PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871082

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871082

Cellulose Nanocrystals for Packaging Applications Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

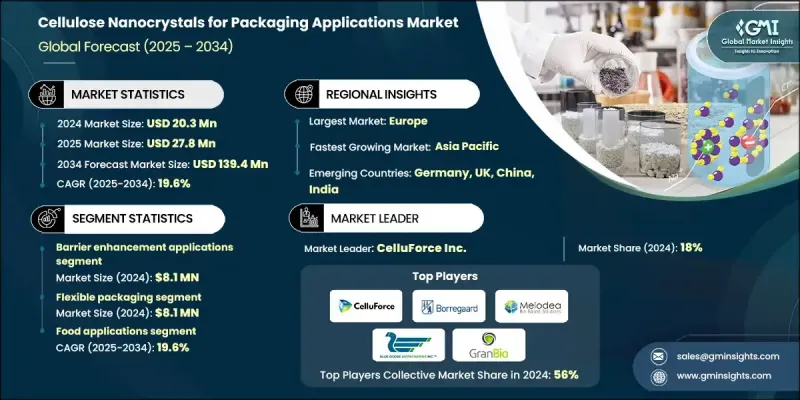

The Global Cellulose Nanocrystals for Packaging Applications Market was valued at USD 20.3 million in 2024 and is estimated to grow at a CAGR of 19.6% to reach USD 139.4 million by 2034.

The demand for CNCs in the packaging industry is rapidly increasing due to their exceptional mechanical strength, biodegradability, and advanced barrier performance. These nanomaterials significantly improve resistance to oxygen and oil in packaging films, providing an eco-friendly substitute for petroleum-based coatings. Packaging and paper applications represent around 60% share for micro and nanocellulose products. Technological innovations in enzymatic and mechanical processing methods have lowered energy requirements by nearly 90%, making large-scale CNC production more feasible and cost-efficient. The global shift toward sustainable and circular packaging solutions remains the key growth drive, with consumers and corporations increasingly prioritizing environmentally friendly materials. Enhanced barrier coatings have shown measurable performance improvements, with oxygen transmission rates reduced by 21-36% at 5-10% CNC loadings. This balance of sustainability and performance positions CNC-based coatings as a preferred material in food, pharmaceutical, and consumer goods packaging, all requiring extended product life and protection against environmental factors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $20.3 Million |

| Forecast Value | $139.4 Million |

| CAGR | 19.6% |

The barrier enhancement applications segment held 39.9% share in 2024, highlighting CNC's superior ability to protect against oxygen, moisture, and UV radiation compared to conventional materials. This segment continues to dominate as high-barrier properties are essential for maintaining product freshness and safety, especially in food, consumer goods, and pharmaceutical packaging.

The flexible packaging category held a 39.9% share in 2024, covering films, wraps, pouches, and other flexible containers. This segment benefits from CNC's ability to improve barrier performance while maintaining flexibility and processability. Applications such as food packaging, blister packs, and sustainable consumer goods packaging rely on CNCs to deliver durability, protection, and environmental advantages without compromising functionality or design versatility.

North America Cellulose Nanocrystals for Packaging Applications Market held 27.6% share in 2024 and is expected to grow at a CAGR of 19% through 2034. The region benefits from a strong research ecosystem, a mature packaging sector, and growing corporate commitments to sustainability. The United States and Canada are leading adopters, supported by active research programs across universities and national laboratories. Regulatory advancements and industry expertise in nanomaterial applications have further reinforced North America's leadership in this emerging market.

