PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871097

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871097

Natural and Organic Cosmetics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

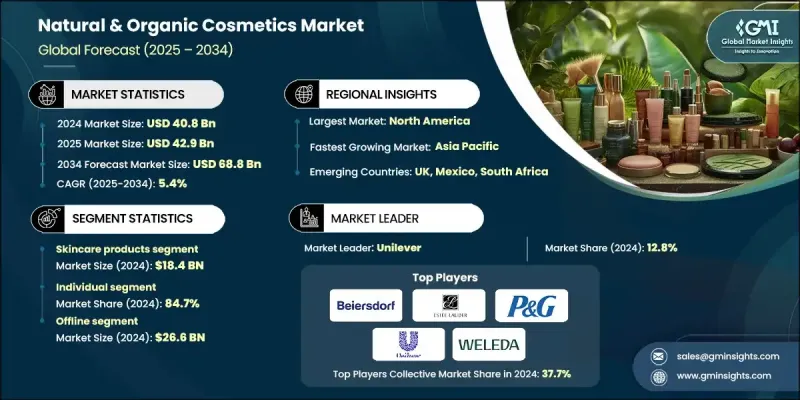

The Global Natural and Organic Cosmetics Market was valued at USD 40.8 Billion in 2024 and is estimated to grow at a CAGR of 5.4% to reach USD 68.8 Billion by 2034.

Growing consumer preference for health-conscious and eco-friendly choices is driving demand for clean-label beauty products. Buyers are increasingly favoring cosmetics free from synthetic chemicals and aligned with ethical and environmental values. Transparency, ingredient traceability, and clear product labeling have become top priorities. A large portion of consumers now actively seek sustainable options and are willing to pay premium prices for them. Digital platforms and social media are playing a major role in influencing purchasing habits and pushing brands to be more accountable. This shift in consumer mindset is also prompting companies to adopt more honest marketing practices and prioritize ethical sourcing. Alongside rising consumer expectations, regulatory support, and labeling standards are contributing to market expansion. However, the lack of a unified global certification system presents challenges for brands seeking to scale internationally. Even with varying trust levels across regions, the demand for authentic and responsibly made products continues to accelerate, creating new opportunities across skincare, makeup, and personal care.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $40.8 billion |

| Forecast Value | $68.8 billion |

| CAGR | 5.4% |

The skincare segment generated USD 18.4 Billion in 2024. This segment is growing steadily as more consumers prioritize clean, plant-based ingredients in their everyday beauty routines. Products like natural moisturizers, face washes, serums, and skin treatments are favored for their multipurpose functions and gentle formulations. With consumers seeking alternatives that both treat and nourish without harsh chemicals, the demand for eco-conscious skincare is climbing steadily. Botanical extracts, essential oils, and herbal blends are now core elements in product development.

In terms of end users, the individual segment held 84.7% share in 2024. Consumers are more informed and engaged in their purchase decisions than ever before. They actively evaluate ingredient lists, seek cruelty-free certifications, and demand transparency in sourcing and production. This awareness has shifted how brands design and label their products, focusing on clean formulations that reflect consumer values around wellness and sustainability. Ethical consumerism and personal health concerns are now central to brand loyalty and market positioning.

U.S. Natural and Organic Cosmetics Market held 81.8% share and generated USD 11.8 Billion in 2024. The regional market benefits from strong consumer awareness, mature retail infrastructure, and active product innovation. Consumers in the U.S. consistently demand clean beauty products with certified organic ingredients and traceable supply chains. With increasing interest in green chemistry and sustainable packaging, the region has become a hub for emerging natural beauty brands. Certifications and regulatory frameworks are also helping to build trust and enhance product credibility.

