAE

- 8.5.3 Saudi Arabia

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Peru

- 8.6.3 Mexico

Chapter 9 Company Profiles

- 9.1 AISIN Corporation

- 9.2 AFC Energy PLC

- 9.3 BorgWarner Inc

- 9.4 Ballard Power Systems

- 9.5 Cummins

- 9.6 Doosan Fuel Cell

- 9.7 ElringKlinger

- 9.8 Freudenberg

- 9.9 Hyundai Motor Company

- 9.10 Honda Motor

- 9.11 Intelligent Energy Limited

- 9.12 Nuvera Fuel Cells

- 9.13 Nedstack Fuel Cell Technology

- 9.14 PowerCell Sweden

- 9.15 Oorja Fuel Cells

- 9.16 Symbio

- 9.17 Toyota Motor Corporation

- 9.18 Toshiba Corporation

- 9.19 Wuhan Tiger Fuel Cell

- 9.20 ZF Friedrichshafen AG