Key companies operating in the Global Cellulose Nanocrystals for Packaging Applications Market include FiberLean Technologies, GranBio, Kruger Inc., CelluForce Inc., Anomera Inc., Blue Goose Biorefineries, Melodea Ltd., Reinste Nano Ventures Pvt. Ltd., Borregaard ASA, and Nanoverse. Leading companies in the cellulose nanocrystals for packaging applications market are strengthening their market foothold through innovation, collaborations, and technological advancement. Many are investing in advanced nanocellulose processing technologies to enhance scalability, reduce energy costs, and improve material quality. Strategic partnerships between packaging producers and research institutions are accelerating product development and expanding CNC applications across food, pharmaceutical, and consumer goods packaging.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Packaging function

- 2.2.3 Packaging format

- 2.2.4 End use packaging sector

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing Demand for Sustainable Packaging Solutions

- 3.2.1.2 Regulatory Push for Bio-based Food Contact Packaging Materials

- 3.2.1.3 Increasing Investment in Packaging Nanotechnology Research

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High production costs & limited commercial scale

- 3.2.2.2 Technical challenges in hydrophobic packaging polymer integration

- 3.2.2.3 Moisture sensitivity limitations in packaging applications

- 3.2.3 Market opportunities

- 3.2.3.1 Surface modification technologies for enhanced packaging compatibility

- 3.2.3.2 Multilayer packaging architecture development

- 3.2.3.3 Active & smart packaging applications growth

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation Landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 Packaging Function

- 3.7.3 Packaging Format

- 3.7.4 End use Packaging Sector

- 3.8 Future market trends

- 3.9 Patent Landscape

- 3.10 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.10.1 Major importing countries

- 3.10.2 Major exporting countries

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.12 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Packaging Function, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Barrier enhancement applications

- 5.2.1 Oxygen barrier applications

- 5.2.2 Moisture barrier applications

- 5.2.3 Grease & oil barrier applications

- 5.2.4 Gas barrier applications

- 5.3 Mechanical reinforcement applications

- 5.3.1 Tensile strength enhancement

- 5.3.2 Stiffness & dimensional stability

- 5.3.3 Tear resistance improvement

- 5.4 Coating applications

- 5.4.1 Surface barrier coatings

- 5.4.2 Functional coatings

- 5.4.3 Protective coatings

- 5.5 Active packaging functions

- 5.5.1 Antimicrobial packaging applications

- 5.5.2 Antioxidant packaging applications

- 5.5.3 Controlled release systems

- 5.6 Smart packaging functions

- 5.6.1 Sensor integration applications

- 5.6.2 Indicator systems

- 5.6.3 Responsive packaging materials

Chapter 6 Market Estimates and Forecast, By Packaging Format, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Flexible packaging

- 6.2.1 Films & sheets

- 6.2.2 Pouches & bags

- 6.2.3 Wraps & liners

- 6.2.4 Multilayer flexible structures

- 6.3 Rigid packaging

- 6.3.1 Containers & bottles

- 6.3.2 Jars & cans

- 6.3.3 Structural packaging components

- 6.4 Paper & paperboard packaging

- 6.4.1 Folding cartons

- 6.4.2 Food service packaging

- 6.4.3 Corrugated packaging

- 6.4.4 Paperboard containers

- 6.5 Multilayer & laminated packaging

- 6.5.1 Barrier layer applications

- 6.5.2 Adhesive layer integration

- 6.5.3 Complex multilayer structures

Chapter 7 Market Estimates and Forecast, By End Use Packaging Sector, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Food packaging

- 7.2.1 Direct food contact applications

- 7.2.2 Indirect food contact applications

- 7.2.3 Fresh food packaging

- 7.2.4 Processed food packaging

- 7.2.5 Frozen food packaging

- 7.3 Beverage packaging

- 7.3.1 Non-alcoholic beverage packaging

- 7.3.2 Alcoholic beverage packaging

- 7.3.3 Dairy beverage packaging

- 7.4 Pharmaceutical packaging

- 7.4.1 Primary pharmaceutical packaging

- 7.4.2 Secondary pharmaceutical packaging

- 7.4.3 Medical device packaging

- 7.5 Consumer goods packaging

- 7.5.1 Personal care packaging

- 7.5.2 Household products packaging

- 7.5.3 Electronics packaging

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 CelluForce Inc.

- 9.2 Borregaard ASA

- 9.3 Reinste Nano Ventures Pvt. Ltd.

- 9.4 Melodea Ltd.

- 9.5 Blue Goose Biorefineries

- 9.6 FiberLean Technologies

- 9.7 Anomera Inc.

- 9.8 Kruger Inc

- 9.9 GranBio

- 9.10 Nanoverse