Major companies operating in the Global Natural and Organic Cosmetics Market include Procter & Gamble, Unilever, Estee Lauder, Weleda, L'Oreal, Johnson & Johnson, Beiersdorf, Dr. Hauschka, True Botanicals, Coty, Josie Maran Cosmetics, Haus Labs, Herbivore Botanicals, Wala Heilmittel, and Burt's Bees. Leading brands in the Global Natural and Organic Cosmetics Market are investing heavily in clean innovation and ethical sourcing to strengthen their market position. Many companies are reformulating products to eliminate synthetic additives and prioritize naturally derived ingredients. Partnerships with certified suppliers help ensure transparency across the supply chain. Brands are also pursuing eco-friendly packaging solutions and leveraging digital platforms to enhance direct-to-consumer engagement. Certification through recognized standards supports product authenticity and boosts consumer trust. Firms are expanding through acquisitions, entering new geographic markets, and launching niche product lines tailored to wellness-conscious consumers.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product Type

- 2.2.3 Ingredients

- 2.2.4 Consumer Group

- 2.2.5 Price

- 2.2.6 End use

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for clean-label and transparent ingredients

- 3.2.1.2 Growth of e-commerce and influencer marketing

- 3.2.1.3 Regulatory support for natural formulations

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High cost of natural ingredients and production

- 3.2.2.2 Limited shelf life and preservation issues

- 3.2.3 Opportunities

- 3.2.3.1 Expansion into emerging markets

- 3.2.3.2 Innovation in sustainable packaging and circular beauty

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Skincare products

- 5.2.1 Face creams & moisturizers

- 5.2.2 Cleansers & makeup removers

- 5.2.3 Serums & anti-aging

- 5.2.4 Sunscreens & UV protection

- 5.2.5 Toners & essences

- 5.2.6 Others (exfoliators & scrubs etc.)

- 5.3 Haircare products

- 5.3.1 Shampoos & conditioners

- 5.3.2 Hair oils

- 5.3.3 Styling products

- 5.3.4 Hair coloring & dyes

- 5.3.5 Others (scalp care products etc.)

- 5.4 Color cosmetics & makeup

- 5.4.1 Lipsticks & lip care

- 5.4.2 Foundations & concealers

- 5.4.3 Eye makeup & mascara

- 5.4.4 Nail polish

- 5.4.5 Others (blushes & bronzers etc.)

- 5.5 Oral care products

- 5.5.1 Toothpaste & tooth powders

- 5.5.2 Mouthwash & oral rinses

- 5.5.3 Others (teeth whitening products etc.)

- 5.6 Others (fragrances etc.)

Chapter 6 Market Estimates and Forecast, By Ingredients, 2021 - 2034 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Plant-based & botanical

- 6.2.1 Essential oils

- 6.2.2 Plant extracts & herbal

- 6.2.3 Fruit & vegetable derivatives

- 6.2.4 Others (flower & petal extracts etc.)

- 6.3 Mineral-based

- 6.3.1 Clays & earth minerals

- 6.3.2 Sea salts & mineral salts

- 6.3.3 Mineral pigments & colorants

- 6.3.4 Marine-derived ingredients

- 6.3.5 Seaweed & algae extracts

- 6.3.6 Others (marine collagen & proteins etc.)

- 6.4 Biotechnology-derived natural ingredients

- 6.5 Others (certified organic agricultural etc.)

Chapter 7 Market Estimates and Forecast, By Consumer Group, 2021 - 2034 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Men

- 7.3 Women

- 7.4 Unisex

Chapter 8 Market Estimates and Forecast, By Price, 2021 - 2034 (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Low

- 8.3 Medium

- 8.4 High

- 8.5 Premium

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Individual

- 9.3 Professional

- 9.3.1 Beauty salons

- 9.3.2 Spa & wellness centers

- 9.3.3 Medical professionals

- 9.3.4 Hotel & resort

- 9.3.5 Others (beauty institutes etc.)

Chapter 10 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 Online

- 10.2.1 E-commerce

- 10.2.2 Company website

- 10.3 Offline

- 10.3.1 Specialty Stores

- 10.3.2 Pharmacies

- 10.3.3 Others (departmental stores, etc.)

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Million Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Beiersdorf

- 12.2 Burt's Bees

- 12.3 Coty

- 12.4 Dr. Hauschka

- 12.5 Estee Lauder

- 12.6 Haus Labs

- 12.7 Herbivore Botanicals

- 12.8 Johnson & Johnson

- 12.9 Josie Maran Cosmetics

- 12.10 L'Oreal

- 12.11 Procter & Gamble

- 12.12 True Botanicals

- 12.13 Unilever

- 12.14 Wala Heilmittel

- 12.15 Weleda