PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871094

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871094

Lithium Titanate Oxide (LTO) Battery Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

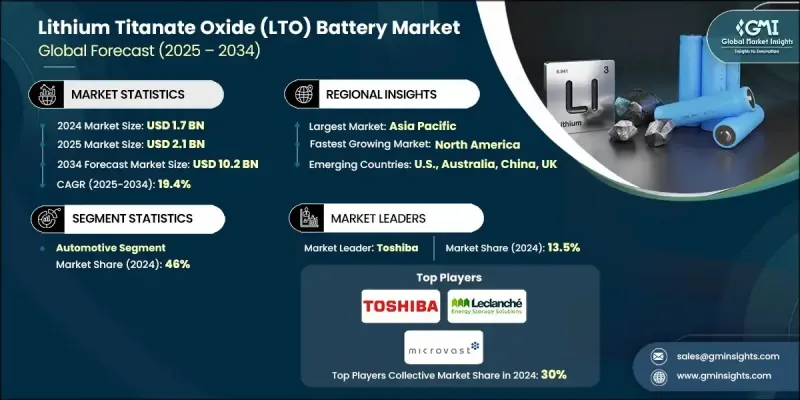

The Global Lithium Titanate Oxide (LTO) Battery Market was valued at USD 1.7 Billion in 2024 and is estimated to grow at a CAGR of 19.4% to reach USD 10.2 Billion by 2034.

The rapid adoption of LTO batteries is transforming modern energy and mobility systems through their superior charging performance and exceptional cycle life. These batteries can reach up to 80% charge within just a few minutes, enabling quick recharges that minimize downtime and optimize fleet operations. Such advantages make them a preferred solution for electric mobility and stationary storage. Governments across the world are investing in clean transportation and sustainable energy initiatives, directly benefiting the growth of the LTO market. Their unique ability to deliver more than 20,000 full charge-discharge cycles without significant capacity loss enhances their suitability for both electric transport and energy storage applications. The robust spinel lattice structure of LTO batteries prevents dendrite formation, ensuring higher reliability and longer operational lifespan. With growing interest in Battery-as-a-Service (BaaS) models, particularly across Asia-Pacific, LTO's high endurance and rapid charging capabilities make it ideal for battery-swap systems and other high-demand use cases across electric fleets and grid applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.7 Billion |

| Forecast Value | $10.2 Billion |

| CAGR | 19.4% |

The automotive segment held a 46% share in 2024 and is expected to grow at a CAGR of 19.5% through 2034. The segment's strong performance is driven by the increasing use of LTO batteries in urban electric mobility, where fast-charging and extended battery life are critical for daily operations. Unlike conventional lithium-ion chemistries, LTO can achieve 80% charge in under 10 minutes, offering a practical solution for high-utilization vehicles such as electric taxis, buses, and logistics fleets. As metropolitan regions move toward zero-emission transportation and stricter environmental regulations, fleet operators are adopting LTO-based electric vehicles to meet performance and sustainability requirements. This growing shift toward rapid-charging vehicle platforms continues to fuel the segment's expansion across both private and commercial mobility sectors.

U.S. Lithium Titanate Oxide (LTO) Battery Market will reach USD 2.6 Billion by 2034. The country's commitment to clean energy transition and electric mobility adoption is reinforced by large-scale federal programs, grants, and incentives. Initiatives supporting the expansion of electric vehicle infrastructure, battery manufacturing, and smart grid upgrades are creating strong opportunities for LTO battery manufacturers. Given their fast-charging capabilities, extended life cycle, and high safety standards, LTO batteries are emerging as a critical component for public transportation and commercial fleet electrification projects in the United States.

Leading players in the Global Lithium Titanate Oxide (LTO) Battery Market include Toshiba Corporation, Yinlong Energy, Altairnano, Leclanche SA, Microvast, PLANNANO, Nichicon Corporation, and Nav Prakriti. To strengthen their market presence, companies in the lithium titanate oxide battery industry are pursuing strategies centered on technological innovation, production scaling, and strategic collaboration. Many manufacturers are investing in advanced material science to improve battery density, charging speed, and thermal stability. Strategic partnerships with electric vehicle OEMs and energy utilities are enabling companies to secure long-term supply contracts and expand into emerging applications such as energy storage and battery-swapping networks. Firms are also enhancing their global supply chains to ensure cost efficiency and timely product delivery.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Technology component analysis

- 3.8 Investment and funding landscape analysis

- 3.9 Emerging technology trends and developments

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.4.1 Key partnerships & collaborations

- 4.4.2 Major M&A activities

- 4.4.3 Product innovations & launches

- 4.4.4 Market expansion strategies

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Application, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Automotive

- 5.3 Energy storage

- 5.4 Industrial

- 5.5 Others

Chapter 6 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S.

- 6.2.2 Canada

- 6.3 Europe

- 6.3.1 UK

- 6.3.2 Germany

- 6.3.3 France

- 6.3.4 Italy

- 6.3.5 Spain

- 6.4 Asia Pacific

- 6.4.1 China

- 6.4.2 South Korea

- 6.4.3 Japan

- 6.4.4 Australia

- 6.5 Rest of World

Chapter 7 Company Profiles

- 7.1 Altairnano

- 7.2 Leclanche SA

- 7.3 Microvast

- 7.4 Nav Prakriti

- 7.5 Nichicon Corporation

- 7.6 PLANNANO

- 7.7 Toshiba Corporation

- 7.8 Yinlong Energy